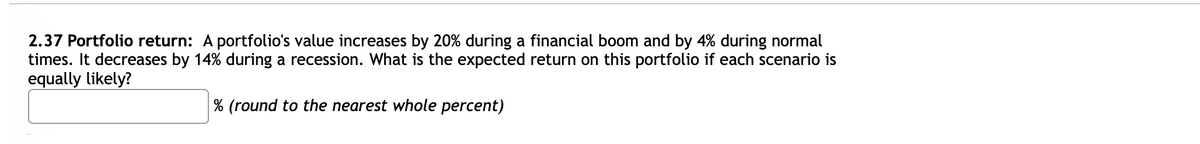

2.37 Portfolio return: A portfolio's value increases by 20% during a financial boom and by 4% during normal times. It decreases by 14% during a recession. What is the expected return on this portfolio if each scenario is equally likely? % (round to the nearest whole percent)

2.37 Portfolio return: A portfolio's value increases by 20% during a financial boom and by 4% during normal times. It decreases by 14% during a recession. What is the expected return on this portfolio if each scenario is equally likely? % (round to the nearest whole percent)

A First Course in Probability (10th Edition)

10th Edition

ISBN:9780134753119

Author:Sheldon Ross

Publisher:Sheldon Ross

Chapter1: Combinatorial Analysis

Section: Chapter Questions

Problem 1.1P: a. How many different 7-place license plates are possible if the first 2 places are for letters and...

Related questions

Concept explainers

Contingency Table

A contingency table can be defined as the visual representation of the relationship between two or more categorical variables that can be evaluated and registered. It is a categorical version of the scatterplot, which is used to investigate the linear relationship between two variables. A contingency table is indeed a type of frequency distribution table that displays two variables at the same time.

Binomial Distribution

Binomial is an algebraic expression of the sum or the difference of two terms. Before knowing about binomial distribution, we must know about the binomial theorem.

Topic Video

Question

Transcribed Image Text:2.37 Portfolio return: A portfolio's value increases by 20% during a financial boom and by 4% during normal

times. It decreases by 14% during a recession. What is the expected return on this portfolio if each scenario is

equally likely?

% (round to the nearest whole percent)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Recommended textbooks for you

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:

9780134753119

Author:

Sheldon Ross

Publisher:

PEARSON