20. The partnership agreement of Socorro and Torres provides that interest at 10% is to be credited to each partner on the basis of average capital 10% is to be credited to each partner on the basis of average capital balances. A summary of Torres Capital account for the year ended December 31, 2020 is as follows: Balance January 1 Additional Investment, July 1 Withdrawal, August 1 P 304,500 87,000 32,625 What amount of interest should be credited to Torres Capital account? a. P33,168.75

20. The partnership agreement of Socorro and Torres provides that interest at 10% is to be credited to each partner on the basis of average capital 10% is to be credited to each partner on the basis of average capital balances. A summary of Torres Capital account for the year ended December 31, 2020 is as follows: Balance January 1 Additional Investment, July 1 Withdrawal, August 1 P 304,500 87,000 32,625 What amount of interest should be credited to Torres Capital account? a. P33,168.75

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 57P

Related questions

Question

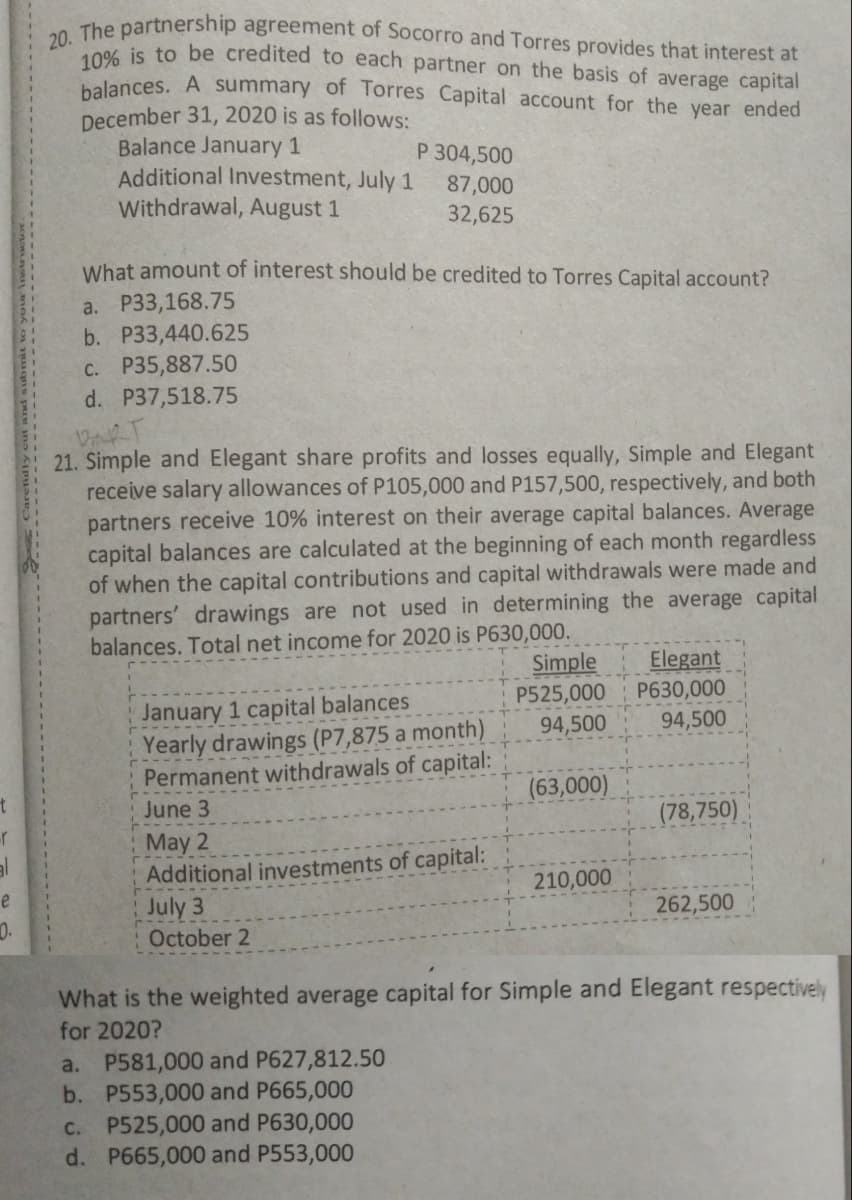

Transcribed Image Text:20. The partnership agreement of Socorro and Torres provides that interest at

10% is to be credited to each partner on the basis of average capital

balances. A summary of Torres Capital account for the year ended

December 31, 2020 is as follows:

Balance January 1

Additional Investment, July 1

Withdrawal, August 1

P 304,500

87,000

32,625

What amount of interest should be credited to Torres Capital account?

a. P33,168.75

b. P33,440.625

C. P35,887.50

d. P37,518.75

21. Simple and Elegant share profits and losses equally, Simple and Elegant

receive salary allowances of P105,000 and P157,500, respectively, and both

partners receive 10% interest on their average capital balances. Average

capital balances are calculated at the beginning of each month regardless

of when the capital contributions and capital withdrawals were made and

partners' drawings are not used in determining the average capital

balances. Total net income for 2020 is P630,000.

Simple

P525,000

Elegant

P630,000

January 1 capital balances

Yearly drawings (P7,875 a month)

Permanent withdrawals of capital:

94,500

94,500

(63,000)

June 3

(78,750)

May 2

Additional investments of capital:

July 3

October 2

210,000

e

262,500

0.

What is the weighted average capital for Simple and Elegant respectively

for 2020?

a. P581,000 and P627,812.50

b. P553,000 and P665,000

C. P525,000 and P630,000

d. P665,000 and P553,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning