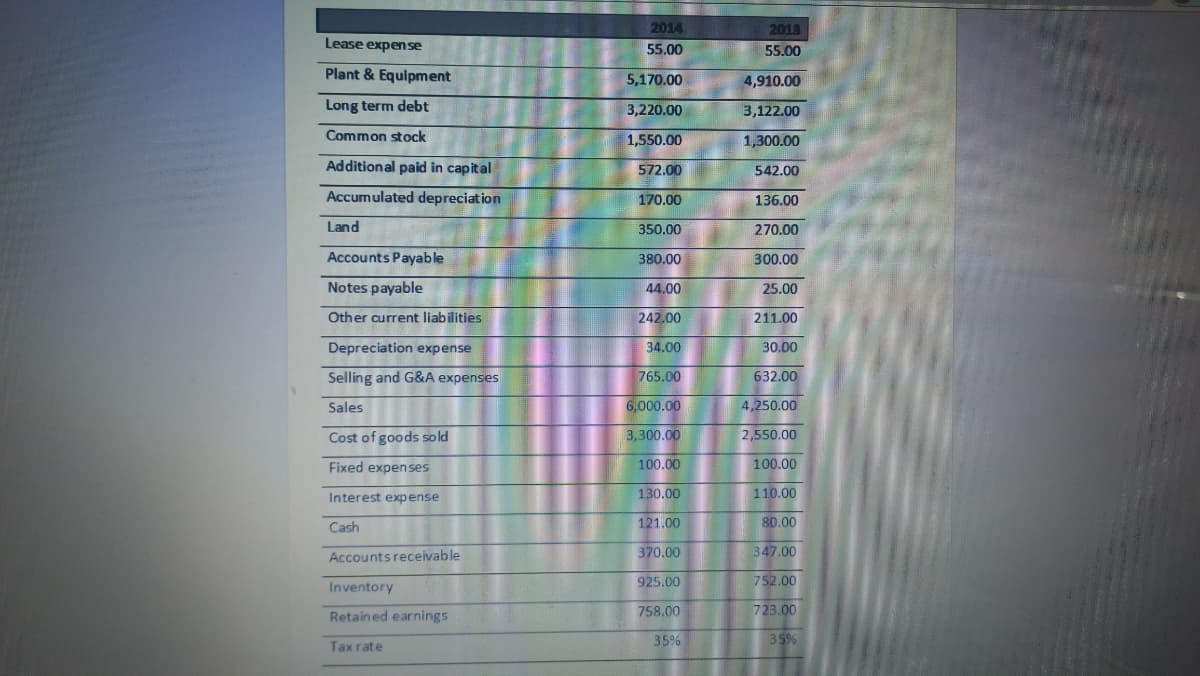

2014 2013 Lease expen se 55.00 55.00 Plant & Equipment 5,170.00 4,910.00 Long term debt 3,220.00 3,122.00 Common stock 1.550.00 1,300.00 Addition al paid in capital 572.00 542.00 Accumulated depreciation 170.00 136.00 Land 350.00 270.00 Accounts Payable 380.00 300.00 Notes payable 44.00 25.00 Other current liabilities 242.00 211.00 Depreciation expense 34.00 30.00 Selling and G&A expenses 765.00 632.00 Sales 6,000.00 4,250.00 Cost of goods sold 3,300.00 2,550.00 Fixed expenses 100.00 100.00 Interest expense 130.00 110.00 Cash 121.00 ৪0.00 Accounts receivable 370.00 347.00 925.00 752.00 Inventory Retained earnings 758.00 723.00 35%

2014 2013 Lease expen se 55.00 55.00 Plant & Equipment 5,170.00 4,910.00 Long term debt 3,220.00 3,122.00 Common stock 1.550.00 1,300.00 Addition al paid in capital 572.00 542.00 Accumulated depreciation 170.00 136.00 Land 350.00 270.00 Accounts Payable 380.00 300.00 Notes payable 44.00 25.00 Other current liabilities 242.00 211.00 Depreciation expense 34.00 30.00 Selling and G&A expenses 765.00 632.00 Sales 6,000.00 4,250.00 Cost of goods sold 3,300.00 2,550.00 Fixed expenses 100.00 100.00 Interest expense 130.00 110.00 Cash 121.00 ৪0.00 Accounts receivable 370.00 347.00 925.00 752.00 Inventory Retained earnings 758.00 723.00 35%

Chapter12: Capital Structure

Section: Chapter Questions

Problem 1PROB

Related questions

Question

Transcribed Image Text:2014

2013

Lease expen se

55.00

55.00

Plant & Equipment

5,170.00

4,910.00

Long term debt

3,220.00

3,122.00

Common stock

1,550.00

1,300.00

Additional paid in capital

572.00

542.00

Accumulated depreciation

170.00

136.00

Land

350.00

270.00

Accounts Payable

380.00

300.00

Notes payable

44.00

25.00

Other current liabilities

242.00

211.00

Depreciation expense

34.00

30.00

Selling and G&A expenses

765.00

632.00

Sales

6,000.00

4,250.00

Cost of goods sold

3,300.00

2,550.00

Fixed expenses

100.00

100.00

130.00

110.00

Interest expense

121.00

80.00

Cash

Accounts receivable

370.00

347.00

925.00

752.00

Inventory

758.00

723.00

Retained earnings

35%

35%

Tax rate

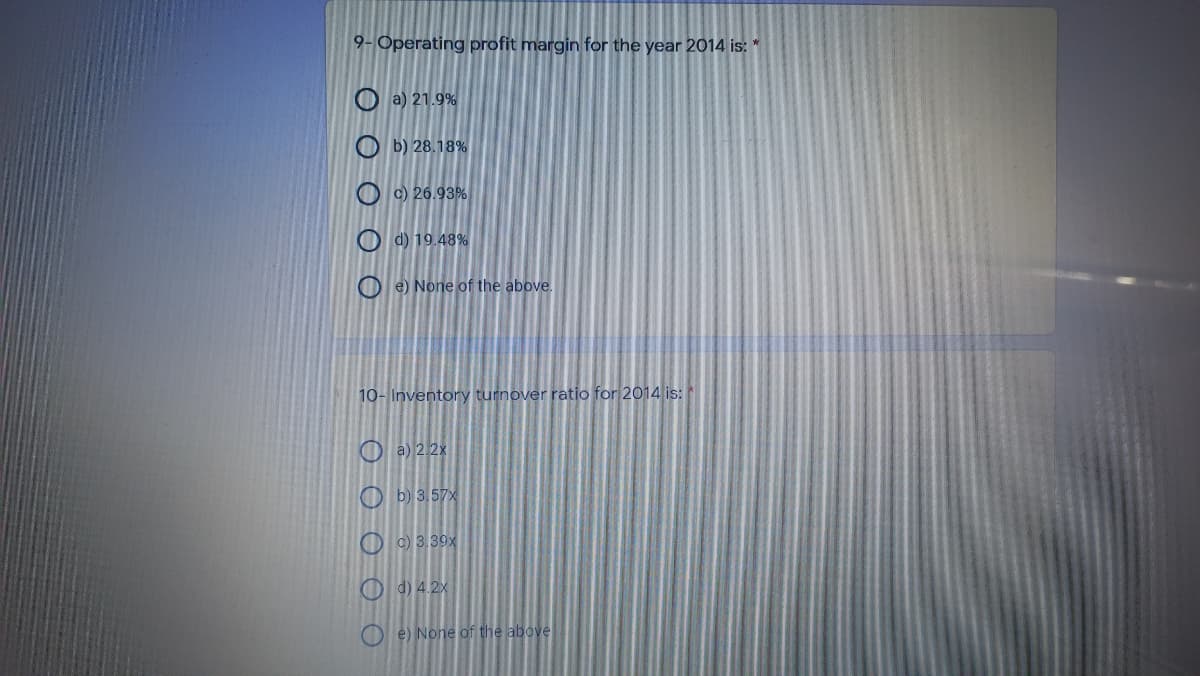

Transcribed Image Text:9- Operating profit margin for the year 2014 is: *

O a) 21.9%

O b) 28.18%

O c) 26.93%

O d) 19.48%

O e) None of the above.

10- Inventory turnover ratio for 2014 is:

O a) 22x

O b) 3,57x

O ©) 3.39x

O d) 4.2x

O e) None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you