2015 Jan. 9 Purchased computer equipment at a cost of $9,000, signing a six-month, 7% note payable for that amount. 29 Recorded the week's sales of $70,000, three-fourths on credit and one-fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Feb. 5 Sent the last week's sales tax to the state. Jul. 9 Paid the six-month, 7% note, plus interest, at maturity. Aug. 31 Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system. Dec. 31 Accrued warranty expense, which is estimated at 2% of sales of $604,000. 31 Accrued interest on all outstanding notes payable. 2016 Feb. 29 Paid the six-month 10% note, plus interest, at maturity.

2015 Jan. 9 Purchased computer equipment at a cost of $9,000, signing a six-month, 7% note payable for that amount. 29 Recorded the week's sales of $70,000, three-fourths on credit and one-fourth for cash. Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold. Feb. 5 Sent the last week's sales tax to the state. Jul. 9 Paid the six-month, 7% note, plus interest, at maturity. Aug. 31 Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The company uses the perpetual inventory system. Dec. 31 Accrued warranty expense, which is estimated at 2% of sales of $604,000. 31 Accrued interest on all outstanding notes payable. 2016 Feb. 29 Paid the six-month 10% note, plus interest, at maturity.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 49P

Related questions

Topic Video

Question

Transcribed Image Text:Part 1 of 8

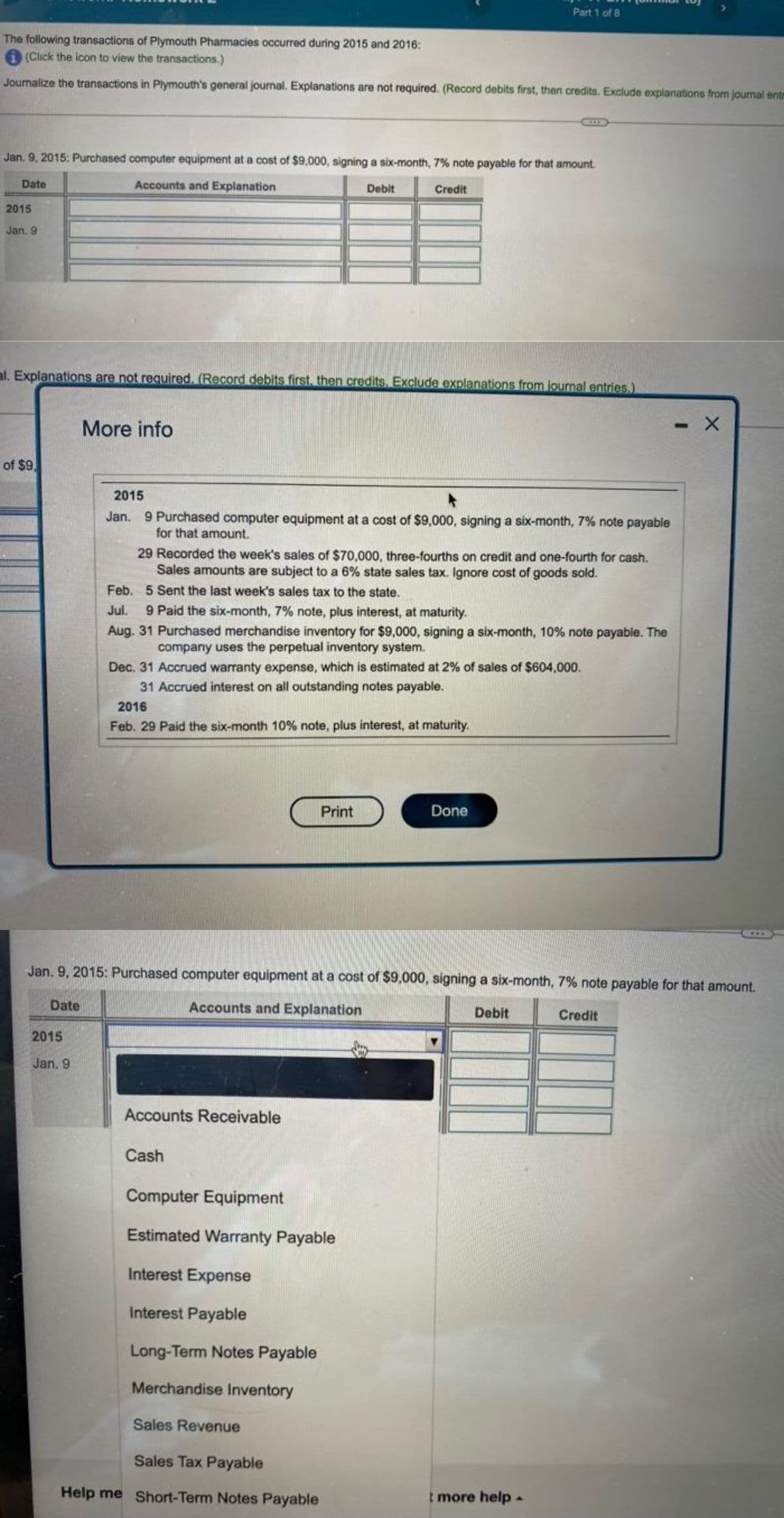

The following transactions of Plymouth Pharmacies occurred during 2015 and 2016:

(Click the icon to view the transactions.)

Journalize the transactions in Plymouth's general journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entr

Jan. 9, 2015: Purchased computer equipment at a cost of $9,000, signing a six-month, 7% note payable for that amount.

Date

Accounts and Explanation

Debit

Credit

2015

Jan. 9

al. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.)

X

More info

of $9.

2015

Jan. 9 Purchased computer equipment at a cost of $9,000, signing a six-month, 7% note payable

for that amount.

29 Recorded the week's sales of $70,000, three-fourths on credit and one-fourth for cash.

Sales amounts are subject to a 6% state sales tax. Ignore cost of goods sold.

Feb. 5 Sent the last week's sales tax to the state.

Jul. 9 Paid the six-month, 7% note, plus interest, at maturity.

Aug. 31 Purchased merchandise inventory for $9,000, signing a six-month, 10% note payable. The

company uses the perpetual inventory system.

Dec. 31 Accrued warranty expense, which is estimated at 2% of sales of $604,000.

31 Accrued interest on all outstanding notes payable.

2016

Feb. 29 Paid the six-month 10% note, plus interest, at maturity.

Print

Done

Jan. 9, 2015: Purchased computer equipment at a cost of $9,000, signing a six-month, 7% note payable for that amount.

Date

Accounts and Explanation

Debit

Credit

2015

Jan. 9

Accounts Receivable

Cash

Computer Equipment

Estimated Warranty Payable

Interest Expense

Interest Payable

Long-Term Notes Payable

Merchandise Inventory

Sales Revenue

Sales Tax Payable

Help me Short-Term Notes Payable

more help.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning