2018 2017 Net Income Dividends-Common Dividends-Preferred Total Stockholders' Equity at Year-End (includes 95,000 shares of common stock) Preferred Stock $ 71,900 $ 64,300 22,000 22,000 16,800 16,800 770,000 200,000 610,000 200,000 Market Price per Share of Common Stock $ 16.50 $ 10.00

2018 2017 Net Income Dividends-Common Dividends-Preferred Total Stockholders' Equity at Year-End (includes 95,000 shares of common stock) Preferred Stock $ 71,900 $ 64,300 22,000 22,000 16,800 16,800 770,000 200,000 610,000 200,000 Market Price per Share of Common Stock $ 16.50 $ 10.00

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.16E

Related questions

Question

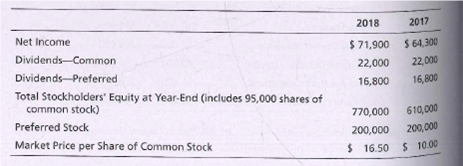

Evaluating a stock as an investment Data for Oxford State Bank follow

Data for Oxford State Bank follow

Evaluate the common stock of Oxford State Bank as an investment. Specifically, use the three stock ratios to determine whether the common stock has increased or decreased in attractiveness during the past year Round to two decimal places.

Transcribed Image Text:2018

2017

Net Income

Dividends-Common

Dividends-Preferred

Total Stockholders' Equity at Year-End (includes 95,000 shares of

common stock)

Preferred Stock

$ 71,900 $ 64,300

22,000

22,000

16,800

16,800

770,000

200,000

610,000

200,000

Market Price per Share of Common Stock

$ 16.50 $ 10.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning