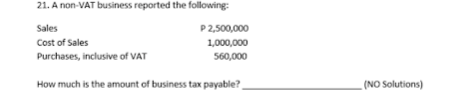

21. A non-VAT business reported the following: Sales Cost of Sales Purchases, inclusive of VAT P2,500,000 1,000,000 560,000 How much is the amount of business tax payable? (NO Solutions)

Q: To reduce the cost to deliver a product or service to consumers, a company must focus on operational…

A: The objective of an organisation is to reduce cost and improve quality of products. This gives…

Q: $5.20

A: To evaluate these companies from the perspective of an investor, we can use some commonly used…

Q: Healthy Earth Products Inc. produces fertilizer and distributes the product by using company trucks.…

A: Predetermined Overhead Rate :— It is the rate used to allocate manufacturing overhead to cost…

Q: Journal entry worksheet

A: Adjusting Entry - Adjusting Entries are the adjustments required to be made at the end of the…

Q: On April 1, 2022, Prince Company pledges $800,000 of its accounts receivable to the Third National…

A: Accounts receivable is an important part of a company's working capital, as it represents the money…

Q: The table below is the current balance sheet for the Maple Leafs Bank. Answer the following…

A: Reserves refer to the amount that is kept aside for the purpose of obligations that will arise in…

Q: Cost Schedule Components produced 72,000 91,200 114,000 Total costs: Total variable…

A: Total variable costs = variable cost per unit x number of components produced Total fixed costs =…

Q: Light emitting diode (LEDs) light bulbs have become required in recent years, but do they make…

A: To determine the break-even cost per kilowatt-hour, we need to compare the total cost of using the…

Q: a company has net sales of 814100 and cost of goods sold of 588100 its net income is 32410 the…

A: Introduction: - Income statement shows company's income and expenses over a period of time.…

Q: Given the following information, determine the cost of the inventory at June 30 using the LIFO…

A: LIFO Last in last out is the method of inventory management used to record inventory. In this…

Q: Scherbatsky Company has the following transactions for the year. Record each transaction in the…

A: As there is basket purchase of building and land amount will be allocated proportionally according…

Q: Which subsidiary account/accounts is/are affected by sale of inventory on credit and how is each…

A: The business transaction affects a minimum of two accounts according to the double entry system,…

Q: Problem Al-4A Journal entries for payroll transactions LO2, 3, 4 A company has three employees, each…

A: Personal Account rule Debit the receiver, Credit the giver Real Account rule Debit what comes in,…

Q: Required information [The following information applies to the questions displayed below.] Jackson…

A: For the total contributions you make each year to all of your traditional IRA and Roth IRAs can't…

Q: According to the company’s constitution, shareholders’ equity in forfeited shares must be refunded…

A: Oak Ltd General Journal Date Accounts and explanation Debit Credit 31-Mar Call-ordinary 450000…

Q: Take2 Company reports the following purchases and sales data for its product Z for the month of…

A: In this scenario, Take2 Company has a mix of beginning inventory and purchases throughout the month,…

Q: Using the following information, calculate the receivables turnover ratio. Sales revenue Credit card…

A: Receivables turnover is the ratio which helps in determining the efficiency of the entity in…

Q: Using the information below, calculate the cash flow impact of operating working capital for year 2.…

A: Operating working capital also termed OWC refers to a company's current assets and it determines the…

Q: A machine costing $215,200 with a four-year life and an estimated $18,000 salvage value is installed…

A: Answer:- Depreciation:- The asset value decreases over the time because of the use, damage etc.…

Q: Required information [The following information applies to the questions displayed below.] Del Gato…

A: Journal Entry: A journal entry is a written record or accounting transaction that documents a…

Q: Two independent situations are described below. Each involves future deductible amounts and/or…

A: I am answering the first three sub-parts of the question as per bartleby guidelines. Please…

Q: Hexagon reports operating cash flows of $3.50 billion, investing cash flows of $0.50 billion, and…

A: The cash flow statement is one of the financial statements prepared by the companies at the end of…

Q: Blue Corporation began operations on December 1, 2024. The only inventory transaction in 2024 was…

A: The company keeps inventory in the business for sale. But some inventory does not sell at the end of…

Q: Boehn Corporation accounts for its investment in the common stock of Sells Company under the equity…

A: Investment is accounted as per equity method if they have an significant influence but do not have…

Q: Solomon Company produces commercial gardening equipment. Since production is highly automated, the…

A: Overhead refers to the continuing expenditures of running a firm, although it does not include the…

Q: Required: a) Determine the net income for 20CY for a Single Proprietorship or Partnership. b)…

A: Net income Net income which is considered to be the important part in the financial statement of…

Q: Financial statements for Rundle Company follow. RUNDLE COMPANY Balance Sheets As of December…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Chapel Charter purchased Durham Co. for $2,160,000 cash. At the time of the purchase, the fair value…

A: The question is based on the concept of Business Acquisition and Mergers. When the amount of the…

Q: Do you agree with the general manager's assertion that managers should be rewarded only on the basis…

A: The concept of rewarding managers based solely on performance measures without fixed salaries is…

Q: On December 31, 2024, Rachel Cooking Services reports the following revenues and expenses.…

A: 1. Income Statement - Income Statement includes Revenue earned and expense incurred during the year.…

Q: An individual has year-to-date earnings prior to the current period of $168,500, earns $3,600 this…

A: The self-employment taxes refers to only social security and the medicare taxes that need to be…

Q: In 2022, Zach is single with no dependents. He is not claimed as a dependent on another's return.…

A: Adjusted gross income refers to the total sum of money is at a company after subtracting all the…

Q: Web Wizard, Incorporated, has provided information technology services for several years. For the…

A: Allowance for Doubtful Accounts - Allowance for doubtful accounts is a provision made by the…

Q: On January 1, 2024, Oriole Co. issued eight-year bonds with a face value of $5940000 and a stated…

A: Present value of the principal amount means the value of face value included in the issue price of…

Q: During 2021 Erin received eligible dividends of $1,000

A: Eligible dividends are paid out by public corporations , from the income that has been…

Q: termine the associated risk measure in this equipment investment in terms of standard deviation.…

A: Standard deviation is measure of the risk of the projects and can be measured by net present value…

Q: Kinsella Corporation's 'statement of financial position showed the following amounts: current…

A: In this question, we need to compute the total long-term debt to total equity ratio. For that, we…

Q: Prepare Journal Entries…

A: Journal entries are the main type of records used during accounting to track financial activities.…

Q: CR Company makes a household appliance with model number E400. The goal for 2017 is to reduce direct…

A: To calculate the change in operating income from 2016 to 2017, we need to calculate the operating…

Q: Balances for selective accounts of Sanborn at the end of 20X6 were: accounts receivable (net)…

A: By examining the correlations between various financial numbers, ratio analysis is a technique used…

Q: The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 December 16 Accepted…

A: Notes receivable is a promise given in writing to receive cash of specific amount on a specified…

Q: please dont provide answer in an image format thank you

A: A form of accounting entry known as an adjustment journal entry is created at the conclusion of an…

Q: performance measures?

A: A good performance measure should have following qualities - Provide a reasonable incentive to the…

Q: he following income statement was drawn from the records of Walton Company, a merchandising firm:…

A: A contribution margin income statement in which all variable expenses are deducted from the sales…

Q: A company uses standard absorption costing to value inventory. Its fixed overhead absorption rate is…

A: Difference in Absorption costing net operating income and Variable costing net operating income :…

Q: Record the above transactions in a horizontal statements model. Note: In the Statement of Cash Flows…

A: Recording transactions in horizontal statements model means it shows all the account of a…

Q: Required information [The following information applies to the questions displayed below.] Chuck…

A: The question is based on the concept of Cost Accounting. Under variable costing only variable…

Q: When the activity level declines within the relevant range, what should happen with respect to the…

A: The company running its operations incurs both variable costs and also fixed costs. The variable…

Q: 18. The FASB requires private not- for-profit organizations to report individual assets and…

A: A not-for-profit organization (NPO) is a type of organization that operates for purposes other than…

Q: In the balance sheet at the end of its first year of operations, Dinty Inc. reported an allowance…

A: ACCOUNT RECEIVABLE Account Receivable is a balance which is Receivable from the customer.…

Step by step

Solved in 3 steps

- LO.3, 4, 5 Contrast the income taxation of individuals and C corporations as to: a. Alternative minimum tax. b. Dividend income. c. Qualified business income deduction of 20 percent. d. Use of the cash method of accounting. e. Accounting period used for tax purposes. f. Applicable tax rates. g. Due date of the tax return.A Non-VAT business reported the following:Sales P2,500,000Cost of Sales P1,000,000Purchases, inclusive of VAT P560,000How much is the amount of business tax payable?FGH Corporation had the following in 2021: Sales P 3.4M; Cost of sales P 1.2M; Admin expense P 0.3M; Selling expenses P .5M; other taxable income from operations P .1M. What is deductible expense if the company uses OSD?* a. 920,000 b. 1,360,000 c. 880,000 d. 800,000 Using the problem above, what is the income tax payable?* a. 330,000 b. 375,000 c. 575,000 d. 525,000

- FGH Corporation had the following in 2021: Sales P 3.4M; Cost of sales P 1.2M; Admin expense P 0.3M; Selling expenses P .5M; other taxable income from operations P .1M. 1. What is deductible expense if the company uses OSD? 2. Using the problem above, what is the income tax payable?Assume that The Bell Company operates in an industry for which NOL carryback is allowed. The Bell Company had the following operating results: Year Income (loss) Tax rate Income tax 2018 40,000 25 % 10,000 2019 40,000 25 % 10,000 2020 50,000 30 % 15,000 2021 (130,000 ) 30 % 0 What is the income tax refund receivable? A) $27,000. B) $24,000. C) $25,000 D) $21,000.A company recently reported $9.8 million of net income. Its EBIT was $15 million, and its federal tax rate was 22%(ignore any possible state corporate taxes).What was its EBT? Blank 1What was its Tax liability? Blank 2What was its interest expense? Blank 3

- 2. Table is given below shows that marginal tax rates for Alejandro Corporation. TaxableIncome of the Company is equal to $44.000. How much will the Company pay tax totally?Average tax rate? taxable income(dollar) tax rate 0-16.000 10% 16.000-39.000 12% 39.000-55.000 16% 55.000-70.000 19% 70.000-86.000 23%For income tax purposes, what is the amount of gross income given the following amounts? Gross sales 4,000,000.00 Sales discounts, returns and allowances 100,000.00 Cost of sales 1,500,000.00 Itemized deductions 800,000.00 Given the amount, how much is the minimum corporate income tax? Group of answer choices P78,000.00 P34,000.00 P32,000.00 P48,000.00Button Company has the following two temporary differences between its income tax expense and income taxes payable. 00202000) 00202100) 00202200) Pretax financial income $840,000) $910,000) $945,000) Excess depreciation expense on tax return (30,000) (40,000) (10,000) Excess warranty expense in financial income 0020,000) 0010,000) 0008,000) Taxable income $830,000) $880,000) $943,000) The income tax rate for all years is 20%. Instructions a. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022. b. Indicate how deferred taxes will be reported on the 2022 balance sheet. Button's product warranty is for 12 months. c. Prepare the income tax expense section of the income statement for 2022, beginning with the line “Pretax financial income.”

- 61. Lala Company reported the following information in 2021:· Sales revenue- P500,000· Cost of Goods Sold- P350,000· Operating Expenses- P55,000· Unrealized translation gain- P20,000· Cash dividends received on investment in equity securities- P2,000Ignore income tax, for 2021, Lala Company would report total comprehensive income before tax of? CHOICES: P115,000 P20,000 P117,000 P97,000Holly’s Art Galleries recently reported $7.9 million of net income. Its EBIT was $13 mil-lion, and its federal tax rate was 21% (ignore any possible state corporate taxes). What was its interest expense? (Hint: Write out the headings for an income statement and then fill in the known values. Then divide $7.9 million net income by 1 2 T 5 0.79 to find the pre-tax income. The difference between EBIT and taxable incomByron Books Inc. recently reported $13 million of net income. ItsEBIT was $20.8 million, and its tax rate was 35%. What was its interest expense? (Hint:Write out the headings for an income statement, and fill in the known values. Then divide$13 million of net income by (1 2T) 5 0.65 to find the pretax income. The differencebetween EBIT and taxable income must be interest expense. Use this same procedure tocomplete similar problems.)