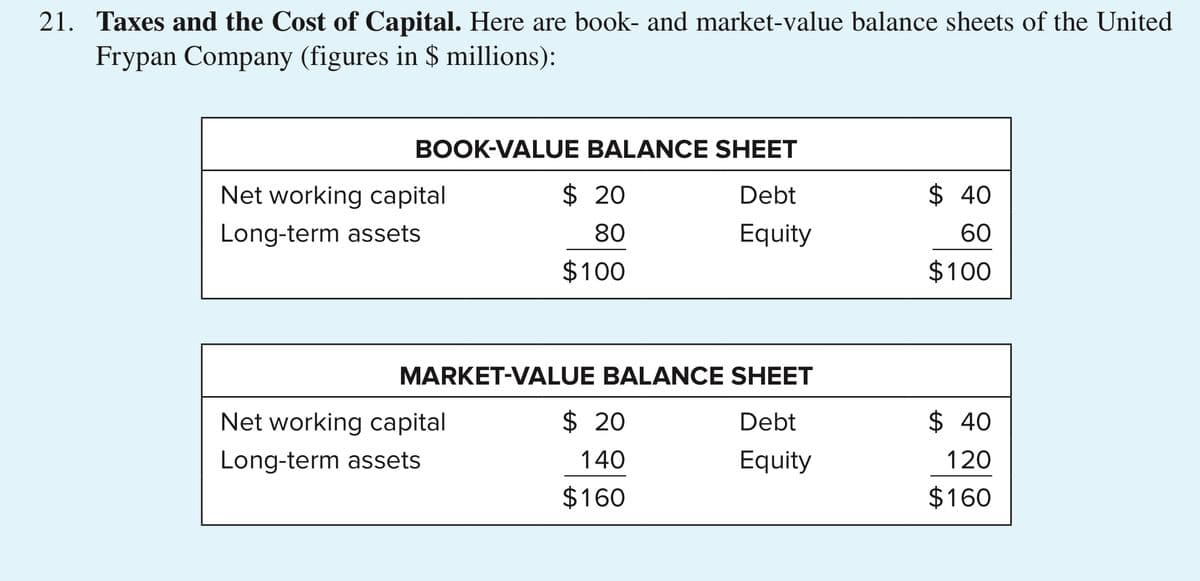

21. Taxes and the Cost of Capital. Here are book- and market-value balance sheets of the United Frypan Company (figures in $ millions): BOOK-VALUE BALANCE SHEET Net working capital $ 20 Debt $ 40 Long-term assets 80 Equity 60 $100 $100 MARKET-VALUE BALANCE SHEET Net working capital $ 20 Debt $ 40 Long-term assets 140 Equity 120 $160 $160

21. Taxes and the Cost of Capital. Here are book- and market-value balance sheets of the United Frypan Company (figures in $ millions): BOOK-VALUE BALANCE SHEET Net working capital $ 20 Debt $ 40 Long-term assets 80 Equity 60 $100 $100 MARKET-VALUE BALANCE SHEET Net working capital $ 20 Debt $ 40 Long-term assets 140 Equity 120 $160 $160

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 7EB: Assume Plainfield Manufacturing has debt of $6,500,000 with a cost of capital of 9.5% and equity of...

Related questions

Question

Transcribed Image Text:21. Taxes and the Cost of Capital. Here are book- and market-value balance sheets of the United

Frypan Company (figures in $ millions):

BOOK-VALUE BALANCE SHEET

Net working capital

$ 20

Debt

$ 40

Long-term assets

80

Equity

60

$100

$100

MARKET-VALUE BALANCE SHEET

Net working capital

$ 20

Debt

$ 40

Long-term assets

140

Equity

120

$160

$160

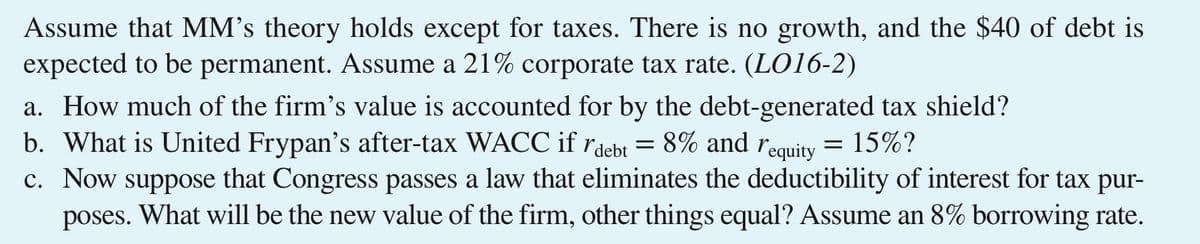

Transcribed Image Text:Assume that MM's theory holds except for taxes. There is no growth, and the $40 of debt is

expected to be permanent. Assume a 21% corporate tax rate. (LO16-2)

a. How much of the firm's value is accounted for by the debt-generated tax shield?

b. What is United Frypan's after-tax WACC if rdebt = 8% and requity

c. Now suppose that Congress passes a law that eliminates the deductibility of interest for tax pur-

poses. What will be the new value of the firm, other things equal? Assume an 8% borrowing rate.

= 15%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College