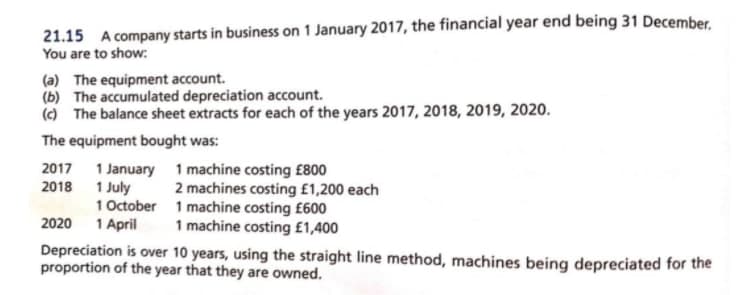

21.15 A company starts in business on 1 January 2017, the financial year end being 31 December. You are to show: (a) The equipment account. (b) The accumulated depreciation account. () The balance sheet extracts for each of the years 2017, 2018, 2019, 2020. The equipment bought was: 2017 1 January 1 machine costing £800 2 machines costing £1,200 each 1 October 1 machine costing £600 1 machine costing £1,400 2018 1 July 2020 1 April Depreciation is over 10 years, using the straight line method, machines being depreciated for the proportion of the year that they are owned.

Q: a. Prepare a worksheet for the postretirement plan in 2022.

A: a) Post retirement plan takes time to evolve. In order to have a fun, secured and comfortable retire...

Q: An entrepreneur runs a website that sells car tires online. Based on the Regression output below, ho...

A: GIVEN An entrepreneur runs a website that sells car tires online. Based on the Regression output b...

Q: A bond sells at a discount when the: O Contract rate is above the market rate O Contract rate is equ...

A: If bond is traded/ sold at par then contract rate will be equal to market rate. Because the coupon i...

Q: Extracts from CeeCee's accounts: Statement of Comprehensive Income, Statement of Financial Position ...

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or str...

Q: Use the following information for the next 2 items: 2022 Formula One World Championship pre-season t...

A: Solution Goodwill is an intangible asset that accounts for the excess purchase price of another comp...

Q: 8..new Carla Company has not yet prepared a statement of cash flows for the 2020 fiscal year. Com...

A: Statement of Cash Flow (Direct) - Statement of Cash Flow is the statement that shows movement of cas...

Q: he explains that she sold one of the properties has been listed the longest in the market. However, ...

A: Sale of capital assets (property) which is been listed longest in the market for sell is now being...

Q: In its income statement for the year ended December 31, 2022, Pina Colada Corp. reported the followi...

A: An income statement that shows the revenue and expenses of a firm. It also shows if a business is ea...

Q: You and Jackie are arguing whether tax laws can be retroactive in its application. Jackie noted that...

A: In the context of taxation, retrospective taxation refers to the implementation of a current law ame...

Q: 1. In the _____, a balance is calculated at the end of each each, incorporating any purchases, credi...

A: Fill in the blanks in the step 2.

Q: Data concerning NikNik Corporation's activity for the 6 months appear below: Machine Electrical Cost...

A: High low method is a method of cost estimation under which variable costs and fixed costs are being ...

Q: Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per Wages a...

A: Formulas that are used to calculate Activity Variances:-

Q: Which of the following accounts is increased by a debit?A. Common StockB. Accounts PayableC. Supplie...

A: Debit and credit are two sides of account in accounting framework. All assets, expenses and withdraw...

Q: On December 1, Martin Company signed a $5,000 3-month 6% note payable, with the principle plus inter...

A: Interest accrued at December 31 on the note = Face value of the note x rate of interest x no. of mon...

Q: Cullumber Chrome Bumpers bought two acres of land with an old office building on it that was deemed ...

A:

Q: Why does management need to evaluate variances and make adjustments? How often do you think a standa...

A: A variance is the difference between being an expected and actual quantity in accounting. Budgeting ...

Q: On January 1, 20x1, an entity issues 9%, 3-year, P3,000,000 bonds at a price that reflects a yield r...

A: Where a Bond is issued at a price lower than it's face value it is said to be issued at a discount.

Q: A company purchased property for a building site. The costs associated with the property were: Purch...

A: Solution: Cost of Land will include all of the costs which makes the land to be ready for building. ...

Q: On which of the following would the year-end Retained Earnings balance be stated correctly?A. Unadju...

A: Retained Earnings (RE) are the accumulated portion of a company's profits that aren't released as di...

Q: What are some ways that each branch can perform checks on the powers of other branches?

A: The president of the executive branch can check on the powers of other branches through veto power. ...

Q: e following is a characteristic of a business combination that should be accounted for as an acquisi...

A: The acquisition is the that another company being merged with original company and two are joined to...

Q: The income statement debit column of the worksheet showed the following expenses: $1,000 Supplies Ex...

A: To close out your expenditure accounts, debit the income summary account & credit every expendit...

Q: Q3) Suppose that on November 15th, 2021 a company purchased ( i.e. Ilong) one May 2022 live cattle f...

A: A futures contract is a derivative instrument to purchase or sell an underlying asset on a future da...

Q: *................... You have been assigned to audit the financial statements of TRUE CORPORATION, a...

A: Rental Income: It is is an income account that is earned from leasing to third parties and is pre...

Q: hort-term notes payable: O Can replace an account payable O Can be issued in return for money borrow...

A: Short term notes payable is a current liability. It is an obligation to pay a specified sum plus int...

Q: Use the following to calculate pretax income (IBT): $ Interest revenue 5,000 Sales revenue 300,000 I...

A: The income before tax is calculated as difference between total revenues and total expenses, before ...

Q: If total fixed costs increase, while selling price per unit and variable cost per unit remain the sa...

A: Break even point = fixed cost / ( sales price per unit -variable cost per unit if fixed cost increas...

Q: A company should not accept a special order for its product for less than its regular sales price. T...

A: We know that, A special order do not affect the fixed cost that is already incurring while producing...

Q: Which of the following statements regarding equity is not true? It is defined independently of asset...

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.

Q: A lessor with a sales-type lease involving an unguaranteed residual value at the end of the lease te...

A: At the inception of a Sale Type Lease, Present Value of all the Future Cash Flows including unguaran...

Q: Steven and Son Inc. sells its car wash package for $180 per unit, its total variable costs per unit ...

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods...

Q: e fo

A: Tax refers to the mandatory charge levied by the government over the income gained by an entity.

Q: Assume the following data pertaining to Franchise agreement between Franchisor Mayang and Franchisee...

A: As per Bartlby policy, only first three sub parts will be answered for the first question. If you wa...

Q: Gensource Company provided the following information from its accounting records for 2021: Estimated...

A: The predetermined overhead rates are used to allocate the overhead. It can be calculated on the basi...

Q: Problem 9-28 (Algo) Complete balance sheet and prepare a statement of changes in retained earnings L...

A: The cash flow statement is prepared to record the cash flow from various activities during the perio...

Q: On September 1, 20x1, an entity issues bonds with face amount of P8,000,000 for P9,105,022, includin...

A: A bond is a fixed-income security that represents a borrower's loan from a lender (typically corpora...

Q: You are the external auditor of National Detergent Company SAOG (NDC) is one of the leading manufact...

A: Auditing refers to an independent examination of financial records of an entity with a view to provi...

Q: Vulcan Flyovers offers scenic overflights of Mount Saint Helens, the volcano in Washington State tha...

A: The variance is the difference between standard production data and actual production data for the c...

Q: Swifty Corporation accounting records show the following for the year ending on December 31, 2022. P...

A: A periodic inventory system updates the inventory account at the end of each accounting period rathe...

Q: If the company realizes at the start of 2021 that the remaining useful life of the 6-year-old buildi...

A: Depreciation is the demunition in the value of an asset on account of...

Q: w does a company determine if it should use an ABO, PBO, or VBO calculation? Is the determination ma...

A: ABO The estimated amount of a company's pension plan commitment at any one time is known as the acc...

Q: At the beginning of October, Nelson Inc. detemined the following for a particular product: Standard ...

A: Solution Working note Calculation of the actual quantity of material purchased Favorable Material p...

Q: Oriole Corporation is a lessee with a finance lease. The asset is recorded at $720000 and has an eco...

A: As lease agreement provides transfer of title of asset to the lessee at the end of the lease term, t...

Q: Question 1 Kevin, a single taxpayer, made payments of $6,000 for a life insurance policy that has a ...

A: If the policy was transferred to you for cash or other valuable consideration, the exclusion for the...

Q: Concord Company reports the following for the month of June. Date Explanation Units Unit Cost Total ...

A: In this question we will find out Ending inventory, COGS with LIFO, FIFO method and Average cost met...

Q: The depreciation cost is included in the cash flow analysis since it is a book cost Select one: True...

A: Financial Statement Analysis: Financial statement analysis is the most common way of dissecting an o...

Q: Magic Realm, Incorporated, has developed a new fantasy board game. The company sold 60,000 games las...

A: Formula: Net income = Revenues - Expenses.

Q: Dividends Per Share Oceanic Company has 30,000 shares of cumulative preferred 1% stock, $100 par an...

A: A dividend is a fee paid to stakeholders by a corporation. When a firm makes a profit or has a surpl...

Q: Explain in detail receivable float and the ways to avoid receivable float loss. Provide a hypothetic...

A: Float refers to the time gap in the receivables management.

Q: cation.com252F/activity/question group/kEZASSEPCAp G Gmail YouTube Maps News Translate Chapter 7 Ass...

A: If Jones division was dropped then fixed costs allocated to that division are to be reallocated to o...

Step by step

Solved in 2 steps with 3 images

- Beg. Retained Earnings= $34 for nov. 30, 2022. . Then, The following transactions occurred during December of 2022: Paid $14 for December rent, Paid $6 to reduce the amount of accounts payable, Sold inventory costing $5 for $60, Collected $10 accounts receivable, Accrued $5 owed to employees for work performed in December to be paid in January, Recorded $8 depreciation on the new equipment. What is retained earnings at 12/31/2022?Exercise: Given the following transactions of LAMA company during the year 2018. On October 1, 2018, the company received cash of $12,000 in advance for services to be performed over 6 months. On December 31, 2018, a salary of $1,650 has not been paid yet On July 1, 2018, the company purchased an equipment for $50,000. It is estimated that the machine will have a residual value of $5,000 and a useful life of 5 years. On December 31, 2018, services earned but not collected in cash are $7000 Required Prepare the adjusting entries on December 31, 2018.Hyland Ltd commenced operation on 31 March 2020. The company balances its accounts at month-end and the end of the reporting period is 31st December each year. Ignore GST. The following events occurred during 2020 and 2021. 2020 April 1 Paid $80 000 cash for a second-hand truck Paid $10 000 to recondition the engine of the truck June 30 Paid $20 000 cash for equipment. It was estimated that the equipment’s useful life would be 5 years with a residual value of $1 500. August 31 Paid $750 cash for the truck’s service and oil change. Dec 31 Recorded depreciation on the truck at 40% p.a. diminishing balance method, and on the equipment using straight line method. 2021 March 13 Paid $600 cash to replace a damaged bumper on the truck. July 1 Installed a new tray back on the truck at a cost of $7 500. Dec 31 It was decided to revise the diminishing balance depreciation method on the truck to 30%. Dec 31 Recorded depreciation on the truck and on the equipment. Required: a. Prepare journal…

- Redlands Inc. begins business on January 1, 2020. Redlands had the following four transactions during 2020. 1. Purchased equipment for $20. 2. Earned $30 of service revenue and collected it all in cash. 3. Incurred $20 of operating expenses. Paid $5 in cash and set up an account payable for the remaining $15. 4. Recorded $5 of depreciation on the equipment. Complete the following journal by recording transactions 2-4 above. The first one has been completed for you. Insert "0" in any space that should be left blank.Prepare journal entries to record the following transactions. You are required to show all calculations: the financial year-end of the client is 30 November 2021. 3.1 The company adopted the straight-line depreciation method. Record the 15% depreciation on the plant and equipment purchased On 1 December 2020 for R125 000. 3.2 The allowance for credit losses account has an opening balance of R4 500. The policy requires the allowance to equate 8% of the total accounts receivable. The debtors sub-ledger totaled R52 000 prior receiving 40c in the rand on an account of R3 000. The financial manager instructed the write off on the balance WITH GENERAL LEDGER ENTERIES: Please dont provide answer in image format thnkuSheffield Corp. purchased equipment for $15900 on December 1. It is estimated that annual depreciation on the computer will be $3180. If financial statements are to be prepared on December 31, the company should make the following adjusting entry: debit Depreciation Expense, $12720; credit Accumulated Depreciation, $12720. debit Depreciation Expense, $3180; credit Accumulated Depreciation, $3180. debit Equipment, $15900; credit Accumulated Depreciation, $15900. debit Depreciation Expense, $265; credit Accumulated Depreciation, $265.

- Question 2A: - On January 3, 2014, a machine was bought. The cost price of it was Rs. 42, 000, estimated residual value was Rs. 6, 000 and estimated useful life was 4 years. The company uses Sum of the Year Digit method, and fiscal year is from January to December. Instructions: - Prepare the depreciation schedule. Give the adjusting entry to record depreciation expense for the year 2015. Prepare the income statement extract for the year ended December 31, 2016. Prepare the statement of financial position extract as at December 31, 2017Ibu Mertuaku Berhad manufactures paper boxes. The company closes its accounts annually on 31 May, and in its year ended 31 May 2022, the company acquired the following assets: • A lorry was acquired under a hire purchase scheme and the relevant details are as follows: Cost 210,000 Deposit paid on 10 January 2022 30,000 Loan 180,000 Interest 2,000 Instalment period (months) 24 First instalment due on 1 February 2022 • A heavy machine was acquired for RM3,000 and used in the company. A reconditioned van was acquired for RM130,000 to transport their management team. The van was not licensed as a commercial vehicle. • On 3 October 2021, the company bought a folding machine for RM120,000. Required: Compute the total capital allowances claimable by Ibu Mertuaku Berhad for the above assets for the year of assessment 2022. [30 marks]37 ABC Company reported net income and retained earnings for a two – year period as follows: Net Income Retained Earnings, Ending 2020 6,000,000 6,000,000 2021 8,000,000 14,000,000 In checking the statement for the year ended December 31, 2020, the following errors are discovered: The company paid one – year insurance premium of P 240,000 effective April 1, 2020. The entire amount was debited to asset account and no adjustment was made at the end of 2020. The company leased a portion of its building for P 480,000. The term of the lease is one year ending April 30, 2021. Collection of rent was credited to unearned rent revenue account. At the end of 2020, no entry was made to take up the earned portion of the amount collected. Depreciation expense in 2020 was understated by P 12,000. Depreciation expense in 2021 was overstated by P 14,000. Bad debts expense of P 11,000 was not recorded in 2020. How much is…

- Gooch Ltd manufactures and sells clothing and their inexperienced bookkeeper has produced the following trial balance for the 15 months ended 31 st March 2019. The company has decided to move the financial year end away from December as that is a very busy time for them. Gooch Ltd – Trial Balance as at 31 March 2019 £’000 £’000 Accumulated depreciation of land and buildings at 1.1.18 250 Accumulated depreciation of shop fittings at 1.1.18 150 Accumulated depreciation of production machinery at 1.1.18 750 Allowance for receivables 20 Bank loan at 5% p.a. 2000 Carriage Inwards 58 Carriage outwards 66 Cash at bank 18 Directors remuneration 120 Discounts allowed 12 Discounts received 24 Dividends paid 500 Heat and light 480…Answer both subparts i,ii.if answered within 40mins,it would be great You were hired as a junior accountant at Byron Manufacturing Company. The following transactions relate to the company’s operations for the year 2020. A. On February 8, the company purchased raw materials from Cetal Company for $80,000 with related terms 2/10, n/30. Byron paid for this purchase on February 15. Purchases and accounts payable are recorded at net amounts. B. On March 1, the company purchased equipment for$500,000 from Machines and More Company. It paid$100,000 in cash and used a one-year, 7% note for the balance. C. On June30, the company borrowed $200,000 by signing a one-year zero-interest-bearing $240,000 note at FSC Bank. D. The company sells smart speakers at an average price of $15,000. Each customer is offered a separate 5-year service type warranty contract of $1500. With this contract, the company would carry out periodic services and replace defective parts. During 2020, the company sold 40…The following is the ending balances of accounts at June 30, 2018 for Excell Company.Account Title Debits CreditsCash $ 83,000Short-term investments 65,000Accounts receivable 280,000Prepaid expenses (for the next 12 months) 32,000Land 75,000Buildings 320,000Accumulated depreciation—buildings $ 160,000Equipment 265,000Accumulated depreciation—equipment 120,000Accounts payable 173,000Accrued expenses 45,000Notes payable 100,000Mortgage payable 250,000Common stock 100,000Retained earnings 172,000Totals $1,120,000 $1,120,000Additional Information:1. The short-term investments account includes $18,000 in U.S. treasury bills purchased in May. The billsmature in July.2. The accounts receivable account consists of the following:a. Amounts owed by customers $225,000 b. Allowance for uncollectible accounts—trade customers (15,000)c. Nontrade note receivable (due in three years) 65,000 d. Interest receivable on note (due in four months) 5,000Total $280,0003. The notes payable account consists of…