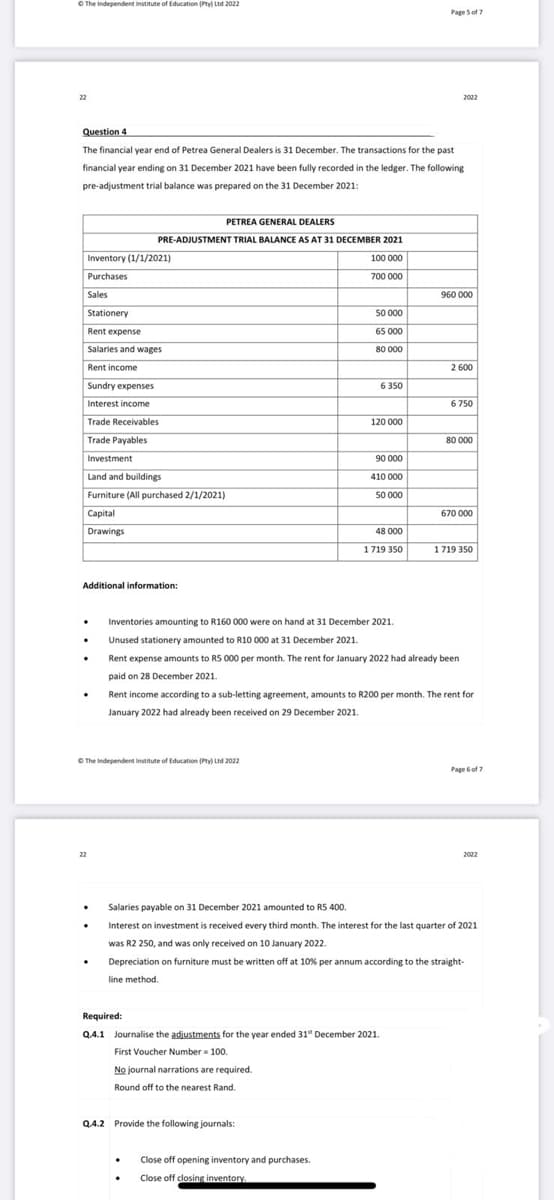

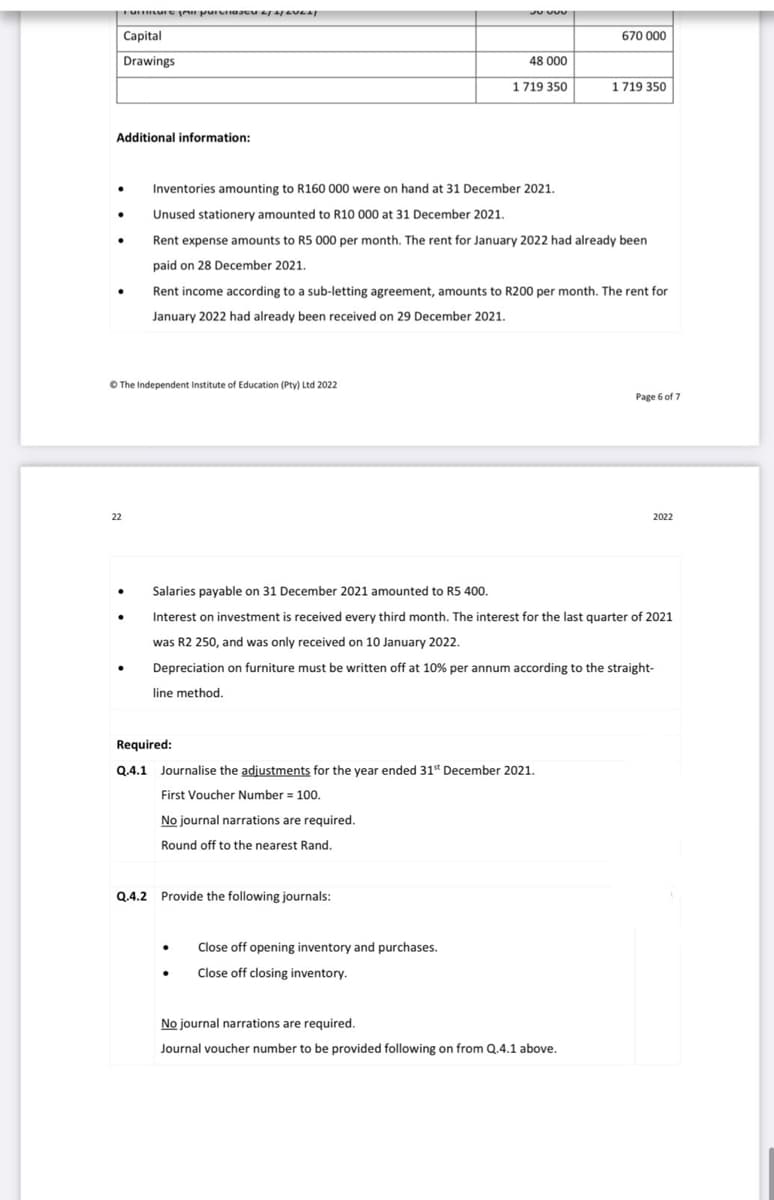

22 2022 Question 4 The financial year end of Petrea General Dealers is 31 December. The transactions for the past financial year ending on 31 December 2021 have been fully recorded in the ledger. The following pre-adjustment trial balance was prepared on the 31 December 2021: PETREA GENERAL DEALERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 31 DECEMBER 2021 Inventory (1/1/2021) 100 000 Purchases 700 000 Sales 960 000 Stationery 50 000 Rent expense 65 000 Salaries and wages 80 000 Rent income 2 600 Sundry expenses 6 350 Interest income 6 750 Trade Receivables 120 000 Trade Payables 80 000 Investment 90 000 Land and buildings 410 000 Furniture (All purchased 2/1/2021) 50 000 Capital 670 000 Drawings 48 000 1719 350 1719 350 Additional information: Inventories amounting to R160 000 were on hand at 31 December 2021. Unused stationery amounted to R10 000 at 31 December 2021. Rent expense amounts to RS 000 per month. The rent for January 2022 had already been paid on 28 December 2021. Rent income according to a sub-letting agreement, amounts to R200 per month. The rent for January 2022 had already been received on 29 December 2021. O The Independent institute of Education (Pty Ltd 2022 Page 6of 7 22 2022 Salaries payable on 31 December 2021 amounted to RS 400. Interest on investment is received every third month. The interest for the last quarter of 2021 was R2 250, and was only received on 10 January 2022. Depreciation on furniture must be written off at 10% per annum according to the straight- line method. Required: Q4.1 Journalise the adjustments for the year ended 31" December 2021. First Voucher Number 100. No journal narrations are required. Round off to the nearest Rand. Q4.2 Provide the following journals: Close off opening inventory and purchases. Close off closing inventory

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images