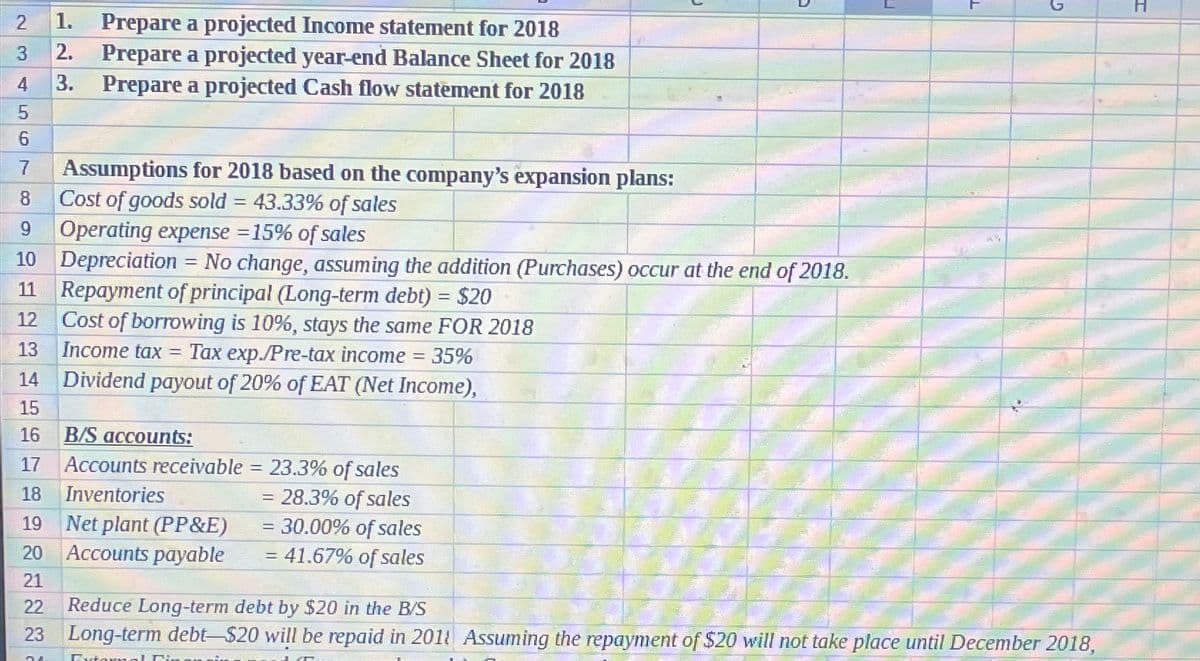

23 4 5 6 7 EN3 Prepare a projected Income statement for 2018 Prepare a projected year-end Balance Sheet for 2018 3. Prepare a projected Cash flow statement for 2018 1. 2. = 9 Assumptions for 2018 based on the company's expansion plans: 8 Cost of goods sold = 43.33% of sales 9 Operating expense = 15% of sales 10 Depreciation = No change, assuming the addition (Purchases) occur at the end of 2018. 11 Repayment of principal (Long-term debt) = $20 12 Cost of borrowing is 10%, stays the same FOR 2018 13 Income tax Tax exp./Pre-tax income = 35% Dividend payout of 20% of EAT (Net Income), 14 15 16 17 18 Inventories 19 Net plant (PP&E) 20 Accounts payable 21 22 Reduce Long-term debt by $20 in the B/S 23 Long-term debt-$20 will be repaid in 2011 Assuming the repayment of $20 will not take place until December 2018, 74 External Fin B/S accounts: Accounts receivable = 23.3% of sales = 28.3% of sales = 30.00% of sales = 41.67% of sales D H

23 4 5 6 7 EN3 Prepare a projected Income statement for 2018 Prepare a projected year-end Balance Sheet for 2018 3. Prepare a projected Cash flow statement for 2018 1. 2. = 9 Assumptions for 2018 based on the company's expansion plans: 8 Cost of goods sold = 43.33% of sales 9 Operating expense = 15% of sales 10 Depreciation = No change, assuming the addition (Purchases) occur at the end of 2018. 11 Repayment of principal (Long-term debt) = $20 12 Cost of borrowing is 10%, stays the same FOR 2018 13 Income tax Tax exp./Pre-tax income = 35% Dividend payout of 20% of EAT (Net Income), 14 15 16 17 18 Inventories 19 Net plant (PP&E) 20 Accounts payable 21 22 Reduce Long-term debt by $20 in the B/S 23 Long-term debt-$20 will be repaid in 2011 Assuming the repayment of $20 will not take place until December 2018, 74 External Fin B/S accounts: Accounts receivable = 23.3% of sales = 28.3% of sales = 30.00% of sales = 41.67% of sales D H

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

Transcribed Image Text:23

4

5

6

7

EN3

Prepare a projected Income statement for 2018

Prepare a projected year-end Balance Sheet for 2018

3. Prepare a projected Cash flow statement for 2018

1.

2.

=

9

Assumptions for 2018 based on the company's expansion plans:

8

Cost of goods sold = 43.33% of sales

9 Operating expense = 15% of sales

10 Depreciation = No change, assuming the addition (Purchases) occur at the end of 2018.

11 Repayment of principal (Long-term debt) = $20

12

Cost of borrowing is 10%, stays the same FOR 2018

13

Income tax

Tax exp./Pre-tax income = 35%

Dividend payout of 20% of EAT (Net Income),

14

15

16

17

18 Inventories

19

Net plant (PP&E)

20 Accounts payable

21

22 Reduce Long-term debt by $20 in the B/S

23 Long-term debt-$20 will be repaid in 2011 Assuming the repayment of $20 will not take place until December 2018,

74

External Fin

B/S accounts:

Accounts receivable = 23.3% of sales

= 28.3% of sales

= 30.00% of sales

= 41.67% of sales

D

H

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning