25. Any amount subsequently received on account of a bad debt previously charged off and allowed as a deduction from gross income in prior years must be included in gross income in the taxable year in which received. This is A. Severance test B. Life-blood theory C. Destination of income test D. Equitable doctrine of tax benefit

25. Any amount subsequently received on account of a bad debt previously charged off and allowed as a deduction from gross income in prior years must be included in gross income in the taxable year in which received. This is A. Severance test B. Life-blood theory C. Destination of income test D. Equitable doctrine of tax benefit

Chapter5: Corporations: Earnings & Profits And Dividend Distributions

Section: Chapter Questions

Problem 27P

Related questions

Question

Questions 24-35

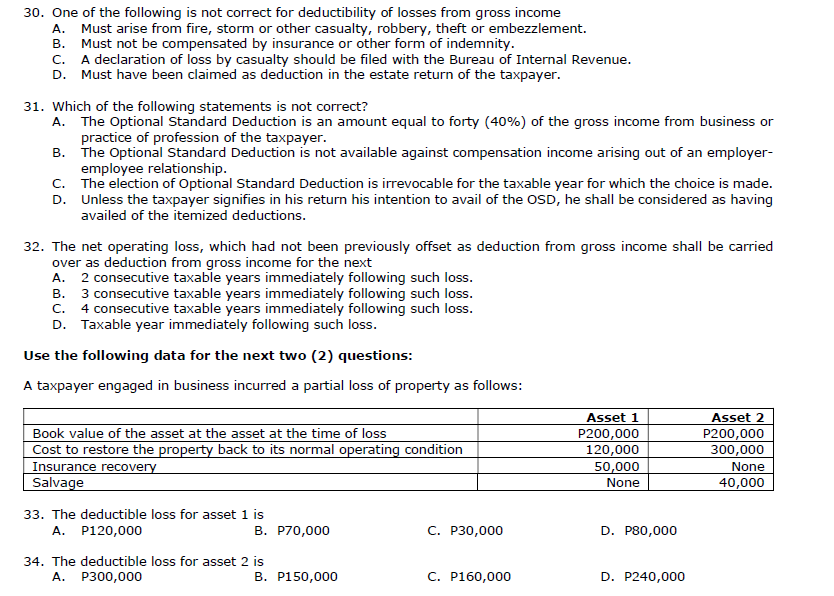

Transcribed Image Text:30. One of the following is not correct for deductibility of losses from gross income

A. Must arise from fire, storm or other casualty, robbery, theft or embezzlement.

B. Must not be compensated by insurance or other form of indemnity.

c. A declaration of loss by casualty should be filed with the Bureau of Internal Revenue.

D. Must have been claimed as deduction in the estate return of the taxpayer.

31. Which of the following statements is not correct?

A. The Optional Standard Deduction is an amount equal to forty (40%) of the gross income from business or

practice of profession of the taxpayer.

B. The Optional Standard Deduction is not available against compensation income arising out of an employer-

employee relationship.

c. The election of Optional Standard Deduction is irrevocable for the taxable year for which the choice is made.

D. Unless the taxpayer signifies in his return his intention to avail of the OSD, he shall be considered as having

availed of the itemized deductions.

32. The net operating loss, which had not been previously offset as deduction from gross income shall be carried

over as deduction from gross income for the next

A. 2 consecutive taxable years immediately following such loss.

B. 3 consecutive taxable years immediately following such loss.

C. 4 consecutive taxable years immediately following such loss.

D. Taxable year immediately following such loss.

Use the following data for the next two (2) questions:

A taxpayer engaged in business incurred a partial loss of property as follows:

Asset 1

Asset 2

Book value of the asset at the asset at the time of loss

Cost to restore the property back to its normal operating condition

Insurance recovery

Salvage

P200,000

120,000

50,000

P200,000

300,000

None

None

40,000

33. The deductible loss for asset 1 is

A. P120,000

B. P70,000

C. P30,000

D. P80,000

34. The deductible loss for asset 2 is

A.

P300,000

B. P150,000

C. P160,000

D. P240,000

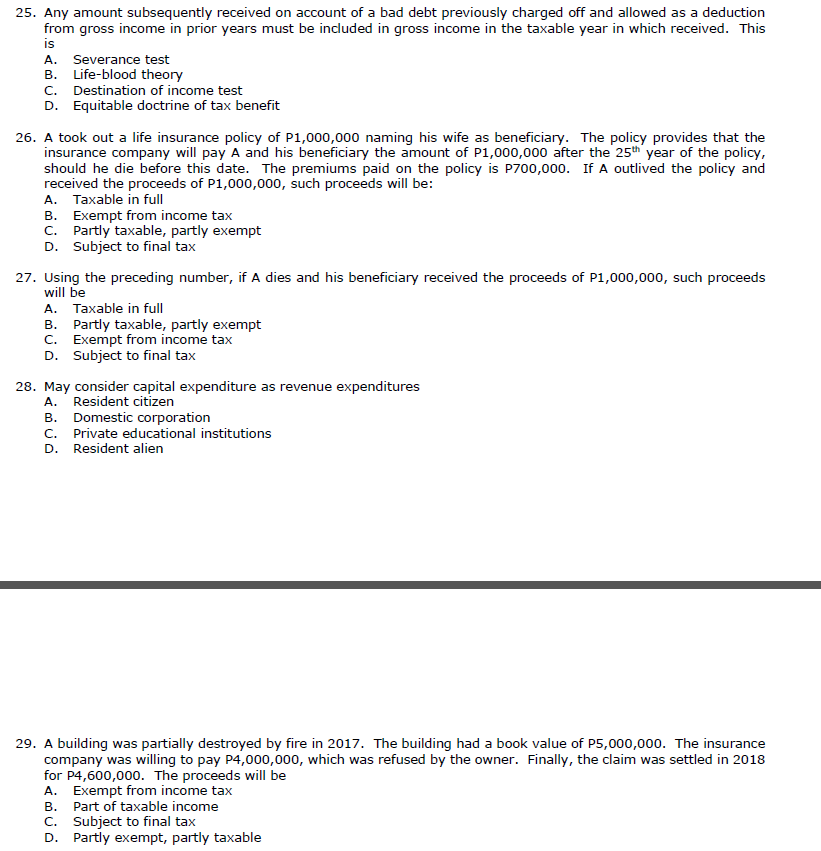

Transcribed Image Text:25. Any amount subsequently received on account of a bad debt previously charged off and allowed as a deduction

from gross income in prior years must be included in gross income in the taxable year in which received. This

is

A. Severance test

B. Life-blood theory

C. Destination of income test

D. Equitable doctrine of tax benefit

26. A took out a life insurance policy of P1,000,000 naming his wife as beneficiary. The policy provides that the

insurance company will pay A and his beneficiary the amount of P1,000,000 after the 25th year of the policy,

should he die before this date. The premiums paid on the policy is P700,000. If A outlived the policy and

received the proceeds of P1,000,000, such proceeds will be:

A. Taxable in full

B. Exempt from income tax

C. Partly taxable, partly exempt

D. Subject to final tax

27. Using the preceding number, if A dies and his beneficiary received the proceeds of P1,000,000, such proceeds

will be

A. Taxable in full

B. Partly taxable, partly exempt

C. Exempt from income tax

D. Subject to final tax

28. May consider capital expenditure as revenue expenditures

A. Resident citizen

B. Domestic oorporation

C. Private educational institutions

D. Resident alien

29. A building was partially destroyed by fire in 2017. The building had a book value of P5,000,000. The insurance

company was willing to pay P4,000,000, which was refused by the owner. Finally, the claim was settled in 2018

for P4,600,000. The proceeds will be

A. Exempt from income tax

B. Part of taxable income

C. Subject to final tax

D. Partly exempt, partly taxable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT