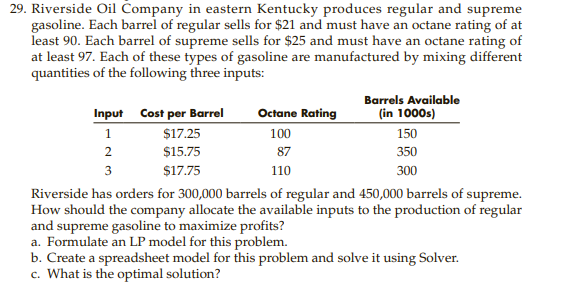

29. Riverside Oil Company in eastern Kentucky produces regular and supreme gasoline. Each barrel of regular sells for $21 and must have an octane rating of at least 90. Each barrel of supreme sells for $25 and must have an octane rating of at least 97. Each of these types of gasoline are manufactured by mixing different quantities of the following three inputs: Barrels Available Input Cost per Barrel Octane Rating (in 1000s) 1 $17.25 100 150 2 $15.75 87 350 3 $17.75 110 300 Riverside has orders for 300,000 barrels of regular and 450,000 barrels of supreme. How should the company allocate the available inputs to the production of regular and supreme gasoline to maximize profits? a. Formulate an LP model for this problem. b. Create a spreadsheet model for this problem and solve it using Solver. c. What is the optimal solution?

29. Riverside Oil Company in eastern Kentucky produces regular and supreme gasoline. Each barrel of regular sells for $21 and must have an octane rating of at least 90. Each barrel of supreme sells for $25 and must have an octane rating of at least 97. Each of these types of gasoline are manufactured by mixing different quantities of the following three inputs: Barrels Available Input Cost per Barrel Octane Rating (in 1000s) 1 $17.25 100 150 2 $15.75 87 350 3 $17.75 110 300 Riverside has orders for 300,000 barrels of regular and 450,000 barrels of supreme. How should the company allocate the available inputs to the production of regular and supreme gasoline to maximize profits? a. Formulate an LP model for this problem. b. Create a spreadsheet model for this problem and solve it using Solver. c. What is the optimal solution?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter4: Linear Programming Models

Section: Chapter Questions

Problem 71P

Related questions

Question

Transcribed Image Text:29. Riverside Oil Čompany in eastern Kentucky produces regular and supreme

gasoline. Each barrel of regular sells for $21 and must have an octane rating of at

least 90. Each barrel of supreme sells for $25 and must have an octane rating of

at least 97. Each of these types of gasoline are manufactured by mixing different

quantities of the following three inputs:

Octane Rating

Barrels Available

(in 1000s)

Input Cost per Barrel

1

$17.25

100

150

$15.75

87

350

3

$17.75

110

300

Riverside has orders for 300,000 barrels of regular and 450,000 barrels of supreme.

How should the company allocate the available inputs to the production of regular

and supreme gasoline to maximize profits?

a. Formulate an LP model for this problem.

b. Create a spreadsheet model for this problem and solve it using Solver.

c. What is the optimal solution?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,