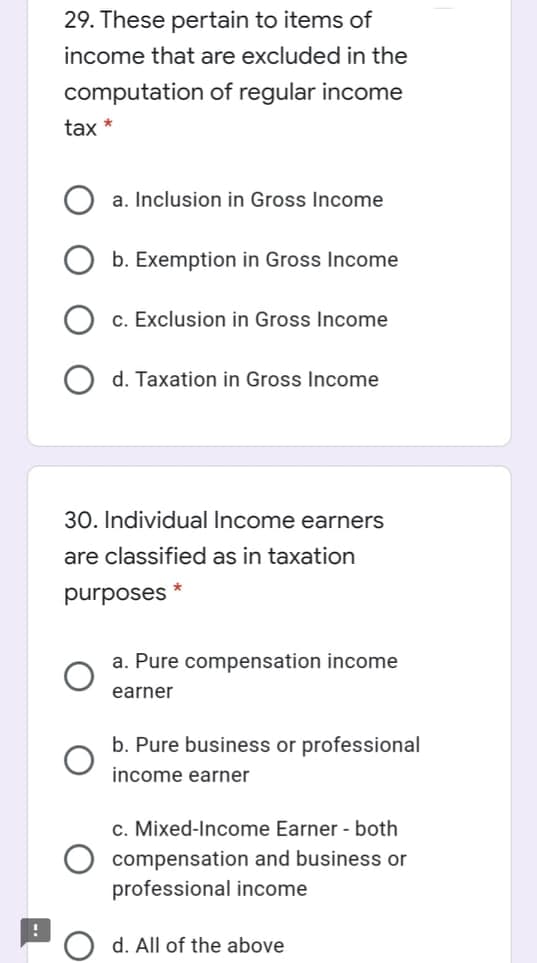

29. These pertain to items of income that are excluded in the computation of regular income tax * a. Inclusion in Gross Income b. Exemption in Gross Income c. Exclusion in Gross Income d. Taxation in Gross Income O O O

29. These pertain to items of income that are excluded in the computation of regular income tax * a. Inclusion in Gross Income b. Exemption in Gross Income c. Exclusion in Gross Income d. Taxation in Gross Income O O O

Chapter9: Deductions: Employee And Self- Employed-related Expenses

Section: Chapter Questions

Problem 13DQ

Related questions

Question

Transcribed Image Text:29. These pertain to items of

income that are excluded in the

computation of regular income

tax *

a. Inclusion in Gross Income

b. Exemption in Gross Income

c. Exclusion in Gross Income

d. Taxation in Gross Income

30. Individual Income earners

are classified as in taxation

purposes

a. Pure compensation income

earner

b. Pure business or professional

income earner

c. Mixed-Income Earner - both

compensation and business or

professional income

d. All of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT