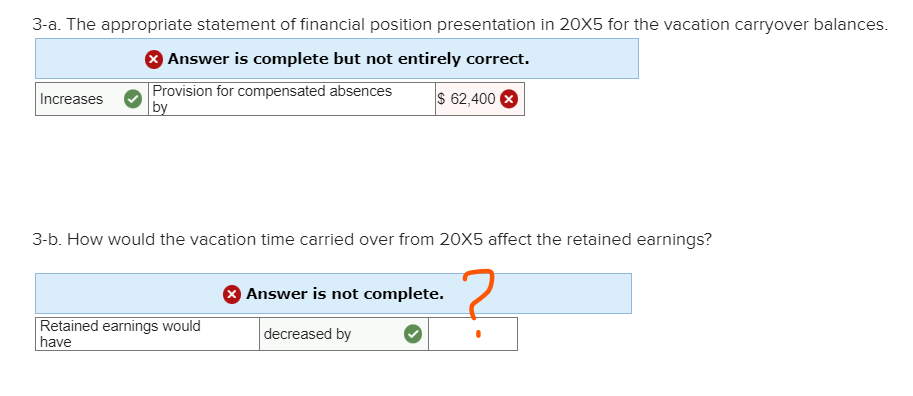

3-a. The appropriate statement of financial position presentation in 20X5 for the vacation carryover balances. Answer is complete but not entirely correct. Provision for compensated absences by $ 62,400 Increases 3-b. How would the vacation time carried over from 20X5 affect the retained earnings? 2 Retained earnings would have > Answer is not complete. decreased by

3-a. The appropriate statement of financial position presentation in 20X5 for the vacation carryover balances. Answer is complete but not entirely correct. Provision for compensated absences by $ 62,400 Increases 3-b. How would the vacation time carried over from 20X5 affect the retained earnings? 2 Retained earnings would have > Answer is not complete. decreased by

Chapter2: Computing Wages And Salaries

Section: Chapter Questions

Problem 1CP

Related questions

Question

1.

The question 1 and 2 are already answered. I need help in question 3a and 3b only. Do not give me different answers for 1 and 2 as they are already correct, for 3a and 3b only. This is my 3rd time to post this question but not getting the right answer.

Thank you for your help!

Transcribed Image Text:3-a. The appropriate statement of financial position presentation in 20X5 for the vacation carryover balances.

> Answer is complete but not entirely correct.

Provision for compensated absences

by

$ 62,400 X

Increases

3-b. How would the vacation time carried over from 20X5 affect the retained earnings?

2

Retained earnings would

have

Answer is not complete.

decreased by

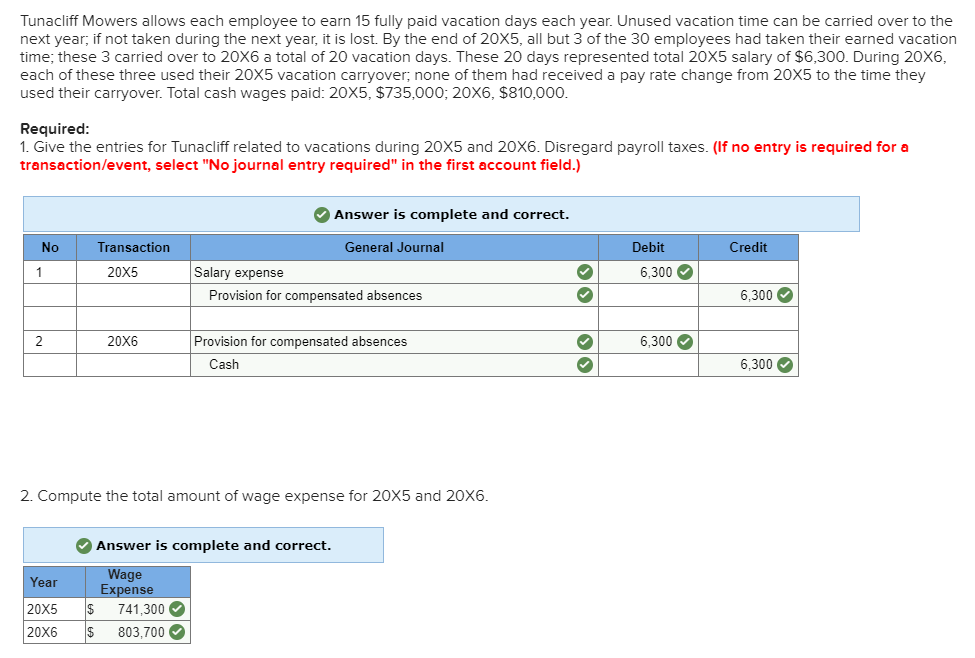

Transcribed Image Text:Tunacliff Mowers allows each employee to earn 15 fully paid vacation days each year. Unused vacation time can be carried over to the

next year; if not taken during the next year, it is lost. By the end of 20X5, all but 3 of the 30 employees had taken their earned vacation

time; these 3 carried over to 20X6 a total of 20 vacation days. These 20 days represented total 20X5 salary of $6,300. During 20X6,

each of these three used their 20X5 vacation carryover; none of them had received a pay rate change from 20X5 to the time they

used their carryover. Total cash wages paid: 20X5, $735,000; 20X6, $810,000.

Required:

1. Give the entries for Tunacliff related to vacations during 20X5 and 20X6. Disregard payroll taxes. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

No

1

2

Transaction

20X5

20X6

✔ Answer is complete and correct.

General Journal

Salary expense

Provision for compensated absences

Year

20X5 $ 741,300✔

20X6 $ 803,700✔

Provision for compensated absences

Cash

2. Compute the total amount of wage expense for 20X5 and 20X6.

✔ Answer is complete and correct.

Wage

Expense

✓

✓

33

Debit

6,300

6,300✔

Credit

6,300✔

6,300✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning