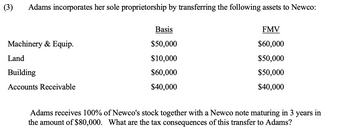

(3) Adams incorporates her sole proprietorship by transferring the following assets to Newco: Machinery & Equip. Land Building Accounts Receivable Basis $50,000 $10,000 $60,000 $40,000 FMV $60,000 $50,000 $50,000 $40,000 Adams receives 100% of Newco's stock together with a Newco note maturing in 3 years in the amount of $80,000. What are the tax consequences of this transfer to Adams?

(3) Adams incorporates her sole proprietorship by transferring the following assets to Newco: Machinery & Equip. Land Building Accounts Receivable Basis $50,000 $10,000 $60,000 $40,000 FMV $60,000 $50,000 $50,000 $40,000 Adams receives 100% of Newco's stock together with a Newco note maturing in 3 years in the amount of $80,000. What are the tax consequences of this transfer to Adams?

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Transcribed Image Text:(3) Adams incorporates her sole proprietorship by transferring the following assets to Newco:

Machinery & Equip.

Land

Building

Accounts Receivable

Basis

$50,000

$10,000

$60,000

$40,000

FMV

$60,000

$50,000

$50,000

$40,000

Adams receives 100% of Newco's stock together with a Newco note maturing in 3 years in

the amount of $80,000. What are the tax consequences of this transfer to Adams?

Recommended textbooks for you