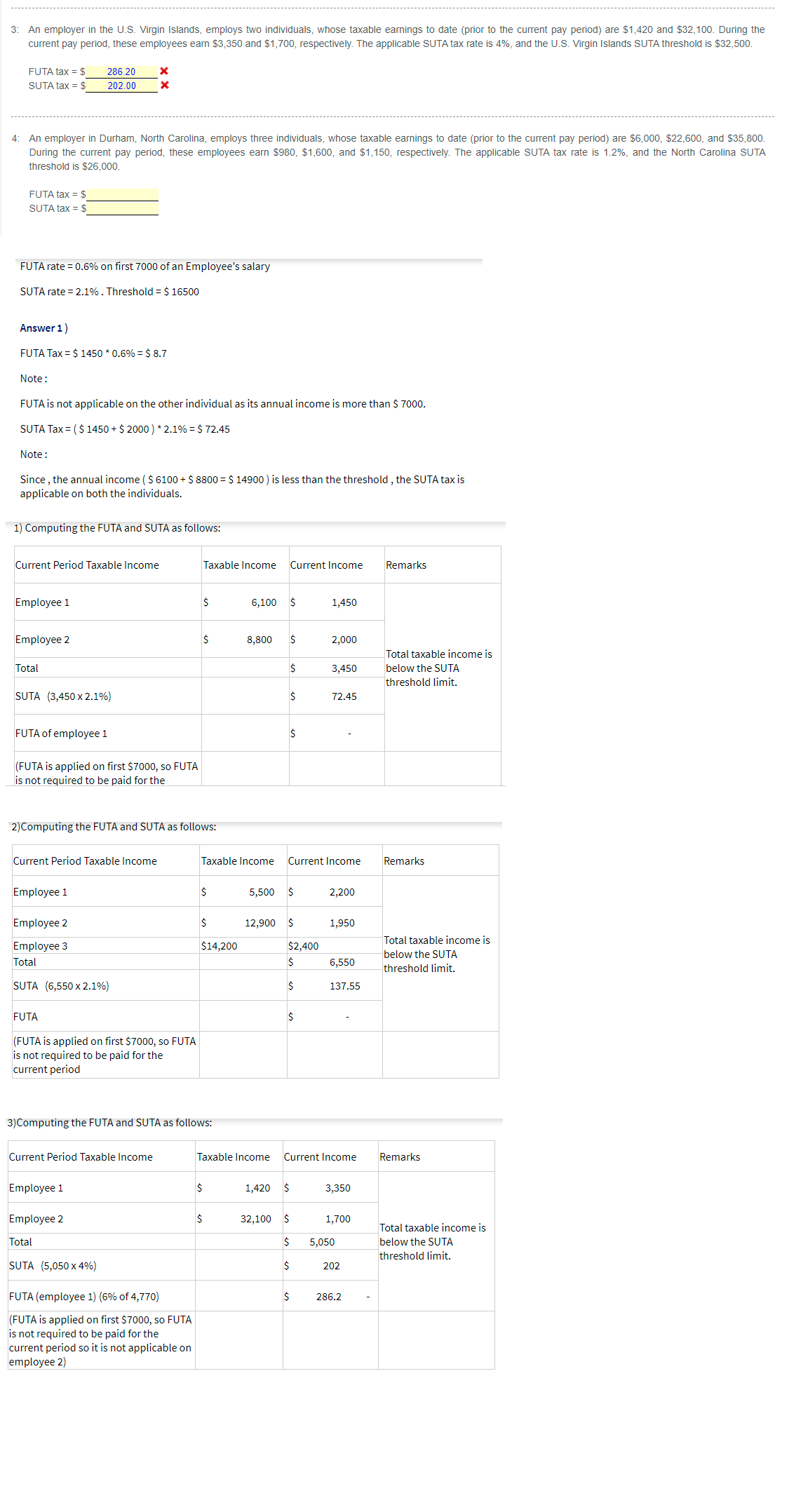

3: An employer in the U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $1,420 and $32,100. During the current pay period, these employees ean $3,350 and $1,700, respectively. The applicable SUTA tax rate is 4%, and the U.S. Virgin Islands SUTA threshold is $32,500. FUTA tax = $ 286.20 SUTA tax = $ 202.00 4: An employer in Durham, North Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,000, $22,600, and $35,800. During the current pay period, these employees earn $980, $1,600, and $1,150, respectively. The applicable SUTA tax rate is 1.2%, and the North Carolina SUTA threshold is $26,000. FUTA tax = $ SUTA tax = $ FUTA rate = 0.6% on first 7000 of an Employee's salary SUTA rate = 2.1%. Threshold = $ 16500 Answer 1) FUTA Tax = $ 1450 * 0.6% = $ 8.7 Note: FUTA is not applicable on the other individual as its annual income is more than $ 7000. SUTA Tax = ($ 1450 + $ 2000 ) * 2.1% = $ 72.45 Note: Since , the annual income ($ 6100 + $ 8800 = $ 14900) is less than the threshold , the SUTA tax is applicable on both the individuals. 1) Computing the FUTA and SUTA as follows: Current Period Taxable Income Taxable Income Current Income Remarks Employee 1 6,100 1,450 Employee 2 8,800 2,000 Total taxable income is Total 3,450 below the SUTA threshold limit. SUTA (3,450 x 2.1%) 72.45 FUTA of employee 1 (FUTA is applied on first $7000, so FUTA is not required to be paid for the 2)Computing the FUTA and SUTA as follows: Current Period Taxable Income Taxable Income Current Income Remarks Employee 1 5,500 2,200 Employee 2 12,900 $ 1,950 Total taxable income is Employee 3 $14,200 $2,400 below the SUTA Total 6,550 threshold limit. SUTA (6,550 x 2.1%) 137.55 FUTA (FUTA is applied on first $7000, so FUTA is not required to be paid for the current period 3)Computing the FUTA and SUTA as follows: Current Period Taxable Income Taxable Income Current Income Remarks Employee 1 1,420 3,350 Employee 2 32,100 $ 1,700 Total taxable income is Total 5,050 below the SUTA threshold limit. SUTA (5,050 x 4%) 202 FUTA (employee 1) (6% of 4,770) 286.2 (FUTA is applied on first $7000, so FUTA is not required to be paid for the current period so it is not applicable on employee 2)

3: An employer in the U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $1,420 and $32,100. During the current pay period, these employees ean $3,350 and $1,700, respectively. The applicable SUTA tax rate is 4%, and the U.S. Virgin Islands SUTA threshold is $32,500. FUTA tax = $ 286.20 SUTA tax = $ 202.00 4: An employer in Durham, North Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,000, $22,600, and $35,800. During the current pay period, these employees earn $980, $1,600, and $1,150, respectively. The applicable SUTA tax rate is 1.2%, and the North Carolina SUTA threshold is $26,000. FUTA tax = $ SUTA tax = $ FUTA rate = 0.6% on first 7000 of an Employee's salary SUTA rate = 2.1%. Threshold = $ 16500 Answer 1) FUTA Tax = $ 1450 * 0.6% = $ 8.7 Note: FUTA is not applicable on the other individual as its annual income is more than $ 7000. SUTA Tax = ($ 1450 + $ 2000 ) * 2.1% = $ 72.45 Note: Since , the annual income ($ 6100 + $ 8800 = $ 14900) is less than the threshold , the SUTA tax is applicable on both the individuals. 1) Computing the FUTA and SUTA as follows: Current Period Taxable Income Taxable Income Current Income Remarks Employee 1 6,100 1,450 Employee 2 8,800 2,000 Total taxable income is Total 3,450 below the SUTA threshold limit. SUTA (3,450 x 2.1%) 72.45 FUTA of employee 1 (FUTA is applied on first $7000, so FUTA is not required to be paid for the 2)Computing the FUTA and SUTA as follows: Current Period Taxable Income Taxable Income Current Income Remarks Employee 1 5,500 2,200 Employee 2 12,900 $ 1,950 Total taxable income is Employee 3 $14,200 $2,400 below the SUTA Total 6,550 threshold limit. SUTA (6,550 x 2.1%) 137.55 FUTA (FUTA is applied on first $7000, so FUTA is not required to be paid for the current period 3)Computing the FUTA and SUTA as follows: Current Period Taxable Income Taxable Income Current Income Remarks Employee 1 1,420 3,350 Employee 2 32,100 $ 1,700 Total taxable income is Total 5,050 below the SUTA threshold limit. SUTA (5,050 x 4%) 202 FUTA (employee 1) (6% of 4,770) 286.2 (FUTA is applied on first $7000, so FUTA is not required to be paid for the current period so it is not applicable on employee 2)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

Transcribed Image Text:3: An employer in the U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $1,420 and $32,100. During the

current pay period, these employees earn $3,350 and $1,700, respectively. The applicable SUTA tax rate is 4%, and the U.S. Virgin Islands SUTA threshold is $32,500.

FUTA tax = $

286.20

SUTA tax = $

202.00

4: An employer in Durham, North Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,000, $22,600, and $35,800.

During the current pay period, these employees earn $980, $1,600, and $1,150, respectively. The applicable SUTA tax rate is 1.2%, and the North Carolina SUTA

threshold is $26,000.

FUTA tax = $

SUTA tax = $

FUTA rate = 0.6% on first 7000 of an Employee's salary

SUTA rate = 2.1%. Threshold = $ 16500

Answer 1)

FUTA Tax = $ 1450 * 0.6% = $ 8.7

Note:

FUTA is not applicable on the other individual as its annual income is more than $ 7000.

SUTA Tax = ($ 1450 + $ 2000 ) * 2.1% = $ 72.45

Note:

Since , the annual income ( $ 6100 + $ 8800 = $ 14900 ) is less than the threshold , the SUTA tax is

applicable on both the individuals.

1) Computing the FUTA and SUTA as follows:

Current Period Taxable Income

Taxable Income

Current Income

Remarks

Employee 1

6,100

1,450

Employee 2

$

8,800

2,000

Total taxable income is

Total

3,450

below the SUTA

threshold limit.

SUTA (3,450 x 2.1%)

72.45

FUTA of employee 1

(FUTA is applied on first $7000, so FUTA

is not required to be paid for the

2)Computing the FUTA and SUTA as follows:

Current Period Taxable Income

Taxable Income

Current Income

Remarks

Employee 1

2$

5,500

2$

2,200

Employee 2

2$

12,900

1,950

Total taxable income is

Employee 3

$14,200

$2,400

below the SUTA

Total

6,550

threshold limit.

SUTA (6,550 x 2.1%)

137.55

FUTA

(FUTA is applied on first $7000, so FUTA

is not required to be paid for the

current period

3)Computing the FUTA and SUTA as follows:

Current Period Taxable Income

Taxable Income

Current Income

Remarks

Employee 1

1,420 $

3,350

Employee 2

32,100 $

1,700

Total taxable income is

Total

5,050

below the SUTA

threshold limit.

SUTA (5,050 x 4%)

202

FUTA (employee 1) (6% of 4,770)

286.2

(FUTA is applied on first $7000, so FUTA

is not required to be paid for the

current period so it is not applicable on

employee 2)

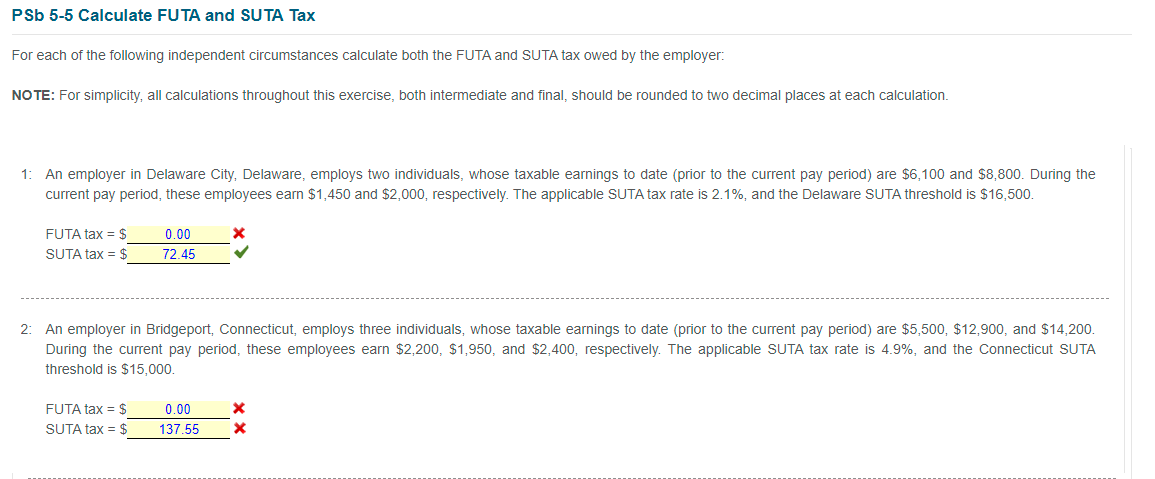

Transcribed Image Text:PSb 5-5 Calculate FUTA and SUTA Tax

For each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer:

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

1: An employer in Delaware City, Delaware, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $6,100 and $8,800. During the

current pay period, these employees earn $1,450 and $2,000, respectively. The applicable SUTA tax rate is 2.1%, and the Delaware SUTA threshold is $16,500.

FUTA tax = $

0.00

SUTA tax = $

72.45

2: An employer in Bridgeport, Connecticut, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,500, $12,900, and $14,200.

During the current pay period, these employees earn $2,200, $1,950, and $2,400, respectively. The applicable SUTA tax rate is 4.9%, and the Connecticut SUTA

threshold is $15,000.

FUTA tax = $

0.00

SUTA tax = $

137.55

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT