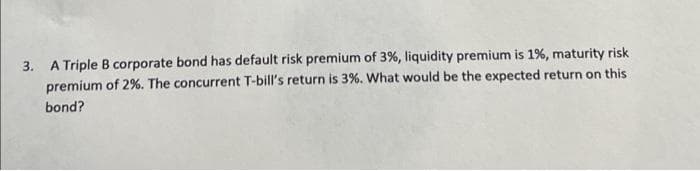

3. A Triple B corporate bond has default risk premium of 3%, liquidity premium is 1%, maturity risk premium of 2%. The concurrent T-bill's return is 3%. What would be the expected return on this bond?

Q: Current Ratio can help a firm determine their ability to cover their current liabilities. Y/N

A: Current ratio is a financial metric used to evaluate a company's short term liquidity and its…

Q: If Michael wants to know his average tax paid on his entire income, he must calculate his

A: First he has to calculate the total Taxable income during the period he earned

Q: Quantitative Problem: Barton Industries estimates its cost of common equity by using three…

A: The rate of return that is expected by investors on their equity investment is term as the cost of…

Q: ontent area top Part 1 You have an outstanding student loan with required payments of $550 per…

A: We need to first calculate total loan outstanding today by using PV function in excel, Thereafter…

Q: Mr. Johnson wants to buy an annuity due that will provide him with income of $50,000 per year for…

A: Given information,Payment per period: Time: yearsInterest rate: To calculate,Present value of…

Q: You are given the following expected 1-year rates for each of the next 5 years and the cash flows…

A: To calculate the yield-to-maturity (YTM) for Bond A, we need to find the discount rate that makes…

Q: An investor has two binds in his portfolio that have a face value of $1,000 and pay a 10% annual…

A: Bond price change to yield refers to the inverse relationship between the price of a bond and its…

Q: Consider the following factor model: E[R] - rf = b Mkt (E[RMkt] - rf) + b SMB E[R$MB] + b The term b…

A: The factor model you've provided seems to be a variation of the Capital Asset Pricing Model (CAPM),…

Q: Yesterday, you entered into a futures contract to buy €62,500 at $1.50/€. Your initial margin was…

A: When Those who open accounts with brokers have to maintain margins with brokers so that they can…

Q: At an annual effective rate of interest i=3%, find the PV of a perpetuity-immediate with annual…

A: To calculate the PV of a perpetuity-immediate with annual payments of 30, 40, 50, and 60 at an…

Q: How do you access the Power Query interface?

A: To access the Power Query interface in applications like Microsoft Excel, you typically go to the…

Q: You have been asked to evaluate a pollution device. The device costs $500 to set up and $100 per…

A: Equivalent annual cost (EAC) is a financial metric used to compare the costs of different investment…

Q: A local entrepreneur asks you to invest $3,000 in a business venture. Based on your estimates, you…

A: IRR, is the discount rate that makes the present value of cash inflows equal to the present value of…

Q: eBook Problem Walk-Through The Stewart Company has $1,170,500 in current assets and $444,790 in…

A: Current ratio is the ratio of current assets to current liabilities. Using this formula, we can get…

Q: H5. Which of the following is not a criteria that's used to pick your trading comparables?…

A: we will discuss the criteria used to select trading comparables for financial analysis and identify…

Q: a. What rate of return could Nicki eam on her money if she place it in annuity A with $8.500 payment…

A: Annuity refers to a series of payments with a fixed number of instalments of the same value and made…

Q: Last year Jonet purchased a $1,000 face value corporate bond with a 10%. annual coupon rate and a…

A: Bonds are a type of debt security that represents a loan made by an investor to a borrower. In…

Q: As a health care analyst, you are valuing the stocks of Hasbro Inc. (NYS HAS) in March 2013. Based…

A: In comparison of companies for investment decisons the companies are compared based on the multiple…

Q: The new CEO of your company asks for 2 million dollars as annual income. Your company considers 3…

A: - CEO receives a fixed salary of $2 million in cash.- Regardless of the stock price, the CEO will…

Q: You have been given the following information for an existing bond that provides coupon payments.…

A: Par Value2000Coupon Rate0.06Required Rate of Return0.06YearCouponPresent Value Factor @6%Present…

Q: A 3-year project requires the purchase of a machine (fixed asset) for $6,000 in Year 0. In Year 2,…

A: Operating cash flow (OCF) is the cash flow a firm generates from its normal operations, calculated…

Q: Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three…

A: a.Calculation of the present value of investment:Formula used:

Q: Craig's Cake Company has an outstanding issue of 13-year convertible bonds with a $800 par value.…

A: Convertible Bond Par Value = $ 800Interest Rate on bond = 12%Interest rate on straight bonds of…

Q: You plan to buy a financial product today. You expect product will give you $100 at the end of first…

A: IRR is the internal rate of return at which the present value of cash flow is equal to the initial…

Q: Payday loans are very short-term loans that charge very high interest rates. You can borrow $500…

A: First let us determine the interest percent charged for 14 days.

Q: Tech Supplies Company, Incorporated, is a leading retailer specializing in consumer electronics. A…

A: Inventory = $5,066Total current assets = $8,851Total current liabilities = $9,175Long-term…

Q: Consider a project with an initial investment (today, t = 0) of $200,975. This project will generate…

A: Profitability Index is also known as PI. It is a capital budgeting technique which helps in decision…

Q: When should you use Power BI Services?

A: While a) When you want to clean, shape, and transform data is true to some extent, Power Pivot…

Q: Required: Suppose you conduct currency carry trade by borrowing $1 million at the start of each year…

A: As per the given information:Borrowing: Exchange rate on January 1, 2000:

Q: A firm issues a $10 million bond with a 7% coupon rate, 4 year maturity, and annual interest…

A: Price of bond is the present value of coupon payments and plus present value of par value of bond…

Q: Suppose you want to have $400,000 for retirement in 20 years. Your account earns 6% interest. How…

A: A constant and fixed sum of cash flow in each period is an annuity. Here the future desired value or…

Q: Indigo Corporation has 4,000 shares of 7%, $101 par value preferred stock outstanding at December…

A: Cumulative Preference dividend refers to the distribution of preference dividend of previous years…

Q: Following is information on two alternative investments. Beachside Resort is co spa. The company…

A: Internal rate of return is the rate at which a company analyses the cash flows of the project at…

Q: Suppose you borrowed $25,000 at a rate of 8.5% and must repay it in 5 equal installments at the end…

A: We need to use loan amortization formula below to calculate annual payment of loan.WherePMT…

Q: Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will…

A: Price of a bond is the present value of coupon payments plus the present value of the par value of…

Q: Carpet Baggers, Incorporated, is proposing to construct a new bagging plant in a country in Europe.…

A: To calculate the Net Present Value (NPV) in dollars for both the German and Swiss plants, we need to…

Q: A. Discuss what could happen if GBC Financial Holdings PLC fails to meet these new requirements.…

A: Basel III standards:Basel III standards are basic regulations established while undertaking…

Q: What is the current yield for a bond that has a coupon rate of 5.2% paid annually, a par value of…

A: Coupon Rate = 5.2%Face Value = fv = $1000Time = t = 29Required Rate of Return = r = 9.5%

Q: A corporate bond with a coupon rate of 7% pays interest semiannually and has a maturity date of May…

A: ParticularsValuesFace value of the bond $ 100.00Coupon rate7.00%Maturity date28-05-2030Settlement…

Q: A corporation has $50 billion of Earnings Before Interest and Taxes (EBIT) and $20 billion in…

A: EBIT stands for "Earnings Before Interest and Taxes." It is a measure of a company's operating…

Q: An investment of $16,000 was growing at 5.25% compounded quarterly. a. Calculate the maturity value…

A: Compound = Quarterly = 4Present Value = pv = $16,000Interest Rate = r = 5.25 / 4 = 1.3125%Time = t =…

Q: what must you invest TODAY to reach your goal? a)$13,719.21

A: We can determine the amount you need to save today by using the time value of money formula as…

Q: One year ago , Igor purchased a newly issued 15- year bond for $1,000. The bond's coupon rate of…

A: Current yield refers to the annual income generated by a bond, expressed as a percentage of its…

Q: Question On September 25th the 5-year GoC bond with a coupon of 1.5% was quoted at a clean price of…

A: As per the given information:To determine:Total money borrowed on September 27th,2023

Q: What is the total return of the TIPS in percentage terms for the year? Assu

A: The return is attributed from 2 ways:Change in price Coupons received

Q: sume that the spot rate for the US Dollar is ZMW24, while the 180-day forward rate for the Zambian…

A: When forward rates are more than spot rate, then one say that there exists a premium for forward…

Q: C5: If Maria is taking out a $10,000 loan to be paid off over 4 years with weekly payments of $55,…

A: Given information,Loan amount: Compounding frequency: WeeklyNumber of years: yearsWeekly payments:…

Q: You are given the following information: A 183-day T-bill, face value $100, currently trading at a…

A: A T-Bill is a short-term debt security issued by the Department of the Treasury with maturities…

Q: a. If Nicki could earn 11 percent on her money, what is the present value of annuity A with $6,000…

A: Annuity refers to a series of payments with a fixed number of instalments of the same value and made…

Q: The Gecko Company and the Gordon Company are two firms that have the same business risk but…

A: pretax required return on Gordin's stock can be calculated by using equation below.Pretax return on…

Step by step

Solved in 3 steps

- Suppose there is a large probability that L will default on its debt. For the purpose of this example, assume that the value of Ls operations is 4 million (the value of its debt plus equity). Assume also that its debt consists of 1-year, zero coupon bonds with a face value of 2 million. Finally, assume that Ls volatility, , is 0.60 and that the risk-free rate rRF is 6%.Assume that the risk-free rate (i.e., Rf) is 2.8%. If, for a particular company bond issue, the default risk premium (i.e., DP) is 3.1%, the maturity risk premium ( i.e., MP) is 0.9%, and the market risk premium ( i.e., MRP) for that company's stock is 12.9% what is the required rate of return for the company's fixed income securities ? Record your answer as a percent , rounded to one decimal place , but do not include a percent sign in your answer . For example , enter 0.1578658 = 15.78625% as 15.8 .If 10-year Treasury bonds have a yield of 4.3%, 10-year corporate bonds yield 6.7%, the maturity risk premium on all 10-year bonds is same, and corporate bonds have a 0.3% liquidity premium vs. a zero liquidity premium for T-bonds,what is the default risk premium on the corporate bond?

- The risk-free rate on long-term Treasury bonds is 6.04%. Assume thatthe market risk premium is 5%. What is the required return on the market? Now use the SML equation to calculate the two companies’ requiredreturns.A fixed rate bond with notional 1 pays annual coupons of c at times T1,T2,...,Tn whereTi+1 =Ti+1andnotional1attimeTn. a) Write down the bond price Bc^(FXD)(t) at time t ≤ T in terms of ZCBs.If 10-year T-bonds have a yield of 6.2%, 10-year corporate bonds yield 9.2%, the maturity risk premium on all 10-year bonds is 1.3%, and corporate bonds have a 0.4% liquidity premium versus a zero liquidity premium for T-bonds, what is the default risk premium on the corporate bond?

- A corporate bond has a nominal or observed yield of 9.8%. Your sister, the famouseconomist, has given you the following estimates:Inflation-risk premium = 3.00%Default-risk premium = 2.10%Maturity premium = 1.90%Liquidity premium = 0.50%On the basis of these data, what is the best estimate of the real risk-free rate of return?7 Suppose the interest rates in the market for one-year, zero-coupon Treasury strips and for one-year, zero-coupon grade B corporate bonds are, respectively: i = 2.05% k = 7.80% Compute the probabilities of repayment and default as well as the risk premium.The risk free rate is 1.7%, inflation is expected to be 3.5%, a corporate bond has a yield rate of 8.7%, which includes a 1% liquidity premium. What is the default risk premium? (ignore the maturity risk) Group of answer choices a)4.2% b)2.5% c)3.5% d)Not enough information

- Suppose a 10-year Treasury (risk-free) bond has a YTM of 5% and a Coupon Rate of 5%. Further, a 10-year corporate bond has a YTM of 7% and a coupon rate of 6%. What is the expected risk premium (in dollars) of this bond? a)$44.26 b)$106.18 c)$8.08 d)$71.06If the pure expectations theory of the term structure is correct, which of the following statements would be CORRECT? a. If a 1-year Treasury bill has a yield to maturity of 7% and a 2-year Treasury bill has a yield to maturity of 8%, this would imply the market believes that 1-year rates will be 7.5% one year from now. b. The yield on a 5-year corporate bond should always exceed the yield on a 3-year Treasury bond. c. Interest rate (price) risk is higher on long-term bonds, but reinvestment rate risk is higher on short-term bonds. d. An upward-sloping yield curve would imply that interest rates are expected to be lower in the future. e. Interest rate (price) risk is higher on short-term bonds, but reinvestment rate risk is higher on long-term bondsWhat is the duration of a three-year, $1,000 Treasury bond with a 12 percent semiannual coupon selling at par? Selling with a yield to maturity of 6 percent? 8 percent? Plot the relationship. What can you conclude about the relationship between duration and yield to maturity? Select one: a. Both the maturity periods have equal duration. b. When the yield to maturity is increasing the years to maturity will decrease. c. There is no relationship d. None of the other three answers are correct