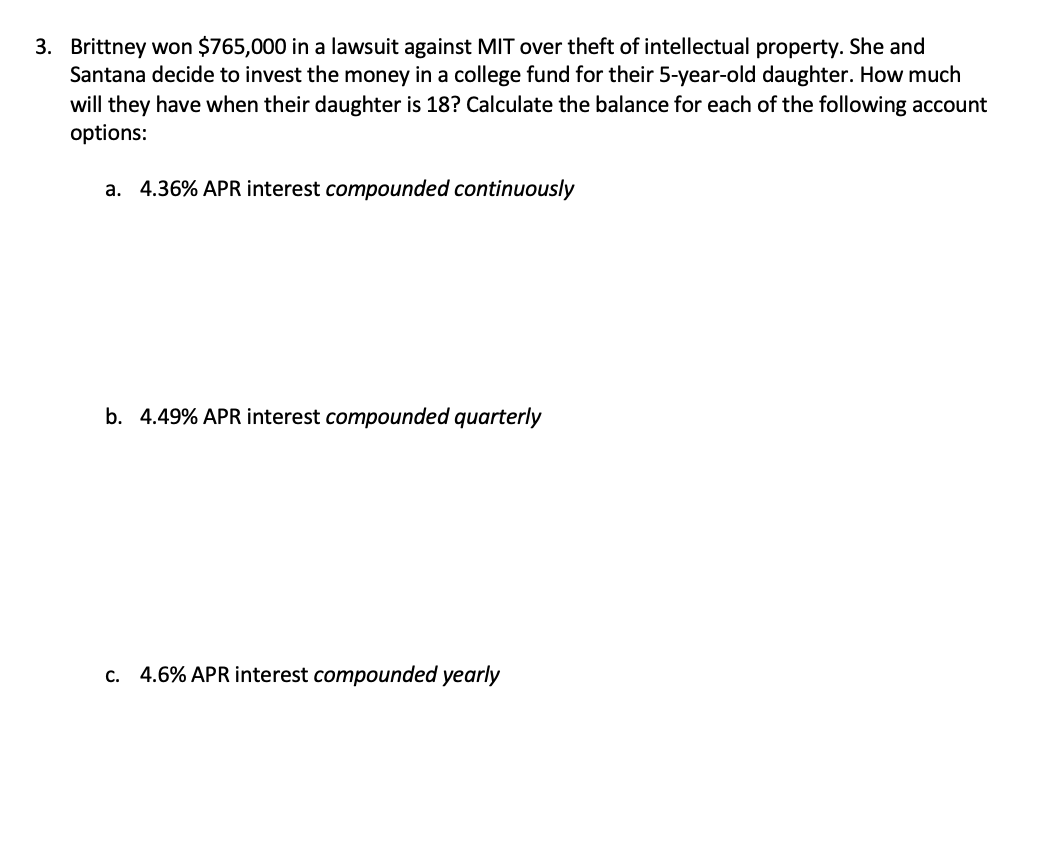

3. Brittney won $765,000 in a lawsuit against MIT over theft of intellectual property. She and Santana decide to invest the money in a college fund for their 5-year-old daughter. How much will they have when their daughter is 18? Calculate the balance for each of the following account options: a. 4.36% APR interest compounded continuously b. 4.49% APR interest compounded quarterly c. 4.6% APR interest compounded yearly

3. Brittney won $765,000 in a lawsuit against MIT over theft of intellectual property. She and Santana decide to invest the money in a college fund for their 5-year-old daughter. How much will they have when their daughter is 18? Calculate the balance for each of the following account options: a. 4.36% APR interest compounded continuously b. 4.49% APR interest compounded quarterly c. 4.6% APR interest compounded yearly

Chapter6: Business Expenses

Section: Chapter Questions

Problem 68P

Related questions

Question

Transcribed Image Text:3. Brittney won $765,000 in a lawsuit against MIT over theft of intellectual property. She and

Santana decide to invest the money in a college fund for their 5-year-old daughter. How much

will they have when their daughter is 18? Calculate the balance for each of the following account

options:

a. 4.36% APR interest compounded continuously

b. 4.49% APR interest compounded quarterly

c. 4.6% APR interest compounded yearly

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you