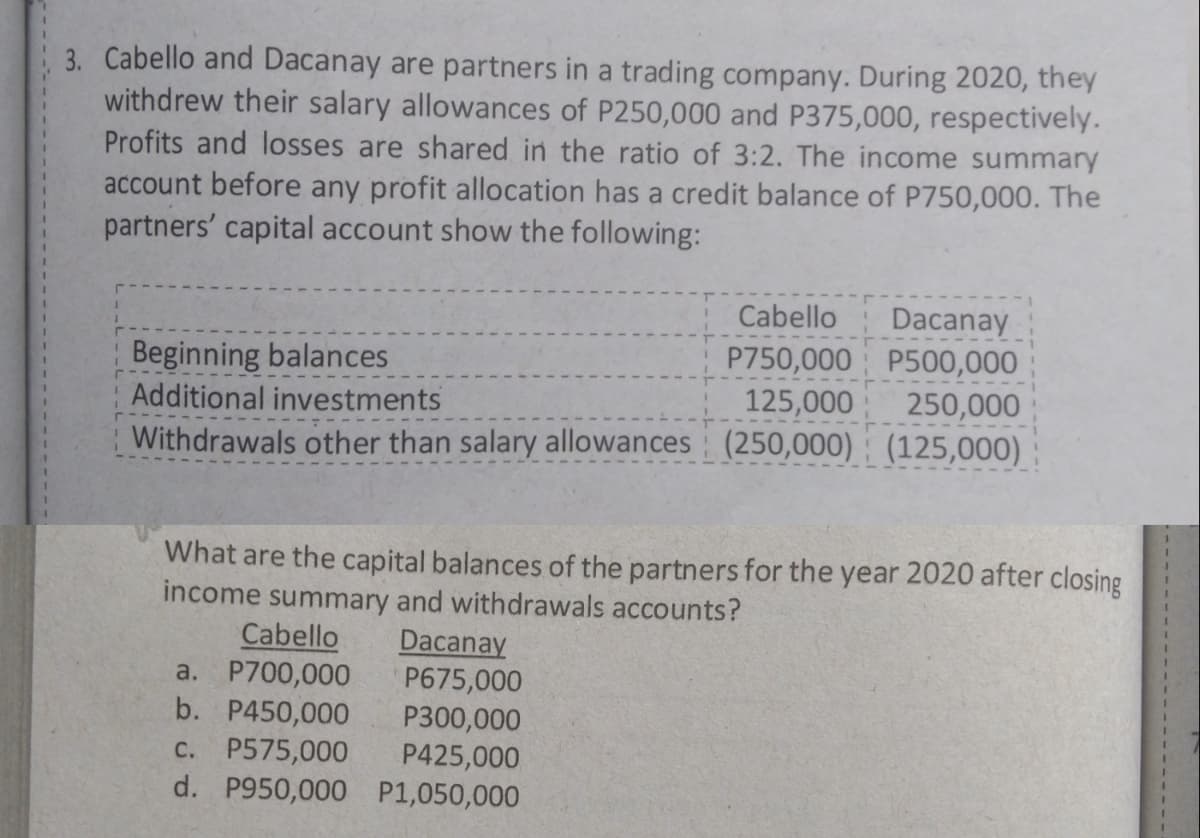

3. Cabello and Dacanay are partners in a trading company. During 2020, they withdrew their salary allowances of P250,000 and P375,000, respectively. Profits and losses are shared in the ratio of 3:2. The income summary account before any profit allocation has a credit balance of P750,000. The partners' capital account show the following: Dacanay P750,000 P500,000 250,000 Cabello Beginning balances Additional investments 125,000 Withdrawals other than salary allowances (250,000) (125,000) What are the capital balances of the partners for the year 2020 after closing income summary and withdrawals accounts? Cabello a. P700,000 b. P450,000 Dacanay P675,000 P300,000 P425,000 c. P575,000 d. P950,000 P1,050,000

3. Cabello and Dacanay are partners in a trading company. During 2020, they withdrew their salary allowances of P250,000 and P375,000, respectively. Profits and losses are shared in the ratio of 3:2. The income summary account before any profit allocation has a credit balance of P750,000. The partners' capital account show the following: Dacanay P750,000 P500,000 250,000 Cabello Beginning balances Additional investments 125,000 Withdrawals other than salary allowances (250,000) (125,000) What are the capital balances of the partners for the year 2020 after closing income summary and withdrawals accounts? Cabello a. P700,000 b. P450,000 Dacanay P675,000 P300,000 P425,000 c. P575,000 d. P950,000 P1,050,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 3PA

Related questions

Question

100%

Transcribed Image Text:3. Cabello and Dacanay are partners in a trading company. During 2020, they

withdrew their salary allowances of P250,000 and P375,000, respectively.

Profits and losses are shared in the ratio of 3:2. The income summary

account before any profit allocation has a credit balance of P750,000. The

partners' capital account show the following:

Cabello

Dacanay

P750,000 P500,000

Beginning balances

Additional investments

250,000

Withdrawals other than salary allowances (250,000) (125,000)

125,000

What are the capital balances of the partners for the year 2020 after closing

income summary and withdrawals accounts?

Cabello

a. P700,000

b. P450,000

Dacanay

P675,000

P300,000

P425,000

c. P575,000

d. P950,000 P1,050,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT