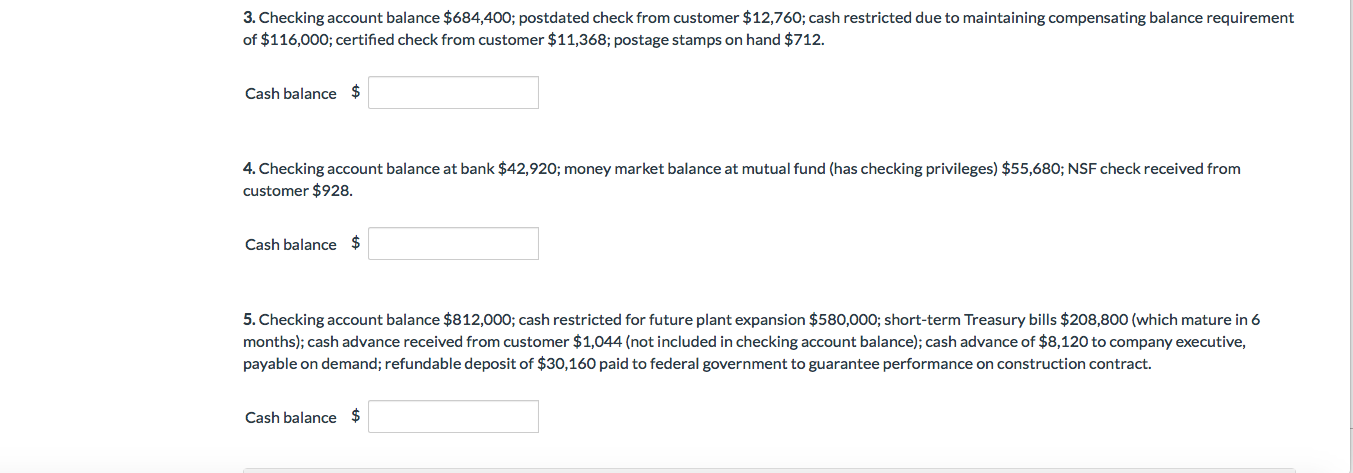

3. Checking account balance $684,400; postdated check from customer $12,760; cash restricted due to maintaining compensating balance requirement of $116,000; certified check from customer $11,368; postage stamps on hand $712. Cash balance $ 4. Checking account balance at bank $42,920; money market balance at mutual fund (has checking privileges) $55,680; NSF check received from customer $928 Cash balance $ 5. Checking account balance $812,000; cash restricted for future plant expansion $580,000; short-term Treasury bills $208,800 (which mature in 6 months); cash advance received from customer $1,044 (not included in checking account balance); cash advance of $8,120 to company executive, payable on demand; refundable deposit of $30,160 paid to federal government to guarantee performance on construction contract. Cash balance $

3. Checking account balance $684,400; postdated check from customer $12,760; cash restricted due to maintaining compensating balance requirement of $116,000; certified check from customer $11,368; postage stamps on hand $712. Cash balance $ 4. Checking account balance at bank $42,920; money market balance at mutual fund (has checking privileges) $55,680; NSF check received from customer $928 Cash balance $ 5. Checking account balance $812,000; cash restricted for future plant expansion $580,000; short-term Treasury bills $208,800 (which mature in 6 months); cash advance received from customer $1,044 (not included in checking account balance); cash advance of $8,120 to company executive, payable on demand; refundable deposit of $30,160 paid to federal government to guarantee performance on construction contract. Cash balance $

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter7: Accounting For Cash

Section: Chapter Questions

Problem 2CE

Related questions

Question

Part 4 through 5

Transcribed Image Text:3. Checking account balance $684,400; postdated check from customer $12,760; cash restricted due to maintaining compensating balance requirement

of $116,000; certified check from customer $11,368; postage stamps on hand $712.

Cash balance $

4. Checking account balance at bank $42,920; money market balance at mutual fund (has checking privileges) $55,680; NSF check received from

customer $928

Cash balance $

5. Checking account balance $812,000; cash restricted for future plant expansion $580,000; short-term Treasury bills $208,800 (which mature in 6

months); cash advance received from customer $1,044 (not included in checking account balance); cash advance of $8,120 to company executive,

payable on demand; refundable deposit of $30,160 paid to federal government to guarantee performance on construction contract.

Cash balance $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning