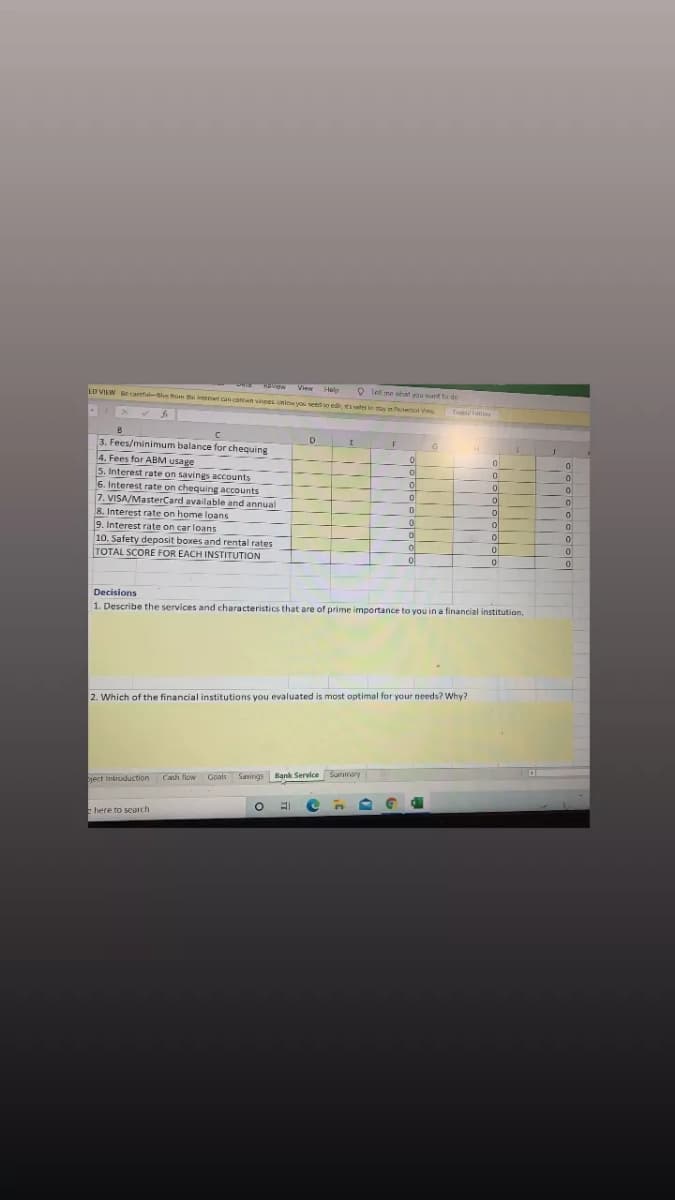

3. Fees/minimum balance for chequing . Fees for ABM usage 5. Interest rate on savings accounts 5. Interest rate on chequing accounts VISA/MasterCard available and annual Interest rate on home loans Interest rate on car loans 0. Safety deposit boxes and rental rates OTAL SCORE FOR EACH INSTITUTION ecisions Describe the services and characteristics that are of prime importance to you in a financial institution. Which of the financial institutions you evaluated is most optimal for your needs? Why?

3. Fees/minimum balance for chequing . Fees for ABM usage 5. Interest rate on savings accounts 5. Interest rate on chequing accounts VISA/MasterCard available and annual Interest rate on home loans Interest rate on car loans 0. Safety deposit boxes and rental rates OTAL SCORE FOR EACH INSTITUTION ecisions Describe the services and characteristics that are of prime importance to you in a financial institution. Which of the financial institutions you evaluated is most optimal for your needs? Why?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

This question is of subject money matters of st clair college windsor .the bank which i use is cibc( best ) so rest two you can choose ( canadian bank)

Transcribed Image Text:ROVN VIien

LD VIEW Be carefalun m thnteet acon vies unic you seed o edit, tiwerin ay in Pte ew.

Hela

O Tell me what ou tto de

Tble t

D

3. Fees/minimum balance for chequing

4. Fees for ABM usage

이

ol

5. Interest rate on savings accounts

6. Interest rate on chequing accounts

7. VISA/MasterCard available and annual

8. Interest rate on home loans

9. Interest rate on car loan5

10. Safety deposit boxes and rental rates

TOTAL SCORE FOR EACH INSTITUTION

of

ol

ol

Decisions

1. Describe the services and characteristics that are of prime importance to you in a financial institution,

2. Which of the financial institutions you evaluated is most optimal for your needs? Why?

Savings Bank Service Summary

bject intreduction Canh flow Goals Savings Bạnk Service Summary

here to seorch

Transcribed Image Text:mu hath ed Veulfet

Reviow View

O lel me wiut vo want tn dn

in VIEW Be carelut-tes fr he iemet can comn ves nlos yoed lo edit f's saler to ay in froteted View

Help

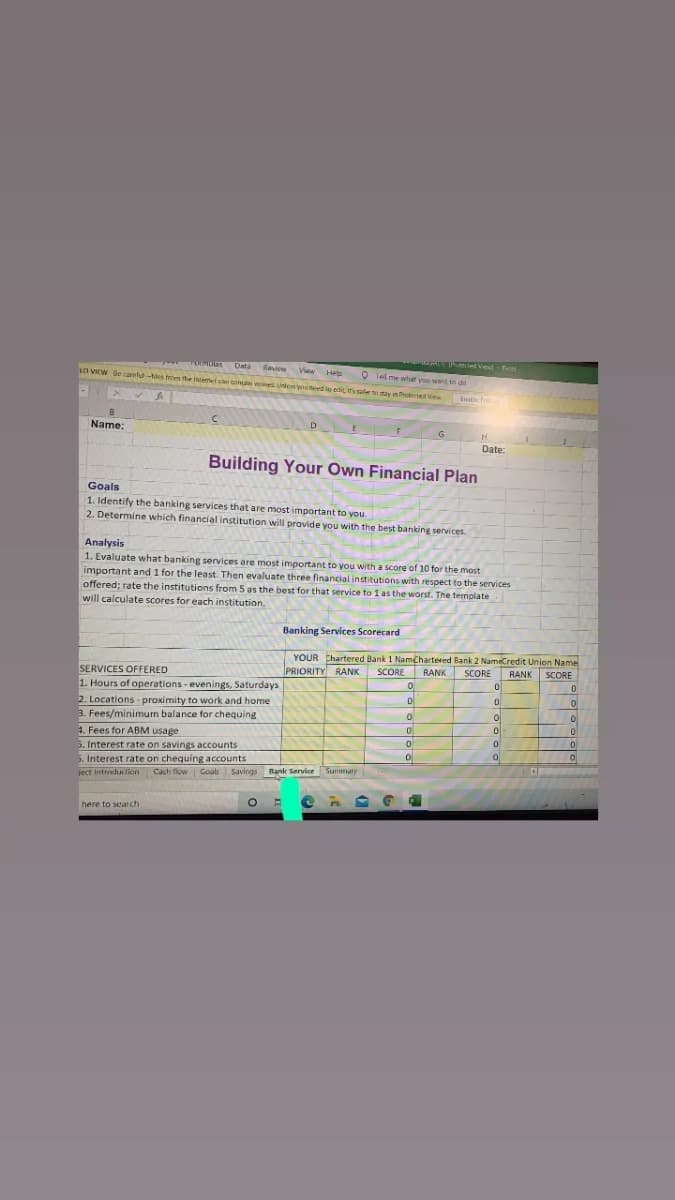

Name:

Date:

Building Your Own Financial Plan

Goals

1. Identify the banking services that are most important to you.

2. Determine which financial institution will provide you with the best banking services.

Analysis

1. Evaluate what banking services are most important to you with a score of 10 for the most

important and 1 for the least. Then evaluate three financial institutions with respect to the services

offered; rate the institutions from 5 as the best for that service to 1 as the worst. The template

will calculate scores for each institution,

Banking Services Scorecard

YOUR Chartered Bank 1 Namchartered Bank 2 NameCredit Union Name

PRIORITY RANK

SERVICES OFFERED

SCORE

RANK SCORE

RANK

SCORE

1. Hours of operations - evenings, Saturdays

2. Locations proximity to work and home

3. Fees/minimum balance for chequing

of

4. Fees for ABM usage

5. Interest rate on savings accounts

5. Interest rate on chequing accounts

of

ject Intredu lion Cash flow Coals

Savings Bank Service

here to sear ch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education