3. Finding the interest rate and the number of years Aa Aa E The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations If a security currently worth $9,200 will be worth $12,106.57 seven years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 7.60% 0 0.19% О 4.00% О 1.32% If an investment of $35,000 is earning an interest rate of 4.00%, compounded annually, then it will take for this investment to reach a value of $41,755.92-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? It takes 10.50 years for $500 to double if invested at an annual rate of 5%. 0 It takes 14.21 years for $500 to double if invested at an annual rate of 5%.

3. Finding the interest rate and the number of years Aa Aa E The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations If a security currently worth $9,200 will be worth $12,106.57 seven years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 7.60% 0 0.19% О 4.00% О 1.32% If an investment of $35,000 is earning an interest rate of 4.00%, compounded annually, then it will take for this investment to reach a value of $41,755.92-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? It takes 10.50 years for $500 to double if invested at an annual rate of 5%. 0 It takes 14.21 years for $500 to double if invested at an annual rate of 5%.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 18P

Related questions

Question

100%

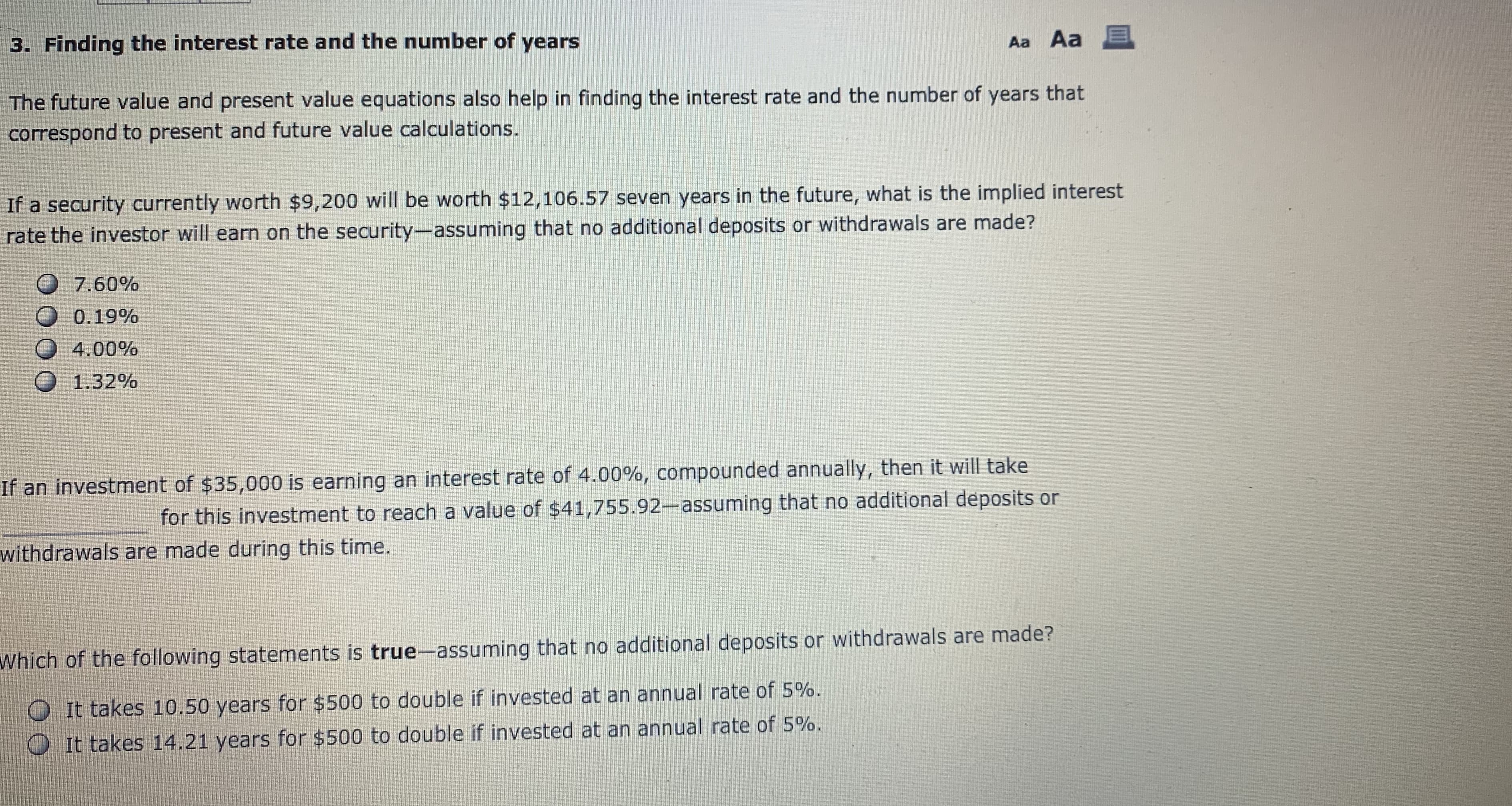

Transcribed Image Text:3. Finding the interest rate and the number of years

Aa Aa E

The future value and present value equations also help in finding the interest rate and the number of years that

correspond to present and future value calculations

If a security currently worth $9,200 will be worth $12,106.57 seven years in the future, what is the implied interest

rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made?

7.60%

0 0.19%

О 4.00%

О 1.32%

If an investment of $35,000 is earning an interest rate of 4.00%, compounded annually, then it will take

for this investment to reach a value of $41,755.92-assuming that no additional deposits or

withdrawals are made during this time.

Which of the following statements is true-assuming that no additional deposits or withdrawals are made?

It takes 10.50 years for $500 to double if invested at an annual rate of 5%.

0 It takes 14.21 years for $500 to double if invested at an annual rate of 5%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning