3. How much is the TOTAL SHAREHOLDERS' EQUITY? *

Q: e following information relates to CA Enterprises payroll for the month Jages Income tax withheld…

A: Payroll -Paying employees is known as payroll. For employees to get their paychecks, employers are…

Q: 2. Use the information below to determine the sales revenue, cost of goods sold and gross profit…

A: A financial statistic known as gross profit is the difference between an organization's total…

Q: The capital accounts of Hassan Khan and Dmitri Palovich have balances of $877,500 and $710,800,…

A: Debit the receiver and credit the giver.Debit what comes in and credit what goes out.Debit expenses…

Q: D.Insert a column called percentage contribution in an appropriate area of the spreadsheet, to…

A: The incentives are based upon the fact which has been set by the company and based upon that…

Q: A hotel purchases an air-conditioning system for OMR 100,000 and with an installation cost of…

A: Depreciation -An asset's value and the profitability of your company can be more accurately…

Q: s part of its stock-based compensation package, International Electronics granted 61 million stock…

A: The stock appreciation rights provide the right to the employees under which they are paid…

Q: On October 10, 202X, Jackson Co. issued debit memorandum no. 1 for $380 to Ada Co. for merchandise…

A: Journal entry:Journal entry is a set of economic events which can be measured in monetary terms.…

Q: 4. The following information is available for Bosch Company for the month of May. a. On May 31, the…

A: The bank reconciliation statement is prepared to equate the balances of cash book and pass book with…

Q: Almaden Valley Variety Store uses the retail inventory method to estimate ending inventory and cost…

A: Cost to Retail Method: The cost-to-retail ratio, sometimes termed the cost-to-retail percentage,…

Q: KFC purchased a new low-fat chicken cooker at a cost of $26,500. The estimated life of the fryer is…

A: Depreciation method not given in question, so assuming straight line method (SLM) for calculation…

Q: Dave LaCroix recently received a 10 percent capital and profits interest in Cirque Capital LLC in…

A: Partnership interest refers to the portion of equity interest in the partnership company. Every…

Q: Audit : List 4 risks and corresponding controls on expenses

A: The objective of this question is to identify four potential risks associated with expenses in an…

Q: Alyeska Services Company, a division of a major oil company, provides various services to the…

A: Return on investment helps in measuring the performance by evaluating the profit and efficiency of…

Q: Which method would result in the smallest income amount for 2026?

A: Straight line method 2021 = $101,250Double decline = $182,813Sum of years digits = $157,500

Q: The finance director returned to his office and after searching all the data concluded that the…

A: Activity-Based Costing (ABC) is an accounting methodology that discerns and allocates costs to…

Q: Fickel Company has two manufacturing departments—Assembly and Testing & Packaging. The predetermined…

A:

Q: During 2021, Ayayai Company incurred $2100000 of research and development costs in to develop a new…

A: Intangible assets are those assets which can not be seen or felt. These assets can only be used for…

Q: Sheffield Manufacturing, which produces a single product, has prepared the following standard cost…

A: Direct material variance is the difference between actual direct material cost and standard direct…

Q: Salo Enterprise which makes up its accounts to 30 June each year, has two types of fixed assets…

A: Depreciation, in the context of real estate and property, refers to the decrease in the value of a…

Q: Current Attempt in Progress On May 1, 2021, Vaughn Manufacturing issued $1630000 of 6% bonds at 104,…

A: The central idea of the question is to calculate the fair value of detachable stock warrants tied to…

Q: The following costs were incurred in May: Direct materials $33,000 Direct labor $13,000…

A: The following formula used to calculate prime cost as follows under:- Prime cost=Direct materials…

Q: Determine the taxable gift in each of the following unrelated scenarios:Abram is single and gives…

A: "Since you have asked multiple questions, the first question was answered for you. If you want the…

Q: Salsa Company is considering an investment in technology to improve its operations. The investment…

A: The Payback period is the length of time required to recover the cost of Investment. The breakeven…

Q: Oriole Dental Clinic is a medium-sized dental service specializing in family dental care. The clinic…

A: A cash budget is a budget that provides information about the company's projected cash inflows and…

Q: Which of the following is not an advantage that Burburr Resorts & Hotels Corporation may experience…

A: The following purposes of standard costing as follows under: - The main purpose of standard cost is…

Q: 1) Which of the following statements is true? I. Allocating common fixed costs to segments on…

A: 1. For the first set of statements:Allocating common fixed costs to segments on segmented income…

Q: Each year, White Mountain Enterprises (WME) prepares a reconciliation schedule that compares its…

A: Prepaid Expense represents money a company pays in advance for products or services it hasn't…

Q: Required: 1. Prepare an analysis showing what impact dropping flight 482 would have on the airline's…

A:

Q: An employee earns $44 per hour and 1.5 times that rate for all hours in excess of 40 hours per week.…

A: Gross pay and net pay are two important terms related to an employee's compensation, and they…

Q: Harris Company manufactures and sells a single product. A partially completed schedule of the…

A: Fixed costs are expenses that do not change in total regardless of the level of production or sales.…

Q: Determine the amount of the child tax credit in each of the following cases: a. A single parent with…

A: Base Credit:The base child tax credit for the 2023 tax year (filed in 2024) is $2,000 per qualifying…

Q: Ortiz & CP signed a contract to priovide EverFresh Bakery with an ingredint weighing system for a…

A: Performance obligation:- A performance obligation is a promise made by the seller to the customer…

Q: On March 1, 2021, Baddour, Inc., issued 10% bonds, dated January 1, with a face amount of $160…

A: Bonds payable is a type of instrument where by an amount is borrowed for a fixed period with fixed…

Q: Sheridan Corporation had the following information in its financial statements for the year ended…

A: Divide the common shareholders' equity by the number of outstanding shares to get the book value per…

Q: Ivanhoe Dental Clinic is a medium-sized dental service specializing in family dental care. The…

A: Cash Budget:Cash Budget is the forecast of cash receipts and payments for the future. Through this…

Q: prepare the balance sheet and p& l for 2022

A: RevenueRevenue ItemAmount (in INR)Gross margin on sale of sugar canes36,73,08,000Dividends received…

Q: (b) Prepare the adjusting entry at March 31, 2022, to record bad debt expense. (Credit account…

A: ALLOWANCE FOR DOUBTFUL DEBT ACCOUNT Allowance for Doubtful debt Account is Considered as Contra…

Q: The following information pertains to an operating sale and leaseback of equipment by Cheerful Co.…

A: An agreement of contract that is prepared to transfer the right to use the resources for a…

Q: If the returns on a stock index can be characterized by a normal distribution with mean 12%, the…

A: A security that denotes ownership of a portion of the issuing company is called an equity, or stock.…

Q: Tiger Pride produces two product lines: T-shirts and Sweatshirts. Product profitability is analyzed…

A: ACTIVITY BASED COSTINGActivity Based Costing is a Powerful tool for measuring…

Q: $0 O $5,000 $5,500 O $6,000 IRAS (contributions, deductions, distributions, and 10% penalty) Mark…

A: Individual Retirement Account is abbreviated as IRA. It is a tax-advantaged personal retirement…

Q: Changes in Current Operating Assets and Liabilities-Indirect Method Mohammed Corporation's…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: On December 31, 2017, Beta Company had 270,000 shares of common stock issued and outstanding. Beta…

A: Earnings per share is one of important measure or metric being used in business. It shows how much…

Q: 7. Compute Working Capital: a. 60,000 b. 50,000 c. 55,000 d. 100,000 e. 10,000 3. Compute Current…

A: Ratio Analysis -When comparing one business to another in the same sector or industry, ratio…

Q: The unadjusted trial balance for Lamb Company at December 31, 2025 is as follows: LAMB COMPANY…

A: 1. Unbilled Revenue: - Debit: Service Revenue $6,000 - Credit: Unbilled Revenue $6,0002. Prepaid…

Q: The trial balance of Pacilio Security Services, Inc. as of January 1, Year 11, had the following…

A: A cash flow statement is a financial record that depicts the influence of changes in a company's…

Q: Disposal of fixed asset Equipment acquired on January 6 at a cost of $317,400 has an estimated…

A: The depreciation expense is charged on the fixed assets as reduction in the value of the fixed…

Q: Austin, Inc., produces small-scale replicas of vintage automobiles for collectors and museums…

A: Contribution Margin Ratio:The Contribution Margin Ratio is calculated as the contribution margin…

Q: The fiscal year ends December 31 for Lake Hamilton Development. To provide funding for its Moonlight…

A: Bonds payable refer to the debt which is issued to the public for raising funds. Bonds payable are…

Q: Lewis Company has a condensed income statement as shown below. Sales Wages expense Rent expense…

A: An analytical income statement, also known as a horizontal analysis or trend analysis income…

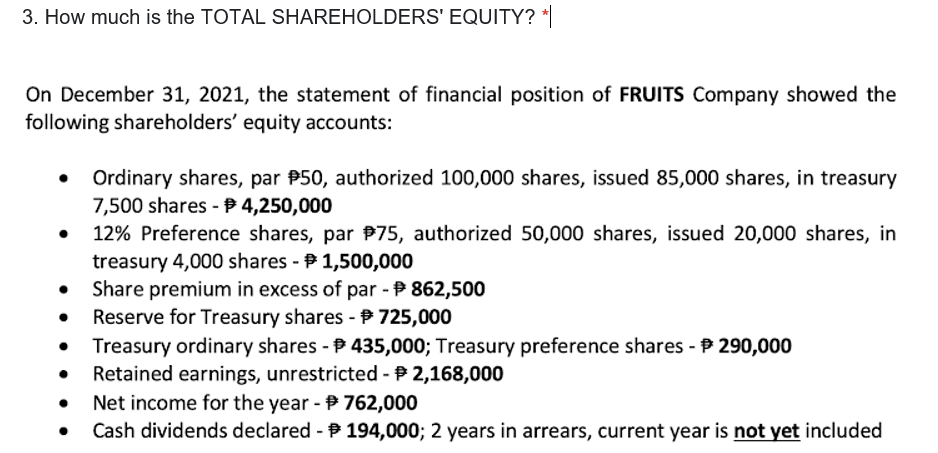

3. How much is the TOTAL SHAREHOLDERS' EQUITY?

Step by step

Solved in 3 steps with 2 images

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.

- Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.Comprehensive Young Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, 100 par preferred stock. The Contributed Capital section of its January 1, 2019, balance sheet is as follows: Part a. A shareholder has raised the following questions: 1. What is the legal capital of the corporation? 2. At what average price per share has the preferred stock been issued? 3. How many shares of common stock have been issued (the common stock has been issued at an average price of 23 per share)? Part b. The company engaged in the following transactions in 2019: Required: 1. Answer the questions in Part a. 2. Prepare journal entries to record the transactions in Part b. 3. Prepare the Contributed Capital section of Youngs December 31, 2016, balance sheet.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.

- The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?

- Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.The following data was reported by Saturday Corporation: Authorized shares: 30,000 Issued shares: 25,000 Treasury shares: 5,000 How many shares are outstanding?