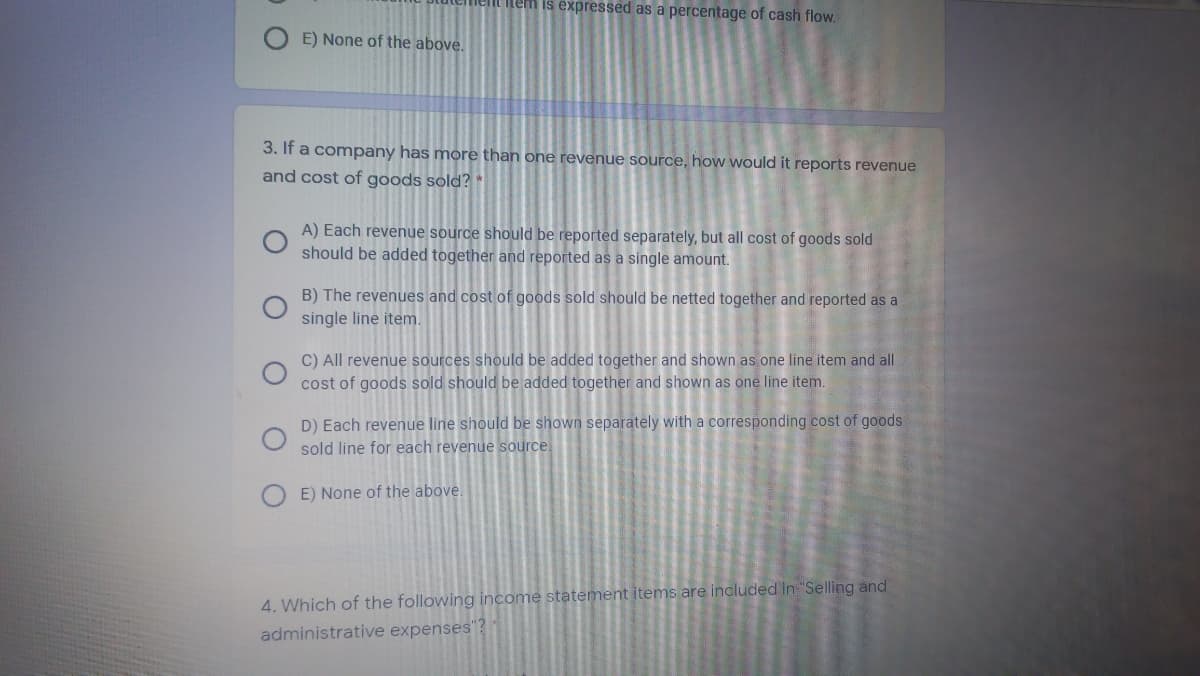

3. If a company has more than one revenue source, how would it reports revenue and cost of goods sold? * A) Each revenue source should be reported separately, but all cost of goods sold should be added together and reported as a single amount. B) The revenues and cost of goods sold should be netted together and reported as a single line item. C) All revenue sources should be added together and shown as one line item and all cost of goods sold should be added together and shown as one line item. D) Each revenue line should be shown separately with a corresponding cost of goods sold line for each revenue source. E) None of the above.

3. If a company has more than one revenue source, how would it reports revenue and cost of goods sold? * A) Each revenue source should be reported separately, but all cost of goods sold should be added together and reported as a single amount. B) The revenues and cost of goods sold should be netted together and reported as a single line item. C) All revenue sources should be added together and shown as one line item and all cost of goods sold should be added together and shown as one line item. D) Each revenue line should be shown separately with a corresponding cost of goods sold line for each revenue source. E) None of the above.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 1MCQ: Which of the following statements is true? Under cash-basis accounting, revenues are recorded when a...

Related questions

Question

Transcribed Image Text:nem is expressed as a percentage of cash flow.

E) None of the above.

3. If a company has more than one revenue source, how would it reports revenue

and cost of goods sold? *

A) Each revenue source should be reported separately, but all cost of goods sold

should be added together and reported as a single amount.

B) The revenues and cost of goods sold should be netted together and reported as a

single line item.

C) All revenue sources should be added together and shown as one line item and all

cost of goods sold should be added together and shown as one line item.

D) Each revenue line should be shown separately with a corresponding cost of goods

sold line for each revenue source.

E) None of the above.

4. Which of the following income statement items are included in "Selling and

administrative expenses"?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage