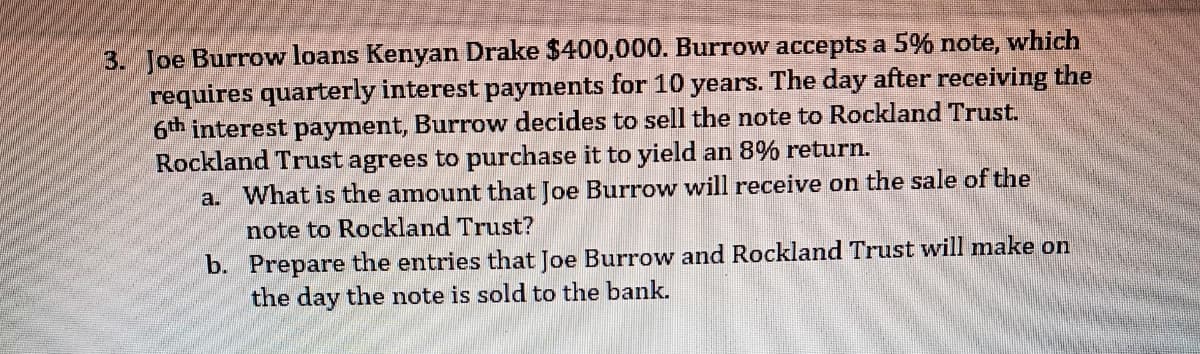

3. Joe Burrow loans Kenyan Drake $400,000. Burrow accepts a 5% note, which requires quarterly interest payments for 10 years. The day after receiving the 6th interest payment, Burrow decides to sell the note to Rockland Trust. Rockland Trust agrees to purchase it to yield an 8% return. a. What is the amount that Joe Burrow will receive on the sale of the note to Rockland Trust? b. Prepare the entries that Joe Burrow and Rockland Trust will make on the day the note is sold to the bank.

3. Joe Burrow loans Kenyan Drake $400,000. Burrow accepts a 5% note, which requires quarterly interest payments for 10 years. The day after receiving the 6th interest payment, Burrow decides to sell the note to Rockland Trust. Rockland Trust agrees to purchase it to yield an 8% return. a. What is the amount that Joe Burrow will receive on the sale of the note to Rockland Trust? b. Prepare the entries that Joe Burrow and Rockland Trust will make on the day the note is sold to the bank.

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

Transcribed Image Text:3. Joe Burrow loans Kenyan Drake $400,000. Burrow accepts a 5% note, which

requires quarterly interest payments for 10 years. The day after receiving the

6th interest payment, Burrow decides to sell the note to Rockland Trust.

Rockland Trust agrees to purchase it to yield an 8% return.

a. What is the amount that Joe Burrow will receive on the sale of the

note to Rockland Trust?

b. Prepare the entries that Joe Burrow and Rockland Trust will make on

the day the note is sold to the bank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT