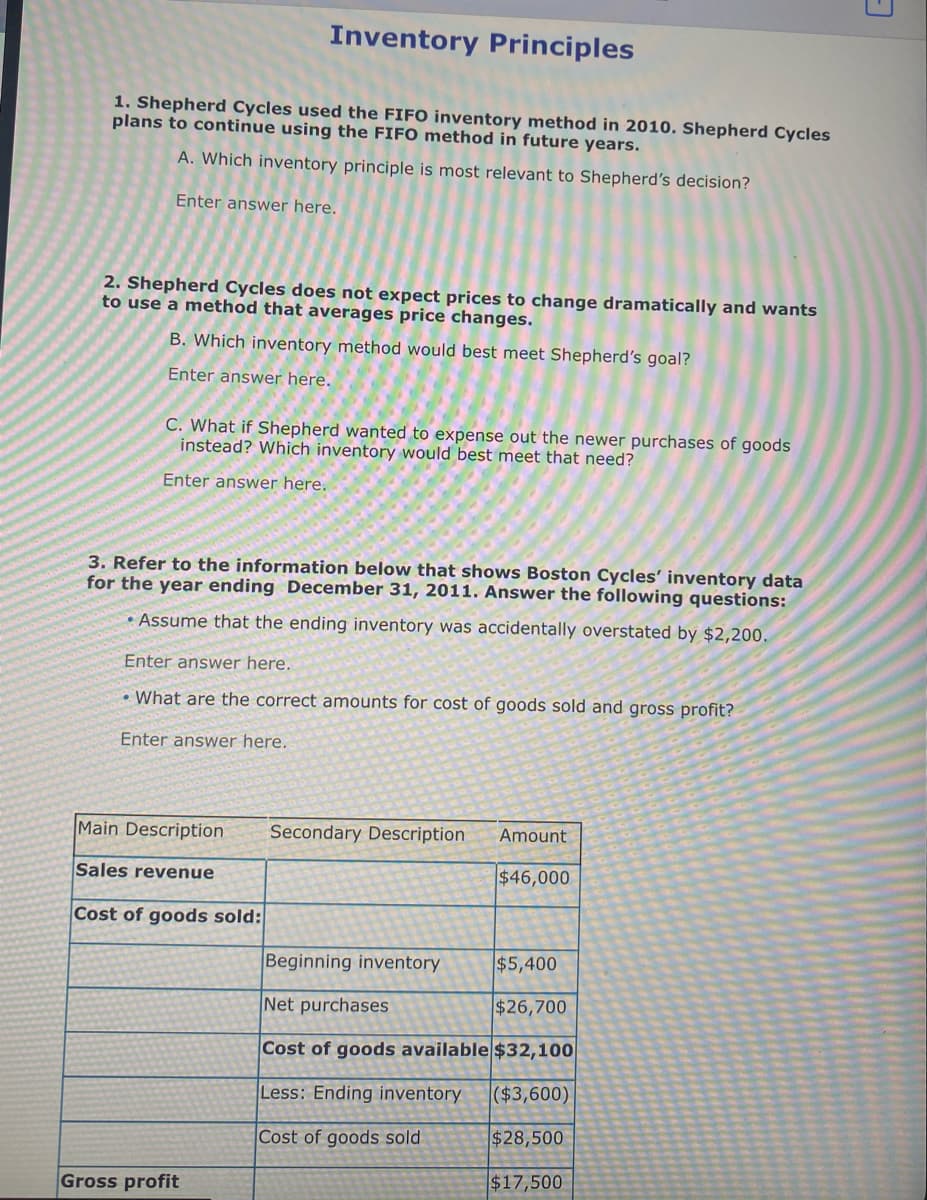

3. Refer to the information below that shows Boston Cycles' inventory data for the year ending December 31, 2011. Answer the following questions: Assume that the ending inventory was accidentally overstated by $2,200. Enter answer here. What are the correct amounts for cost of goods sold and gross profit? Enter answer here. Main Description Secondary Description Amount Sales revenue $46,000 Cost of goods sold: Beginning inventory $5,400 Net purchases $26,700 Cost of goods available $32,100| Less: Ending inventory ($3,600) Cost of goods sold $28,500 Gross profit $17,500

3. Refer to the information below that shows Boston Cycles' inventory data for the year ending December 31, 2011. Answer the following questions: Assume that the ending inventory was accidentally overstated by $2,200. Enter answer here. What are the correct amounts for cost of goods sold and gross profit? Enter answer here. Main Description Secondary Description Amount Sales revenue $46,000 Cost of goods sold: Beginning inventory $5,400 Net purchases $26,700 Cost of goods available $32,100| Less: Ending inventory ($3,600) Cost of goods sold $28,500 Gross profit $17,500

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 25CE: Effects of Inventory Costing Methods Refer to your answers for Filimonov Inc. in Cornerstone...

Related questions

Question

Please just answer question 3

Transcribed Image Text:Inventory Principles

1. Shepherd Cycles used the FIFO inventory method in 2010. Shepherd Cycles

plans to continue using the FIFO method in future years.

A. Which inventory principle is most relevant to Shepherd's decision?

Enter answer here.

2. Shepherd Cycles does not expect prices to change dramatically and wants

to use a method that averages price changes.

B. Which inventory method would best meet Shepherd's goal?

Enter answer here.

C. What if Shepherd wanted to expense out the newer purchases of goods

instead? Which inventory would best meet that need?

Enter answer here.

3. Refer to the information below that shows Boston Cycles' inventory data

for the year ending December 31, 2011. Answer the following questions:

• Assume that the ending inventory was accidentally overstated by $2,200.

Enter answer here.

• What are the correct amounts for cost of goods sold and gross profit?

Enter answer here.

Main Description

Secondary Description

Amount

Sales revenue

$46,000

Cost of goods sold:

Beginning inventory

$5,400

Net purchases

$26,700

Cost of goods available $32,100|

Less: Ending inventory

($3,600)

Cost of goods sold

$28,500

Gross profit

$17,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning