3. The graphical presentation of the best combinations of portfolio expected returns and deviations constructed form al available risky aseets is called the • Portfolio Opportunity set • Capital Allocation Line • Capital Market line • Efficient frontier 4. Given the capital allocation line, an investor's optimal complete portfolio is the portfo

3. The graphical presentation of the best combinations of portfolio expected returns and deviations constructed form al available risky aseets is called the • Portfolio Opportunity set • Capital Allocation Line • Capital Market line • Efficient frontier 4. Given the capital allocation line, an investor's optimal complete portfolio is the portfo

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Question

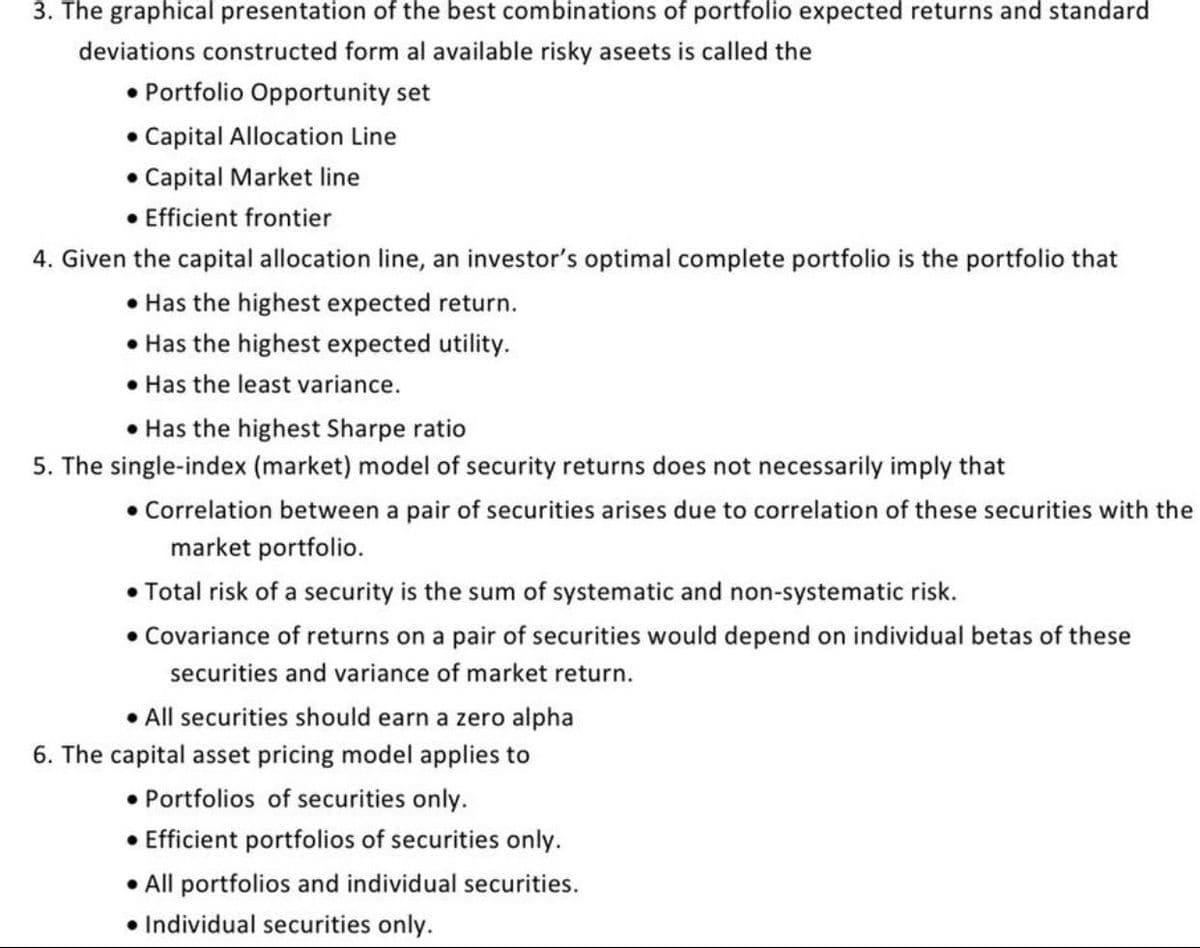

Transcribed Image Text:3. The graphical presentation of the best combinations of portfolio expected returns and standard

deviations constructed form al available risky aseets is called the

• Portfolio Opportunity set

• Capital Allocation Line

• Capital Market line

Efficient frontier

4. Given the capital allocation line, an investor's optimal complete portfolio is the portfolio that

• Has the highest expected return.

• Has the highest expected utility.

• Has the least variance.

• Has the highest Sharpe ratio

5. The single-index (market) model of security returns does not necessarily imply that

• Correlation between a pair of securities arises due to correlation of these securities with the

market portfolio.

Total risk of a security is the sum of systematic and non-systematic risk.

• Covariance of returns on a pair of securities would depend on individual betas of these

securities and variance of market return.

• All securities should earn a zero alpha

6. The capital asset pricing model applies to

• Portfolios of securities only.

• Efficient portfolios of securities only.

• All portfolios and individual securities.

• Individual securities only.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education