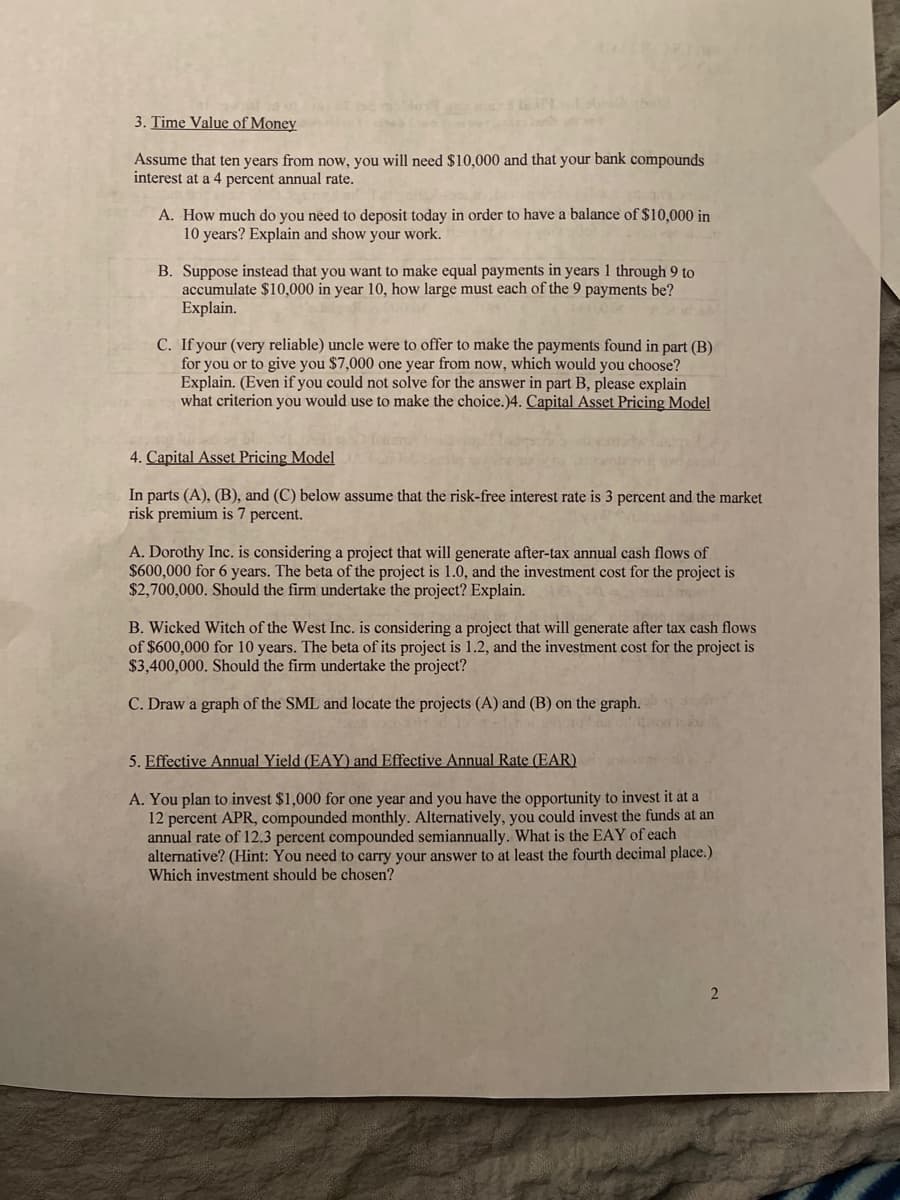

3. Time Value of Money Assume that ten years from now, you will need $10,000 and that your bank compounds interest at a 4 percent annual rate. A. How much do you need to deposit today in order to have a balance of $10,000 in 10 years? Explain and show your work. B. Suppose instead that you want to make equal payments in years 1 through 9 to accumulate $10,000 in year 10, how large must each of the 9 payments be? Explain. C. If your (very reliable) uncle were to offer to make the payments found in part (B) for you or to give you $7,000 one year from now, which would you choose? Explain. (Even if you could not solve for the answer in part B, please explain what criterion you would use to make the choice.)4. Capital Asset Pricing Model 4. Capital Asset Pricing Model In parts (A), (B), and (C) below assume that the risk-free interest rate is 3 percent and the market risk premium is 7 percent. A. Dorothy Inc. is considering a project that will generate after-tax annual cash flows of $600,000 for 6 years. The beta of the project is 1.0, and the investment cost for the project is $2,700,000. Should the firm undertake the project? Explain. B. Wicked Witch of the West Inc. is considering a project that will generate after tax cash flows of $600,000 for 10 years. The beta of its project is 1.2, and the investment cost for the project is $3,400,000. Should the firm undertake the project? C. Draw a graph of the SML and locate the projects (A) and (B) on the graph. 5. Effective Annual Yield (EAY) and Effective Annual Rate (EAR) A. You plan to invest $1,000 for one year and you have the opportunity to invest it at a 12 percent APR, compounded monthly. Alternatively, you could invest the funds at an annual rate of 12.3 percent compounded semiannually. What is the EAY of each alternative? (Hint: You need to carry your answer to at least the fourth decimal place.) Which investment should be chosen?

3. Time Value of Money Assume that ten years from now, you will need $10,000 and that your bank compounds interest at a 4 percent annual rate. A. How much do you need to deposit today in order to have a balance of $10,000 in 10 years? Explain and show your work. B. Suppose instead that you want to make equal payments in years 1 through 9 to accumulate $10,000 in year 10, how large must each of the 9 payments be? Explain. C. If your (very reliable) uncle were to offer to make the payments found in part (B) for you or to give you $7,000 one year from now, which would you choose? Explain. (Even if you could not solve for the answer in part B, please explain what criterion you would use to make the choice.)4. Capital Asset Pricing Model 4. Capital Asset Pricing Model In parts (A), (B), and (C) below assume that the risk-free interest rate is 3 percent and the market risk premium is 7 percent. A. Dorothy Inc. is considering a project that will generate after-tax annual cash flows of $600,000 for 6 years. The beta of the project is 1.0, and the investment cost for the project is $2,700,000. Should the firm undertake the project? Explain. B. Wicked Witch of the West Inc. is considering a project that will generate after tax cash flows of $600,000 for 10 years. The beta of its project is 1.2, and the investment cost for the project is $3,400,000. Should the firm undertake the project? C. Draw a graph of the SML and locate the projects (A) and (B) on the graph. 5. Effective Annual Yield (EAY) and Effective Annual Rate (EAR) A. You plan to invest $1,000 for one year and you have the opportunity to invest it at a 12 percent APR, compounded monthly. Alternatively, you could invest the funds at an annual rate of 12.3 percent compounded semiannually. What is the EAY of each alternative? (Hint: You need to carry your answer to at least the fourth decimal place.) Which investment should be chosen?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 2STP

Related questions

Question

Transcribed Image Text:3. Time Value of Money

Assume that ten years from now, you will need $10,000 and that your bank compounds

interest at a 4 percent annual rate.

A. How much do you need to deposit today in order to have a balance of $10,000 in

10 years? Explain and show your work.

B. Suppose instead that you want to make equal payments in years 1 through 9 to

accumulate $10,000 in year 10, how large must each of the 9 payments be?

Explain.

C. If your (very reliable) uncle were to offer to make the payments found in part (B)

for you or to give you $7,000 one year from now, which would you choose?

Explain. (Even if you could not solve for the answer in part B, please explain

what criterion you would use to make the choice.)4. Capital Asset Pricing Model

4. Capital Asset Pricing Model

In parts (A), (B), and (C) below assume that the risk-free interest rate is 3 percent and the market

risk premium is 7 percent.

A. Dorothy Inc. is considering a project that will generate after-tax annual cash flows of

$600,000 for 6 years. The beta of the project is 1.0, and the investment cost for the project is

$2,700,000. Should the firm undertake the project? Explain.

B. Wicked Witch of the West Inc. is considering a project that will generate after tax cash flows

of $600,000 for 10 years. The beta of its project is 1.2, and the investment cost for the project is

$3,400,000. Should the firm undertake the project?

C. Draw a graph of the SML and locate the projects (A) and (B) on the graph.

5. Effective Annual Yield (EAY) and Effective Annual Rate (EAR)

A. You plan to invest $1,000 for one year and you have the opportunity to invest it at a

12 percent APR, compounded monthly. Alternatively, you could invest the funds at an

annual rate of 12.3 percent compounded semiannually. What is the EAY of each

alternative? (Hint: You need to carry your answer to at least the fourth decimal place.)

Which investment should be chosen?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning