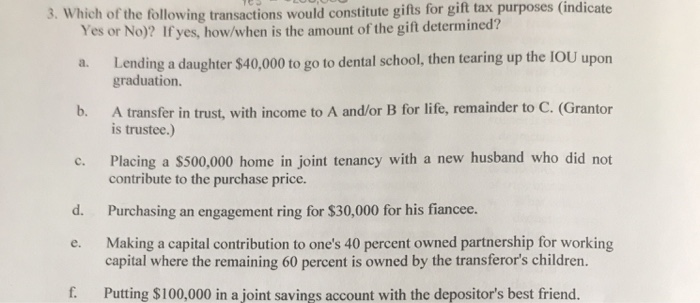

3. Which of the following transactions would constitute gifts for gift tax purposes (indicate Yes or No)? If yes, how/when is the amount of the gift determined? a. Lending a daughter $40,000 to go to dental school, then tearing up the IOU upon graduation. b. C. d. e. f. A transfer in trust, with income to A and/or B for life, remainder to C. (Grantor is trustee.) Placing a $500,000 home in joint tenancy with a new husband who did not contribute to the purchase price. Purchasing an engagement ring for $30,000 for his fiancee. Making a capital contribution to one's 40 percent owned partnership for working capital where the remaining 60 percent is owned by the transferor's children. Putting $100,000 in a joint savings account with the depositor's best friend.

3. Which of the following transactions would constitute gifts for gift tax purposes (indicate Yes or No)? If yes, how/when is the amount of the gift determined? a. Lending a daughter $40,000 to go to dental school, then tearing up the IOU upon graduation. b. C. d. e. f. A transfer in trust, with income to A and/or B for life, remainder to C. (Grantor is trustee.) Placing a $500,000 home in joint tenancy with a new husband who did not contribute to the purchase price. Purchasing an engagement ring for $30,000 for his fiancee. Making a capital contribution to one's 40 percent owned partnership for working capital where the remaining 60 percent is owned by the transferor's children. Putting $100,000 in a joint savings account with the depositor's best friend.

Chapter20: Income Taxation Of Trusts And Estates

Section: Chapter Questions

Problem 32P

Related questions

Question

Please do not give image format

Transcribed Image Text:3. Which of the following transactions would constitute gifts for gift tax purposes (indicate

Yes or No)? If yes, how/when is the amount of the gift determined?

a. Lending a daughter $40,000 to go to dental school, then tearing up the IOU upon

graduation.

b.

A transfer in trust, with income to A and/or B for life, remainder to C. (Grantor

is trustee.)

C.

d.

e.

f.

Placing a $500,000 home in joint tenancy with a new husband who did not

contribute to the purchase price.

Purchasing an engagement ring for $30,000 for his fiancee.

Making a capital contribution to one's 40 percent owned partnership for working

capital where the remaining 60 percent is owned by the transferor's children.

Putting $100,000 in a joint savings account with the depositor's best friend.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you