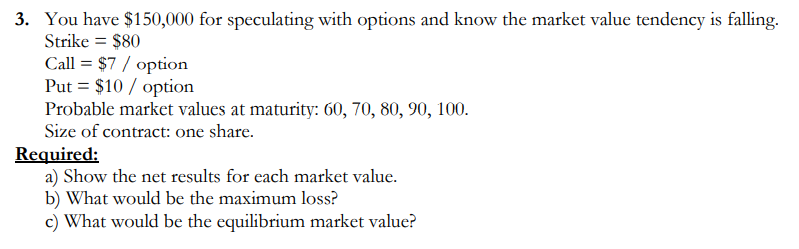

3. You have $150,000 for speculating with options and know the market value tendency is falling. Strike = $80 Call = $7 / option Put = $10 / option Probable market values at maturity: 60, 70, 80, 90, 100. Size of contract: one share. Required: a) Show the net results for each market value. b) What would be the maximum loss? c) What would be the equilibrium market value?

3. You have $150,000 for speculating with options and know the market value tendency is falling. Strike = $80 Call = $7 / option Put = $10 / option Probable market values at maturity: 60, 70, 80, 90, 100. Size of contract: one share. Required: a) Show the net results for each market value. b) What would be the maximum loss? c) What would be the equilibrium market value?

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 35QA

Related questions

Question

Transcribed Image Text:3. You have $150,000 for speculating with options and know the market value tendency is falling.

Strike = $80

Call = $7 / option

Put = $10 / option

Probable market values at maturity: 60, 70, 80, 90, 100.

Size of contract: one share.

Required:

a) Show the net results for each market value.

b) What would be the maximum loss?

c) What would be the equilibrium market value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you