3.1 Calculate each of the following independently from the information provided below: 3.1.1 Break-even value using the contribution margin ratio 3.1.2 The increase in operating profit if total sales increase by R60 000 3.1.3 Margin of safety (in units) 3.1.4 Total Contribution Margin and Operating Profit (Loss), if the selling price increases by 10% and advertising costs increase by R20 000 INFORMATION Cook4life Ltd manufactures pots. The following information was extracted from the budget for the month ended 31 December 2022: Expected sales are 3 000 units at R300 per unit. The direct materials cost, direct labour cost and variablle manufacturing overheads cost are estimated at R210 000, R150 000 and R90 000 respectively. Fixed manufacturing overheads and fixed administration costs are expected to total R160 000 and R80 000 respectively. Variable selling and administration costs are estimated at 10% of sales.

3.1 Calculate each of the following independently from the information provided below: 3.1.1 Break-even value using the contribution margin ratio 3.1.2 The increase in operating profit if total sales increase by R60 000 3.1.3 Margin of safety (in units) 3.1.4 Total Contribution Margin and Operating Profit (Loss), if the selling price increases by 10% and advertising costs increase by R20 000 INFORMATION Cook4life Ltd manufactures pots. The following information was extracted from the budget for the month ended 31 December 2022: Expected sales are 3 000 units at R300 per unit. The direct materials cost, direct labour cost and variablle manufacturing overheads cost are estimated at R210 000, R150 000 and R90 000 respectively. Fixed manufacturing overheads and fixed administration costs are expected to total R160 000 and R80 000 respectively. Variable selling and administration costs are estimated at 10% of sales.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 56P: Contribution Margin Ratio, Break-Even Sales, Operating Leverage Elgart Company produces plastic...

Related questions

Question

Good day

Please answer question 3.1.4.

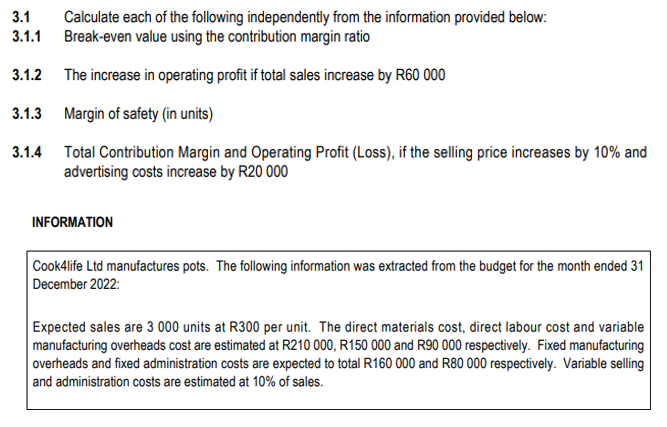

Transcribed Image Text:3.1

3.1.1

Calculate each of the following independently from the information provided below:

Break-even value using the contribution margin ratio

3.1.2

The increase in operating profit if total sales increase by R60 000

3.1.3 Margin of safety (in units)

3.1.4 Total Contribution Margin and Operating Profit (Loss), if the selling price increases by 10% and

advertising costs increase by R20 000

INFORMATION

Cook4life Ltd manufactures pots. The following information was extracted from the budget for the month ended 31

December 2022:

Expected sales are 3 000 units at R300 per unit. The direct materials cost, direct labour cost and variable

manufacturing overheads cost are estimated at R210 000, R150 000 and R90 000 respectively. Fixed manufacturing

overheads and fixed administration costs are expected to total R160 000 and R80 000 respectively. Variable selling

and administration costs are estimated at 10% of sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,