3.1 Suppose Alex wants to save money to go for a holiday in three years' time. He needs R8 000 for his holiday. He has three options for saving his money: Option A: At 10% per annum simple interest Option B: At 3.25% compounded quarterly Option C: At 7.5% per annual interest compounded monthly a. Calculate the value of P for options A, B and C. nt A = P(1+2) "² b. Which option will allow Alex to save the least amount of money presently so he can still enjoy his planned holiday in three years' time?

3.1 Suppose Alex wants to save money to go for a holiday in three years' time. He needs R8 000 for his holiday. He has three options for saving his money: Option A: At 10% per annum simple interest Option B: At 3.25% compounded quarterly Option C: At 7.5% per annual interest compounded monthly a. Calculate the value of P for options A, B and C. nt A = P(1+2) "² b. Which option will allow Alex to save the least amount of money presently so he can still enjoy his planned holiday in three years' time?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 12PROB

Related questions

Question

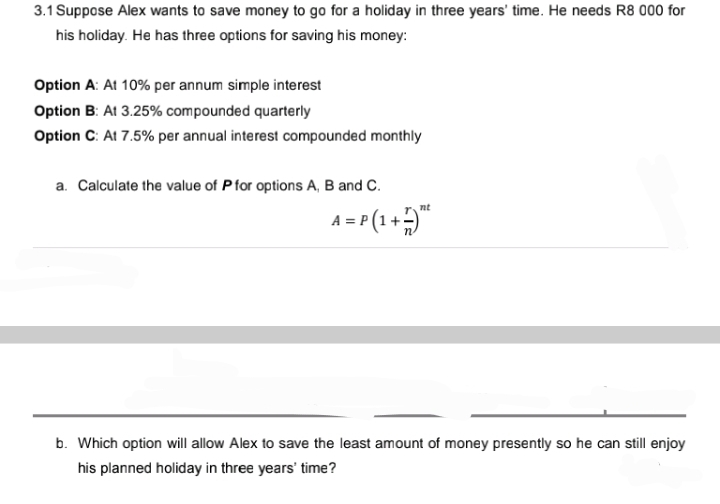

Transcribed Image Text:3.1 Suppose Alex wants to save money to go for a holiday in three years' time. He needs R8 000 for

his holiday. He has three options for saving his money:

Option A: At 10% per annum simple interest

Option B: At 3.25% compounded quarterly

Option C: At 7.5% per annual interest compounded monthly

a. Calculate the value of P for options A, B and C.

nt

A = P(1 + 5)²

b. Which option will allow Alex to save the least amount of money presently so he can still enjoy

his planned holiday in three years' time?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you