3.4 Break Even Point Analysis Multiple choice. Indicate on the ANSWER SHEET the letter and the amount of the correct answer. Given: Based on 100,000 units of production, variable cost rate is P2 per unit and fixed cost is P20,000. Q34 How much must be the variable cost rate at 80,000 and 125,000 units of production? a) P2.50 and P1.60, respectively c)P2.00 for both e) P3.00 and P2.50 b) P2.75 and P1.76, respectively d) P2.00 and P1.60 respectively d) None of the above Q35. How much must be the fixed cost rate per unit at 80,000 and 125,000 units of production? a) P.25 & P.16, respectively b) P.20 for both e). P 60 and P30 respectively c) P.16 & P.20, respectively d) P25 & P 30 respectively f) None of the above

3.4 Break Even Point Analysis Multiple choice. Indicate on the ANSWER SHEET the letter and the amount of the correct answer. Given: Based on 100,000 units of production, variable cost rate is P2 per unit and fixed cost is P20,000. Q34 How much must be the variable cost rate at 80,000 and 125,000 units of production? a) P2.50 and P1.60, respectively c)P2.00 for both e) P3.00 and P2.50 b) P2.75 and P1.76, respectively d) P2.00 and P1.60 respectively d) None of the above Q35. How much must be the fixed cost rate per unit at 80,000 and 125,000 units of production? a) P.25 & P.16, respectively b) P.20 for both e). P 60 and P30 respectively c) P.16 & P.20, respectively d) P25 & P 30 respectively f) None of the above

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter21: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 21.17EX

Related questions

Question

Transcribed Image Text:3.4 Break Even Point Analysis

Multiple choice. Indicate on the ANSWER SHEET the letter and the amount of the correct answer.

Given: Based on 100,000 units of production, variable cost rate is P2 per unit and fixed cost is P20,000.

Q34 How much must be the variable cost rate at 80,000 and 125,000 units of production?

a) P2.50 and P1.60, respectively c)P2.00 for both

e) P3.00 and P2.50

b) P2.75 and P1.76, respectively

d) P2.00 and P1.60 respectively d) None of the above

Q35. How much must be the fixed cost rate per unit at 80,000 and 125,000 units of production?

a) P.25 & P.16, respectively c) P.16 & P.20, respectively

b) P.20 for both

d) P25 & P 30 respectively

e). P 60 and P30 respectively

f) None of the above

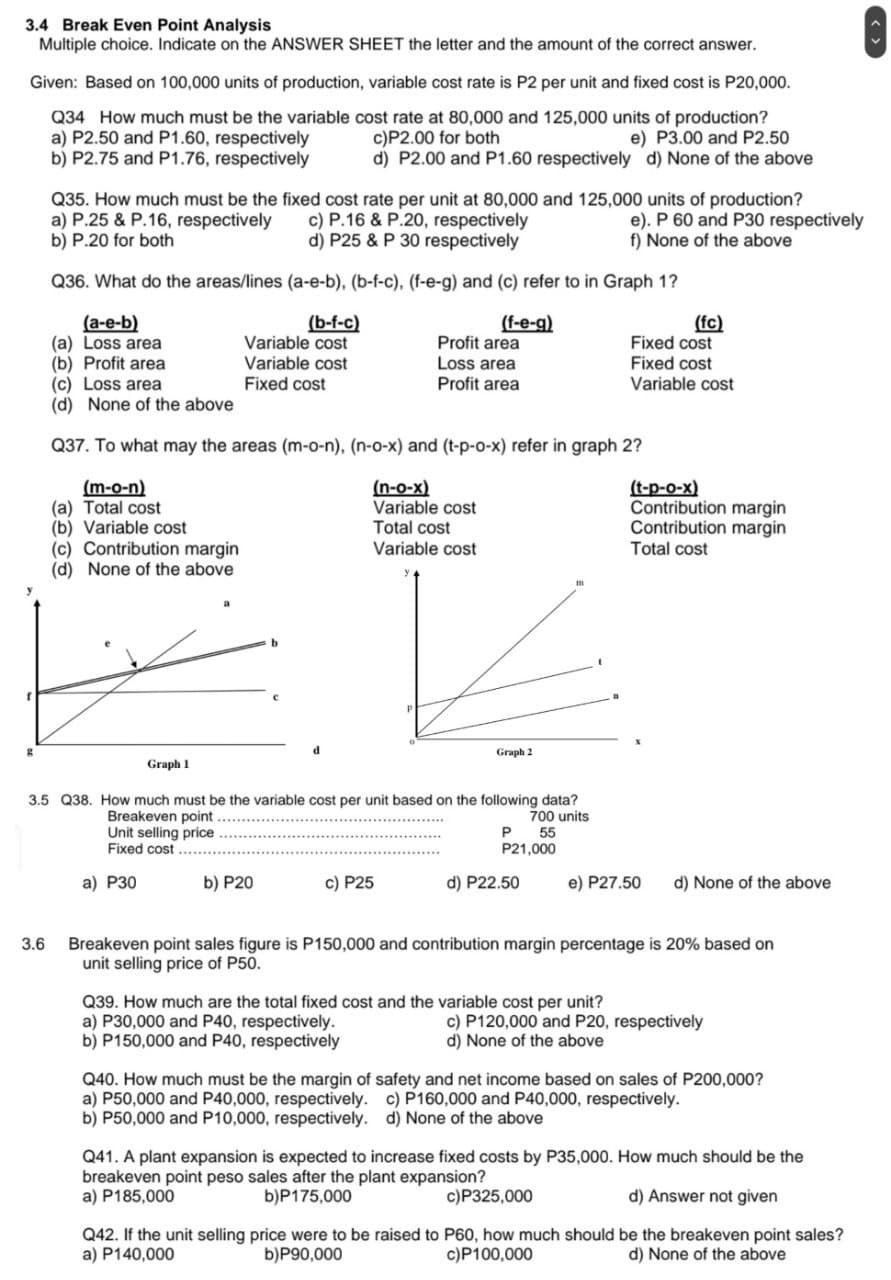

Q36. What do the areas/lines (a-e-b), (b-f-c), (f-e-g) and (c) refer to in Graph 1?

(a-e-b)

(a) Loss area

(b) Profit area

3.6

(b-f-c)

Variable cost

Variable cost

Fixed cost

a) P30

b) P20

(c) Loss area

(d) None of the above

Q37. To what may the areas (m-o-n), (n-o-x) and (t-p-o-x) refer in graph 2?

(m-o-n)

(a) Total cost

(b) Variable cost

(c) Contribution margin

(d) None of the above

(f-e-g)

Profit area

Loss area

Profit area

(n-o-x)

Variable cost

Total cost

Variable cost

Graph 1

3.5 Q38. How much must be the variable cost per unit based on the following data?

Breakeven point

Unit selling price

Fixed cost.

700 units

P 55

P21,000

c) P25

Graph 2

d) P22.50

(fc)

Fixed cost

Fixed cost

Variable cost

(t-p-o-x)

Contribution margin

Contribution margin

Total cost

e) P27.50

Q39. How much are the total fixed cost and the variable cost per unit?

a) P30,000 and P40, respectively.

b) P150,000 and P40, respectively

d) None of the above

Breakeven point sales figure is P150,000 and contribution margin percentage is 20% based on

unit selling price of P50.

c) P120,000 and P20, respectively

d) None of the above

Q40. How much must be the margin of safety and net income based on sales of P200,000?

a) P50,000 and P40,000, respectively. c) P160,000 and P40,000, respectively.

b) P50,000 and P10,000, respectively. d) None of the above

Q41. A plant expansion is expected to increase fixed costs by P35,000. How much should be the

breakeven point peso sales after the plant expansion?

a) P185,000

b)P175,000

c) P325,000

d) Answer not given

Q42. If the unit selling price were to be raised to P60, how much should be the breakeven point sales?

a) P140,000

c) P100,000

d) None of the above

b)P90,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT