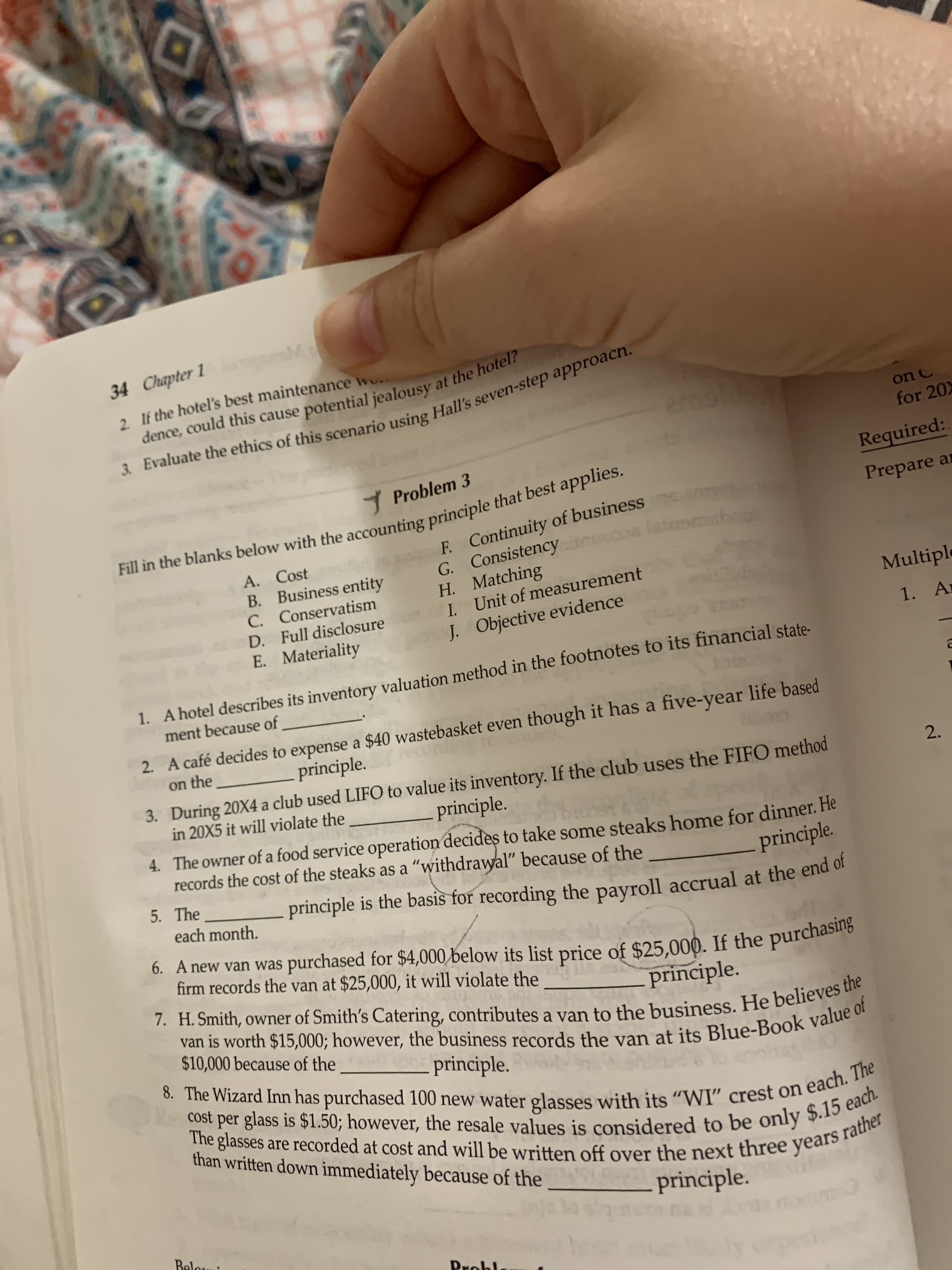

34 Chapter 1 dence, could this cause potential jealousy at the hotel? 3. Evaluate the ethics of this scenario using Hall's seven-step approach. 2 lí the hotel's best maintenance wo.. on C for 20X Problem 3 Required: F. Continuity of business G. Consistency H. Matching I. Unit of measurement J. Objective evidence Fill in the blanks below with the accounting principle that best applies. Prepare ar A. Cost B. Business entity C. Conservatism D. Full disclosure Multiple E. Materiality 1. Ar 1. A hotel describes its inventory valuation method in the footnotes to its financial state- ment because of 2. A café decides to expense a $40 wastebasket even though it has a five-year life based principle. on the 3. During 20X4 a club used LIFO to value its inventory. If the club uses the FIFO method in 20X5 it will violate the 2. principle. 4. The owner of a food service operation decides to take some steaks home for dinner. He records the cost of the steaks as a "withdrawal" because of the principle. principle is the basis for recording the payroll accrual at the end of 5. The each month. 6. A new van was purchased for $4,000 below its list price of $25,000. If the purchasiro firm records the van at $25,000, it will violate the 7. H. Smith, owner of Smith's Catering, contributes a van to the business. He believes the van is worth $15,000; however, the business records the van at its Blue-Book value of principle. $10,000 because of the 8. The Wizard Inn has purchased 100 new water glasses with its “WI" crest on each. The cost per glass is $1.50; however, the resale values is considered to be only $.15 each. principle. o ennas The glasses are recorded at cost and will be written off over the next three yca than written down immediately because of the rather years principle. Belo

34 Chapter 1 dence, could this cause potential jealousy at the hotel? 3. Evaluate the ethics of this scenario using Hall's seven-step approach. 2 lí the hotel's best maintenance wo.. on C for 20X Problem 3 Required: F. Continuity of business G. Consistency H. Matching I. Unit of measurement J. Objective evidence Fill in the blanks below with the accounting principle that best applies. Prepare ar A. Cost B. Business entity C. Conservatism D. Full disclosure Multiple E. Materiality 1. Ar 1. A hotel describes its inventory valuation method in the footnotes to its financial state- ment because of 2. A café decides to expense a $40 wastebasket even though it has a five-year life based principle. on the 3. During 20X4 a club used LIFO to value its inventory. If the club uses the FIFO method in 20X5 it will violate the 2. principle. 4. The owner of a food service operation decides to take some steaks home for dinner. He records the cost of the steaks as a "withdrawal" because of the principle. principle is the basis for recording the payroll accrual at the end of 5. The each month. 6. A new van was purchased for $4,000 below its list price of $25,000. If the purchasiro firm records the van at $25,000, it will violate the 7. H. Smith, owner of Smith's Catering, contributes a van to the business. He believes the van is worth $15,000; however, the business records the van at its Blue-Book value of principle. $10,000 because of the 8. The Wizard Inn has purchased 100 new water glasses with its “WI" crest on each. The cost per glass is $1.50; however, the resale values is considered to be only $.15 each. principle. o ennas The glasses are recorded at cost and will be written off over the next three yca than written down immediately because of the rather years principle. Belo

Accounting Information Systems

11th Edition

ISBN:9781337552127

Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Chapter7: Controlling Information Systems: Introduction To Enterprise Risk Management And Internal Control

Section: Chapter Questions

Problem 1P

Related questions

Question

I need help !

Transcribed Image Text:34 Chapter 1

dence, could this cause potential jealousy at the hotel?

3. Evaluate the ethics of this scenario using Hall's seven-step approach.

2 lí the hotel's best maintenance wo..

on C

for 20X

Problem 3

Required:

F. Continuity of business

G. Consistency

H. Matching

I. Unit of measurement

J. Objective evidence

Fill in the blanks below with the accounting principle that best applies.

Prepare ar

A. Cost

B. Business entity

C. Conservatism

D. Full disclosure

Multiple

E. Materiality

1. Ar

1. A hotel describes its inventory valuation method in the footnotes to its financial state-

ment because of

2. A café decides to expense a $40 wastebasket even though it has a five-year life based

principle.

on the

3. During 20X4 a club used LIFO to value its inventory. If the club uses the FIFO method

in 20X5 it will violate the

2.

principle.

4. The owner of a food service operation decides to take some steaks home for dinner. He

records the cost of the steaks as a "withdrawal" because of the

principle.

principle is the basis for recording the payroll accrual at the end of

5. The

each month.

6. A new van was purchased for $4,000 below its list price of $25,000. If the purchasiro

firm records the van at $25,000, it will violate the

7. H. Smith, owner of Smith's Catering, contributes a van to the business. He believes the

van is worth $15,000; however, the business records the van at its Blue-Book value of

principle.

$10,000 because of the

8. The Wizard Inn has purchased 100 new water glasses with its “WI" crest on each. The

cost per glass is $1.50; however, the resale values is considered to be only $.15 each.

principle.

o ennas

The glasses are recorded at cost and will be written off over the next three yca

than written down immediately because of the

rather

years

principle.

Belo

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L