4) Depreciation and amortization expenses are often combined because they are similar. Many income statements embed depreciation and amortization in "other expense/ selling general & administrative" amounts. To learn the amounts of these expenses, it often becomes necessary to examine the statement of cash flows. Where does your company report depreciation and amortization on its income statement (is the number for depreciation within a larger total for many expenses)? What were these expenses for the current year? Depreciation and amortization is found in the URBN statement of cash flows as a total of $117,986 in 2019. URBAN OUTFITTERS, INC. Consolidated Statements of Cash Flows (in thousands) Fiscal Year Ended January 31, 2019 2018 2017 Cash flows from operating activities: Net income 298,003 108,263 218,120 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization (Benefit) provision for deferred income taxes Share-based compensation expense Impairment Loss on disposition of property and equipment, net Changes in assets and liabilities: 128,408 8,329 14,517 11,410 117,986 135,330 (11,414) 18,104 3,544 3,492 (4,801) 18,291 4,341 3,667 4,037 (21,744) (8,644) 12,967 45,516 Receivables Inventory Prepaid expenses and other assets Payables, accrued expenses and other liabilities Net cash provided by operating activities (4,012) (21,696) 8,605 20,934 (9,963) (10,359) 39,692 415,252 34,012 446,624 303,059 Cash flows from investing activities: (114,924) (396,646) 267,072 (143,714) (318,742) 243,159 (15,325) (234,622) Cash paid for property and equipment Cash paid for marketable securities (83,813) (281,385) 243,818 Sales and maturities of marketable securities Acquisition of business Net cash used in investing activities (244,498) (121,380) Cash flows from financing activities: (150,000) 4,096 (45,787) (2,052) (193,743) (4,023) (17,136) 265,276 248,140 Repayments of long-tem debt Proceeds from the exercise of share-based awards 13,618 (121,397) (10,245) (118,024) Share repurchases related to share repurchase program Share repurchases related to taxes for share-based awards (157,044) (2,182) (159,226) Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (8,062) 11,627 76,040 282,220 34,080 248,140 358,260 282,220 Supplemental cash flow information: Cash paid during the year for: Income taxes $ 102,211 83,986 111,958 Non-cash investing activities-Accrued capital expenditures 7,193 10,144 17,020

4) Depreciation and amortization expenses are often combined because they are similar. Many income statements embed depreciation and amortization in "other expense/ selling general & administrative" amounts. To learn the amounts of these expenses, it often becomes necessary to examine the statement of cash flows. Where does your company report depreciation and amortization on its income statement (is the number for depreciation within a larger total for many expenses)? What were these expenses for the current year? Depreciation and amortization is found in the URBN statement of cash flows as a total of $117,986 in 2019. URBAN OUTFITTERS, INC. Consolidated Statements of Cash Flows (in thousands) Fiscal Year Ended January 31, 2019 2018 2017 Cash flows from operating activities: Net income 298,003 108,263 218,120 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization (Benefit) provision for deferred income taxes Share-based compensation expense Impairment Loss on disposition of property and equipment, net Changes in assets and liabilities: 128,408 8,329 14,517 11,410 117,986 135,330 (11,414) 18,104 3,544 3,492 (4,801) 18,291 4,341 3,667 4,037 (21,744) (8,644) 12,967 45,516 Receivables Inventory Prepaid expenses and other assets Payables, accrued expenses and other liabilities Net cash provided by operating activities (4,012) (21,696) 8,605 20,934 (9,963) (10,359) 39,692 415,252 34,012 446,624 303,059 Cash flows from investing activities: (114,924) (396,646) 267,072 (143,714) (318,742) 243,159 (15,325) (234,622) Cash paid for property and equipment Cash paid for marketable securities (83,813) (281,385) 243,818 Sales and maturities of marketable securities Acquisition of business Net cash used in investing activities (244,498) (121,380) Cash flows from financing activities: (150,000) 4,096 (45,787) (2,052) (193,743) (4,023) (17,136) 265,276 248,140 Repayments of long-tem debt Proceeds from the exercise of share-based awards 13,618 (121,397) (10,245) (118,024) Share repurchases related to share repurchase program Share repurchases related to taxes for share-based awards (157,044) (2,182) (159,226) Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (8,062) 11,627 76,040 282,220 34,080 248,140 358,260 282,220 Supplemental cash flow information: Cash paid during the year for: Income taxes $ 102,211 83,986 111,958 Non-cash investing activities-Accrued capital expenditures 7,193 10,144 17,020

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.9E

Related questions

Question

I am having trouble completing this question. "My company" means Urban Outfitters, Inc. which is the company assigned for me. We are using the 10k annual report 2019 to answer this question. I tried answering the question but I am not sure if its correct.

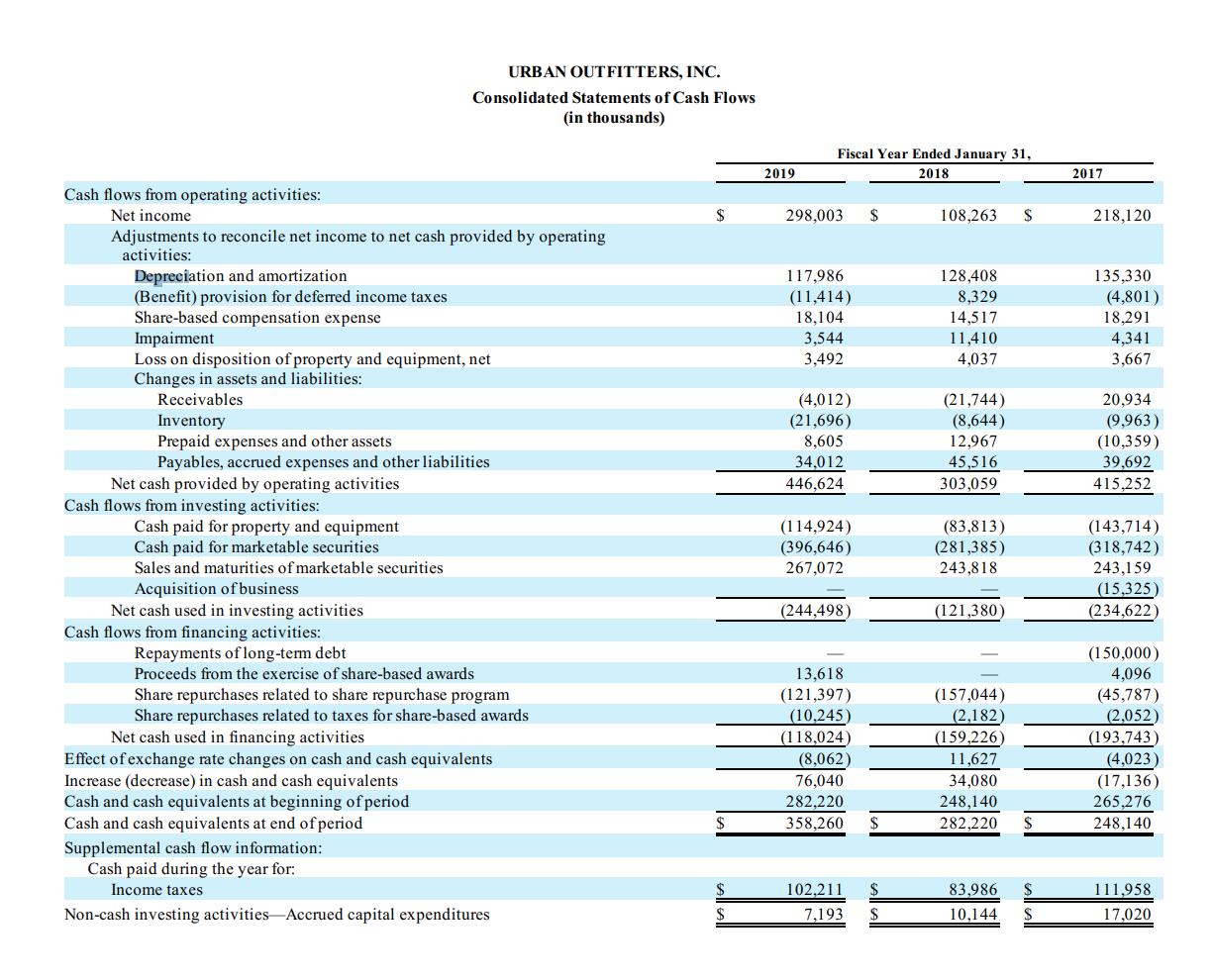

Transcribed Image Text:4) Depreciation and amortization expenses are often combined because they are similar.

Many income statements embed depreciation and amortization in "other expense/ selling

general & administrative" amounts. To learn the amounts of these expenses, it often

becomes necessary to examine the statement of cash flows. Where does your company

report depreciation and amortization on its income statement (is the number for

depreciation within a larger total for many expenses)? What were these expenses for the

current year?

Depreciation and amortization is found in the URBN statement of cash flows as a total of

$117,986 in 2019.

Transcribed Image Text:URBAN OUTFITTERS, INC.

Consolidated Statements of Cash Flows

(in thousands)

Fiscal Year Ended January 31,

2019

2018

2017

Cash flows from operating activities:

Net income

298,003

108,263

218,120

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization

(Benefit) provision for deferred income taxes

Share-based compensation expense

Impairment

Loss on disposition of property and equipment, net

Changes in assets and liabilities:

128,408

8,329

14,517

11,410

117,986

135,330

(11,414)

18,104

3,544

3,492

(4,801)

18,291

4,341

3,667

4,037

(21,744)

(8,644)

12,967

45,516

Receivables

Inventory

Prepaid expenses and other assets

Payables, accrued expenses and other liabilities

Net cash provided by operating activities

(4,012)

(21,696)

8,605

20,934

(9,963)

(10,359)

39,692

415,252

34,012

446,624

303,059

Cash flows from investing activities:

(114,924)

(396,646)

267,072

(143,714)

(318,742)

243,159

(15,325)

(234,622)

Cash paid for property and equipment

Cash paid for marketable securities

(83,813)

(281,385)

243,818

Sales and maturities of marketable securities

Acquisition of business

Net cash used in investing activities

(244,498)

(121,380)

Cash flows from financing activities:

(150,000)

4,096

(45,787)

(2,052)

(193,743)

(4,023)

(17,136)

265,276

248,140

Repayments of long-tem debt

Proceeds from the exercise of share-based awards

13,618

(121,397)

(10,245)

(118,024)

Share repurchases related to share repurchase program

Share repurchases related to taxes for share-based awards

(157,044)

(2,182)

(159,226)

Net cash used in financing activities

Effect of exchange rate changes on cash and cash equivalents

Increase (decrease) in cash and cash equivalents

Cash and cash equivalents at beginning of period

Cash and cash equivalents at end of period

(8,062)

11,627

76,040

282,220

34,080

248,140

358,260

282,220

Supplemental cash flow information:

Cash paid during the year for:

Income taxes

$

102,211

83,986

111,958

Non-cash investing activities-Accrued capital expenditures

7,193

10,144

17,020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College