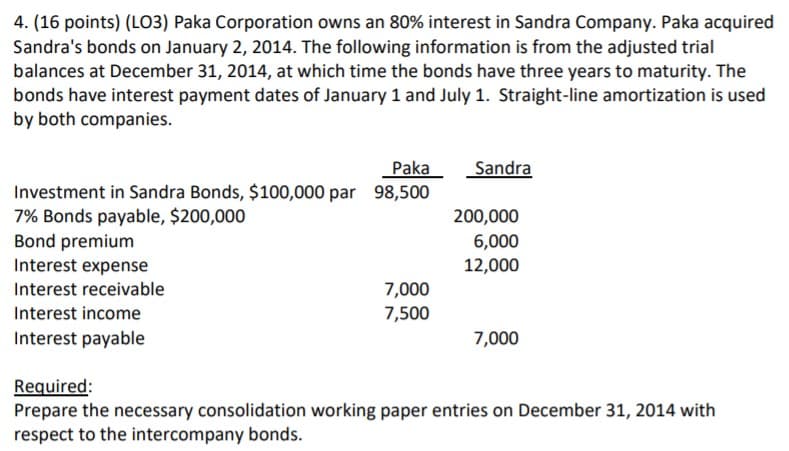

4. (16 points) (LO3) Paka Corporation owns an 80% interest in Sandra Company. Paka acquired Sandra's bonds on January 2, 2014. The following information is from the adjusted trial balances at December 31, 2014, at which time the bonds have three years to maturity. The bonds have interest payment dates of January 1 and July 1. Straight-line amortization is used by both companies. Paka Sandra Investment in Sandra Bonds, $100,000 par 98,500 7% Bonds payable, $200,000 Bond premium 200,000 6,000 12,000 Interest expense Interest receivable 7,000 Interest income 7,500 Interest payable 7,000

4. (16 points) (LO3) Paka Corporation owns an 80% interest in Sandra Company. Paka acquired Sandra's bonds on January 2, 2014. The following information is from the adjusted trial balances at December 31, 2014, at which time the bonds have three years to maturity. The bonds have interest payment dates of January 1 and July 1. Straight-line amortization is used by both companies. Paka Sandra Investment in Sandra Bonds, $100,000 par 98,500 7% Bonds payable, $200,000 Bond premium 200,000 6,000 12,000 Interest expense Interest receivable 7,000 Interest income 7,500 Interest payable 7,000

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 18DQ: LO.4, 7 In December 2019, Carl Corporation sold land it held as an investment. The corporation...

Related questions

Question

Transcribed Image Text:4. (16 points) (LO3) Paka Corporation owns an 80% interest in Sandra Company. Paka acquired

Sandra's bonds on January 2, 2014. The following information is from the adjusted trial

balances at December 31, 2014, at which time the bonds have three years to maturity. The

bonds have interest payment dates of January 1 and July 1. Straight-line amortization is used

by both companies.

Paka

Sandra

Investment in Sandra Bonds, $100,000 par 98,500

7% Bonds payable, $200,000

200,000

Bond premium

6,000

12,000

Interest expense

Interest receivable

7,000

7,500

Interest income

Interest payable

7,000

Required:

Prepare the necessary consolidation working paper entries on December 31, 2014 with

respect to the intercompany bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning