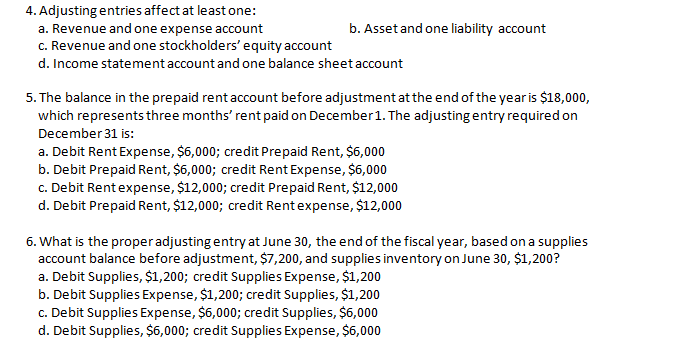

4. Adjusting entries affect at least one: a. Revenue and one expense account c. Revenue and one stockholders' equity account b. Asset and one liability account d. Income statement account and one balance sheet account 5. The balance in the prepaid rent account before adjustment atthe end of the yearis $18,000, which represents three months' rent paid on December1. The adjusting entry required on December 31 is: a. Debit Rent Expense, $6,000; credit Prepaid Rent, $6,000 b. Debit Prepaid Rent, $6,000; credit Rent Expense, $6,000 c. Debit Rentexpense, $12,000; credit Prepaid Rent, $12,000 d. Debit Prepaid Rent, $12,000; credit Rentexpense, $12,000 6. What is the properadjusting entry at June 30, the end of the fiscal year, based on a supplies account balance before adjustment, $7,200, and supplies inventory on June 30, $1,200? a. Debit Supplies, $1,200; credit Supplies Expense, $1,200 b. Debit Supplies Expense, $1,200; credit Supplies, $1,200 c. Debit Supplies Expense, $6,000; credit Supplies, $6,000 d. Debit Supplies, $6.000: credit Supplies Expense, $6.000

4. Adjusting entries affect at least one: a. Revenue and one expense account c. Revenue and one stockholders' equity account b. Asset and one liability account d. Income statement account and one balance sheet account 5. The balance in the prepaid rent account before adjustment atthe end of the yearis $18,000, which represents three months' rent paid on December1. The adjusting entry required on December 31 is: a. Debit Rent Expense, $6,000; credit Prepaid Rent, $6,000 b. Debit Prepaid Rent, $6,000; credit Rent Expense, $6,000 c. Debit Rentexpense, $12,000; credit Prepaid Rent, $12,000 d. Debit Prepaid Rent, $12,000; credit Rentexpense, $12,000 6. What is the properadjusting entry at June 30, the end of the fiscal year, based on a supplies account balance before adjustment, $7,200, and supplies inventory on June 30, $1,200? a. Debit Supplies, $1,200; credit Supplies Expense, $1,200 b. Debit Supplies Expense, $1,200; credit Supplies, $1,200 c. Debit Supplies Expense, $6,000; credit Supplies, $6,000 d. Debit Supplies, $6.000: credit Supplies Expense, $6.000

Chapter5: Completing The Accounting Cycle

Section: Chapter Questions

Problem 3EB: For each of the following accounts, identify whether it would be closed at year-end (yes or no) and...

Related questions

Topic Video

Question

100%

this multiple choice questions from ACCOUNTING PRINCIPLES I

Transcribed Image Text:4. Adjusting entries affect at least one:

a. Revenue and one expense account

c. Revenue and one stockholders' equity account

b. Asset and one liability account

d. Income statementaccount and one balance sheet account

5. The balance in the prepaid rent account before adjustment atthe end of the yearis $18,000,

which represents three months' rent paid on December1. The adjusting entry required on

December 31 is:

a. Debit Rent Expense, $6,000; credit Prepaid Rent, $6,000

b. Debit Prepaid Rent, $6,000; credit Rent Expense, $6,000

c. Debit Rentexpense, $12,000; credit Prepaid Rent, $12,000

d. Debit Prepaid Rent, $12,000; credit Rentexpense, $12,000

6. What is the properadjusting entry at June 30, the end of the fiscal year, based on a supplies

account balance before adjustment, $7,200, and supplies inventory on June 30, $1,200?

a. Debit Supplies, $1,200; credit Supplies Expense, $1,200

b. Debit Supplies Expense, $1,200; credit Supplies, $1,200

c. Debit Supplies Expense, $6,000; credit Supplies, $6,000

d. Debit Supplies, $6,000; credit Supplies Expense, $6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning