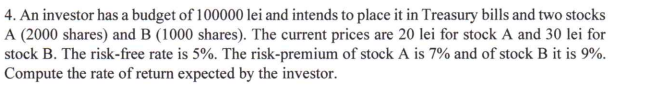

4. An investor has a budget of 100000 lei and intends to place it in Treasury bills and two stocks A (2000 shares) and B (1000 shares). The current prices are 20 lei for stock A and 30 lei for stock B. The risk-free rate is 5%. The risk-premium of stock A is 7% and of stock B it is 9%. Compute the rate of return expected by the investor.

Q: 16. Lancaster Corp is considering two equally risky, mutually exclusive projects, both of which have…

A: IRR of project A = 11% IRR of project B = 14% Crossover rate = 8%

Q: 6) Consider two thirty year bonds with the same purchase price. Each has a coupon rate of 5% paid…

A: Here, Time to maturity = 30 years Semi-annual Coupon rate = 5% Par value = 1,000 First bond nominal…

Q: 10. Wint Clothing Store had a balance in the Accounts Receivable account of P390,000 at the…

A: Average collection period shows in how many days on an average a debtors pays his dues Average…

Q: 1.Find the total number of compounding periods and the interest rate per period for the investment.…

A: Period = 7 Years Interest rate = 3% Number of compounding per year = 12

Q: A corporation uses a type of motor truck which costs P 250,000, with life of 2 years and final…

A: The annual cost method helps in comparing two different projects having different periods. The…

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery…

A: Cost of equity With current market price (P), next year dividend (D1) and constant growth rate in…

Q: 700 Solve: 2. G00 EOQ i- 5% co. monthly Show your work below and put the answer in the yellow box.…

A: The value of all future cash flows discounted at required rate of return constitutes the present…

Q: etermine the amount of money he ne

A: Present value refers to the value of assets present today of the value at some future date. It…

Q: Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over…

A: Dividend after 10 years (D10) = $11 Growth rate (g) = 4% Required return (r) = 12% Period without…

Q: Ana Chavarria, front office manager of The Times Hotel, has been meeting with the owner and general…

A: A user registration system often requires the creation of a username and password, as well as the…

Q: Having achieved immense success since graduating from university, you have set up an endowment fund…

A: First annual contribution (X) = $100000 Constant rate of growth (d) = - 2% (Declining rate) Interest…

Q: 21.Calculate the present value (principal) and the compound interest (in $). Use Table 11-2. Round…

A: The present value and compound interest can be calculated as per the function of present value

Q: A $10,000 note with 6% interest payable quarterly is purchased for $8,000. The note matures in 5…

A: Par value = $10,000 Coupon rate = 6% Quarterly coupon amount = 10000*0.06/4 = $150 Period = 5 Years…

Q: The Baileys bought a $363,000 townhome. They made a down payment of $44,000 and took out a mortgage…

A: In case of a mortgage the interest is charged on a declining balance method. Hence as the principal…

Q: What is the standard deviation of the following portfolio? |Weight Correlation(A,B) Growth Rate 3 .2…

A: Standard deviation of a portfolio = WA2σA2+WB2σB2+2*WA*WB*σA*σB*r Where, WA = Weight of stock AWB =…

Q: A real estate development company is planning to build five homes, each costing $175,000, in 2 1…

A: Total amount needed in the future (F) = $175000 * 5 = $875000 n = 2.5 years = 5 semiannual periods r…

Q: Mr. Mouton purchased a dwelling, complete with outbuildings and a swimming pool, from Mr. Strauss.…

A: Finance and operations divisions are important to the success of any organization. Finance…

Q: Suppose you buy a bond with a coupon of 9.6 percent today for $1,090. The bond has 6 years to…

A: Coupon Rate 9.60% Price $ 1,090.00 Time Period 6…

Q: places.) (a) Wesbanco offers an account 7.28 % interest compounded daily. APY = Number %3D (b) PNC…

A: Effective annual rate (EAR) refers to a real interest rate which an investor is expect from his…

Q: Explain the importance of a business report.

A: A business report is a report or a document which is essentially includes an array of data and…

Q: (d) BB&T offers an account with 5.69 % interest compounded quarterly. APY = Number (e) Navy Federal…

A: APY or annual percentage yield is the actual rate of return earned on the investment

Q: Stock Y has a beta of 1.2 and an expected return of 11.5 percent. Stock Z has a beta of .80 and an…

A: The risk-free rate of return is the theoretical return on a risk-free investment. Over a given…

Q: 1. Sources of Tax Laws 2. Constitutional Limitations 3. Elements of Sound Tax System 4.…

A: A tax is a necessary fee or financial charge imposed by a government on an individual or an…

Q: rmine the present value equivalent of a geometric sequence of annual cash flows starting at P 1,254…

A: Geometric sequence is that sequence in which the money grow each year by some fixed percentage of…

Q: Problem 9-16 Problems with Profitability Index [LO1, 7] The Michner Corporation is trying to choose…

A: a1) Let the initial investment = C Annual cashflow = A r = 11% n = 3 years

Q: Given the cash flow diagram below, expressed in months, determine: A. The Present value at a nominal…

A: NPV and IRR both are methods of capital budgeting that are used to make decesion of selecting and…

Q: You borrow $30,000 for 10 years to pay tuition and fees. The annual interest rate is 12 percent.…

A: Loan Amortization: It refers to the process of paying off the loan in equal periodic payments.…

Q: 6. Hart Corp is considering a project that has the following cash flow data. What is the project's…

A: Given: Year Cash flows 0 -$1,000 1 $425 2 $425 3 $425

Q: B. Last year, Nikkola Company had net sales of P2,299,500, and cost of goods sold of P1,755,000.…

A: Note: Hi! Thank you for the question, As per the Honor Code of Bartleby, we are allowed to answer…

Q: Paul and Donna Kelsch are planning a Mediterranean cruise in 3 years and will need $6,500 for the…

A: We need to use future value of annuity formula to calculate quarterly payment PMT =FV*i(1+i)n -1…

Q: Yield to maturities, par values and market prices for government securities (with semi-annual…

A: Maturity (Years) Yield To Maturity Par Value (K) Market Price (K) 0.5 6% 100 97.09 1 7% 100…

Q: The amount of simple interest on a deposit varies jointly with the principal and the time in days.…

A: The simple interest can be calculated with the help of simple interest function

Q: (Bond valuation relationships) A bond of Telink Corporation pays $120 in annual interest, with a…

A: a) Coupon (C) = $120 Par value (P) = $1000 n = 10 years r = 10%

Q: What is the correct interest expense on the serial notes payable for 2022?

A: Interest refers to the amount paid by the borrower to bank on the amount borrowed at a fixed or…

Q: A corporation decides to deposit fixed payment per account earning 9% interest per year in order to…

A: Amount required after 9 years 235000 Period in years 9 No of period (Quarterly) 36 Rate…

Q: The maintenance cost of a new equipment is projected to start at the end of the 2nd year at an…

A: Cost in year n = Cn C2 = P 8000 C6 = P 10000 Uniform increase in cost = (10000 - 8000) / (6 - 2) = P…

Q: Which one of the following statements is correct with respect to policy retention? Group of answer…

A: Insurance is a contract represented by a policy that an individual or group receives financial…

Q: Suppose a ten-year, $1,000 bond with an 8.5% coupon rate and semiannual coupons is trading for…

A: Here,

Q: 15. Suzanne's Cleaners is considering a project that has the following cash flow data. What is the…

A: Year Cash flow 0 -1100 1 300 2 310 3 320 4 330 5 340

Q: Student E saves his allowance worth of P 25,000 and promised to use it only when it reaches the…

A: Present value (PV) = P 25,000 Future value (FV) = P 45,000 Interest rate = 8% Quarterly interest…

Q: Financial analysts forecast GDY Inc.’s growth for the future to be 5%. GDY's recent annual dividend…

A: The stock value can be calculated with the help of dividend growth model

Q: In year 2018, the real rate of interest was 9 percent and infation was meesured at 3 perbent Whet…

A: Real Rate of Return = 9% Inflation = 3%

Q: pay out period.

A: The payback period refers to the amount which is required to cover its initial investment in the…

Q: •Assume that you have saved money for a down payment on your dream house, but you still need to…

A: a) Given that: Loan Amount=Php500000= PV of annuity Year of mortgage=5 Year= 60 months Annual Rate…

Q: What is meant by a perfect hedge? Does a perfect hedge always lead to a better outcome than an…

A: A perfect hedge is a position taken by an investor that eliminates the risk of an existing position…

Q: Q7-5. Can an ordinary annuity table be used to determine the present value of a three-year…

A: Answer:- No EXPLANATION:- The cash flow given above is uneven. the present value of an uneven cash…

Q: January February March 15,000 Sales in units.. 20,000 18,000 Production in units.. 18,000 19,000…

A: This pertains to production budget in finance. We often make different types of budget in finance…

Q: 3. Robbins Inc. is considering a project that has the following cash flows and cost capital (r)…

A: Net present value is the sum of the present values of net of all future cash outflows and inflows…

Q: 14.Mariah invested $10,000 in a bank certificate of deposit at a rate of 5% interest compounded…

A: Investment (PV) = $10,000 Interest rate (r) = 5% Period (n) = 3 Years

Q: 8. Scott took a short position for 500 ounces of July gold at $653.25 per ounce. He did not close…

A: Initial margin In order to trade in exchange, investors have to deposit the initial margin…

Step by step

Solved in 2 steps with 2 images

- John has an investment budget of £20,000. In addition, he has borrowed £10,000 at afixed interest rate of 5%. He decides to invest all available funds in a portfolio of equitieswhich has an expected rate of return of 12% and standard deviation of 20%. What is thestandard deviation of the return on John’s overall investment portfolio?A mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %. What is the rate of return in the fund? If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0. 05 and ends the month with NAV of K20.10. Calculate the monthly rate of return. An equity fund has a front end load of 4 % and special fees of 0.5% annually as well as back-end fees that start at 5 % and fall by 1 % for each full year the investor holds the portfolio until the fifth year. Assuming the rate of return on the fund net of operating expenses is 10 % annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years?A mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %. Required: a. What is the rate of return in the fund? b. If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0. 05 and ends the month with NAV of K20.10. Calculate the monthly rate of return. c. An equity fund has a front end load of 4 % and special fees of 0.5% annually as well as back-end fees that start at 5 % and fall by 1 % for each full year the investor holds the portfolio until the fifth year. Assuming the rate of return on the fund net of operating expenses is 10 % annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years?

- City Street Fund has a portfolio of $420 million and liabilities of $30 million. Required:a. If there are 30 million shares outstanding, what is the net asset value? b-1. If a large investor redeems 3 million shares, what happens to the portfolio value? (Enter your answer in dollars not in millions.)Suppose you have $275,000 in cash, and you decide to borrow another $33,000 at a 4% interest rate to invest in the stock market. You invest the entire $308,000 in a portfolio J with a 15% expected return and a 22% volatility. a. What is the expected return and volatility (standard deviation) of your investment? b. What is your realized return if J goes up 32% over the year? c. What return do you realize if J falls by 25% over the year?Please explain using Excel and show/explain formulas. Percival Hygiene has $10 million invested in long-term corporate bonds. This bond portfolio’s expected annual rate of return is 8%, and the annual standard deviation is 10%. Amanda Reckonwith, Percival’s financial adviser, recommends that Percival consider investing in an index fund that closely tracks the Standard & Poor’s 500 index. The index has an expected return of 13%, and its standard deviation is 14%. a. Suppose Percival puts all his money in a combination of the index fund and Treasury bills. Can he thereby improve his expected rate of return without changing the risk of his portfolio? The Treasury bill yield is 3%. multiple choice Yes No b. Could Percival do even better by investing equal amounts in the corporate bond portfolio and the index fund? The correlation between the bond portfolio and the index fund is +0.3. multiple choice Yes No

- 1. A mutual fund with K100 million in assets at the start of the year and with 10 million shares outstanding invests in a portfolio of stocks that provides no income but increases in value by 10 %. Required: What is the rate of return in the fund? If a fund has an initial NAV of K20 at the start of the month makes income distributions K0.15 and capital gain distributions of K0. 05 and ends the month with NAV of K20.10. Calculate the monthly rate of return. 2. An equity fund has a front end load of 4 % and special fees of 0.5% annually as well as back-end fees that start at 5 % and fall by 1 % for each full year the investor holds the portfolio until the fifth year. Assuming the rate of return on the fund net of operating expenses is 10 % annually, what will be the value of a K10 000 investment in the equity fund shares if the shares are sold after 1 year, 4 years and 10 years?Percival Hygiene has $10 million invested in long-term corporate bonds. This bond portfolio’s expected annual rate of return is 24%, and the annual standard deviation is 13%. Amanda Reckonwith, Percival’s financial adviser, recommends that Percival consider investing in an index fund that closely tracks the Standard & Poor’s 500 Index. The index has an expected return of 20%, and its standard deviation is 18%. Suppose Percival puts all his money in a combination of the index fund and Treasury bills. The Treasury bill yield is 6%. Can he thereby improve his expected rate of return without changing the risk of his portfolio? Multiple Choice No: if Percival puts all his money in a combination of the index fund and Treasury, it will produce a return = 16%<24% Yes: if Percival puts all his money in a combination of the index fund and Treasury, it will produce a return = 24%>13% No: if Percival puts all his money in a combination of the index fund and…A company's fund manager has a P20,000,000 portfolio with a beta of 0.75. The risk-free rate is 4.50% and the market risk premium is 5.00%.The manager expects to receive an additional P30,000,000, which she plans to invest in several stocks. After investing the additional funds, she wants the fund's required return to be 9.50%. 1. What is the required rate of return on the initial P20M investment? 2. What is the rate of return of all risky and risk-free securities? 3. To achieve the fund manager’s required return target, the funds should be invested in an investment with a beta of 4. Judge the overall riskiness of the P50M portfolio A. Aggressive B. Neutral C. Conservative

- The total market value of the equity of Okefenokee Condos is $8 million, and the total value of its debt is $2 million. The treasurer estimates that the beta of the stock currently is 0.6 and that the expected risk premium on the market is 10%. The Treasury bill rate is 4%, and investors believe that Okefenokee's debt is essentially free of default risk. a. What is the required rate of return on Okefenokee stock? (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Estimate the WACC assuming a tax rate of 21%. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Estimate the discount rate for an expansion of the company’s present business. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The beta of optical manufacturers with no debt outstanding is .8. What is the…The total market value of the equity of Okefenokee Condos is $8 million, and the total value of its debt is $2 million. The treasurer estimates that the beta of the stock currently is 0.6 and that the expected risk premium on the market is 10%. The Treasury bill rate is 4%, and investors believe that Okefenokee's debt is essentially free of default risk. a. What is the required rate of return on Okefenokee stock? (Do not round intermediate calculations. Enter your answer as a whole percent.) b. Estimate the WACC assuming a tax rate of 21%. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Estimate the discount rate for an expansion of the company’s present business. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Suppose the company wants to diversify into the manufacture of rose-colored glasses. The beta of optical manufacturers with no debt outstanding is .8. What is the…You want to achieve an expected annual return of 12% by investing in a risky fund that generates 20% per year and the rest of your budget in t-bill that generates 5% per year. What proportion of your budget should be invested in the risky fund?