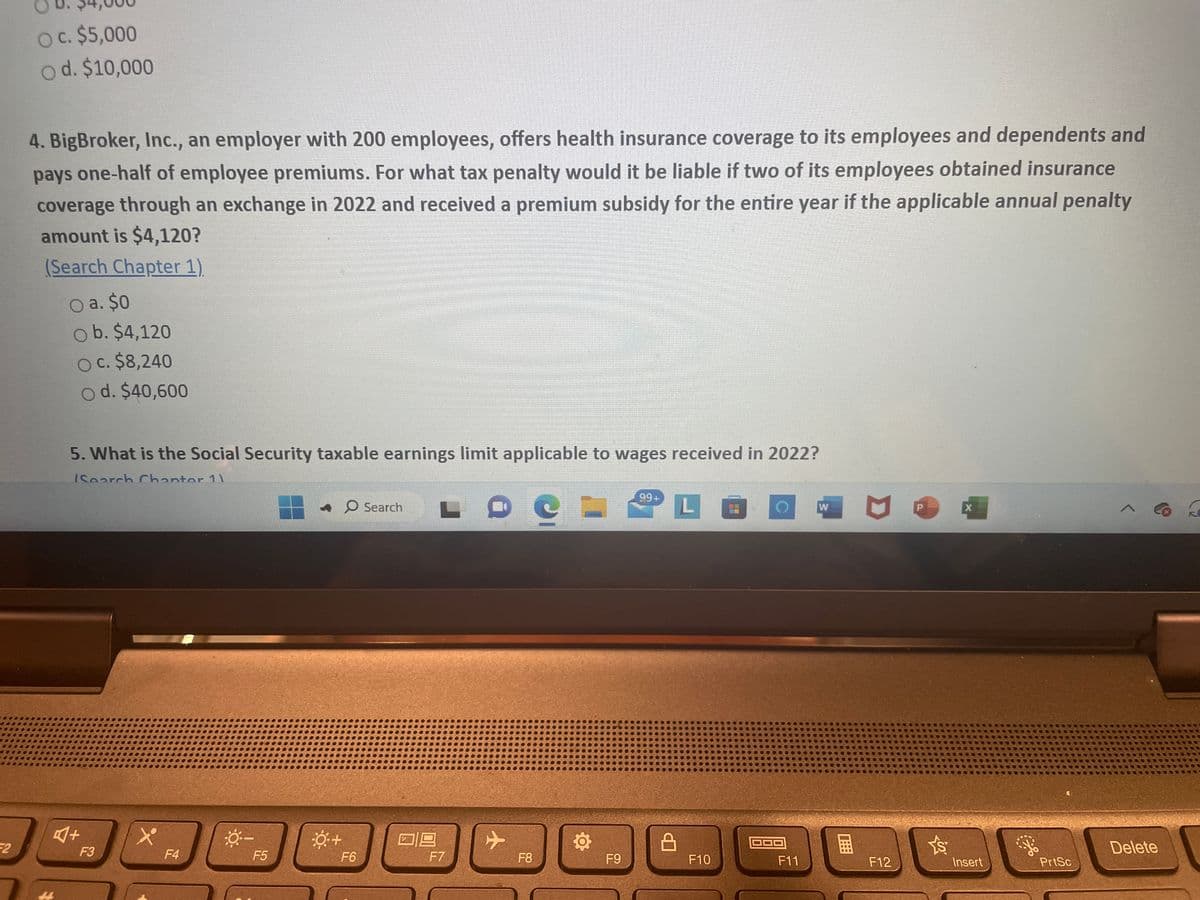

4. BigBroker, Inc., an employer with 200 employees, offers health insurance coverage to its employees and dependents and pays one-half of employee premiums. For what tax penalty would it be liable if two of its employees obtained insurance coverage through an exchange in 2022 and received a premium subsidy for the entire year if the applicable annual penalty amount is $4,120? (Search Chapter 1) O a. $0 ob. $4,120 OC. $8,240 Od. $40,600

4. BigBroker, Inc., an employer with 200 employees, offers health insurance coverage to its employees and dependents and pays one-half of employee premiums. For what tax penalty would it be liable if two of its employees obtained insurance coverage through an exchange in 2022 and received a premium subsidy for the entire year if the applicable annual penalty amount is $4,120? (Search Chapter 1) O a. $0 ob. $4,120 OC. $8,240 Od. $40,600

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:2

O c. $5,000

od. $10,000

4. BigBroker, Inc., an employer with 200 employees, offers health insurance coverage to its employees and dependents and

pays one-half of employee premiums. For what tax penalty would it be liable if two of its employees obtained insurance

coverage through an exchange in 2022 and received a premium subsidy for the entire year if the applicable annual penalty

amount is $4,120?

(Search Chapter 1)

O a. $0

O b. $4,120

O C. $8,240

O d. $40,600

4

5. What is the Social Security taxable earnings limit applicable to wages received in 2022?

Search Chapter 11

e

LA

A+

F3

x

F4

-0--

F5

→ Search

+

F6

09

F7

F8

F9

99+

F10

F11

W

1

F12

<

X

Insert

$

PrtSc

Delete

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT