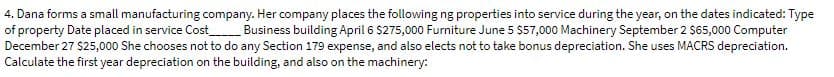

4. Dana forms a small manufacturing company. Her company places the following ng properties into service during the year, on the dates indicated: Type of property Date placed in service Cost Business building April 6 $275,000 Furniture June 5 $57,000 Machinery September 2 $65,000 Computer December 27 $25,000 She chooses not to o any Section 179 expense, and also elects not to take bonus depreciation. She uses MACRS depreciation. Calculate the first year depreciation on the building, and also on the machinery:

4. Dana forms a small manufacturing company. Her company places the following ng properties into service during the year, on the dates indicated: Type of property Date placed in service Cost Business building April 6 $275,000 Furniture June 5 $57,000 Machinery September 2 $65,000 Computer December 27 $25,000 She chooses not to o any Section 179 expense, and also elects not to take bonus depreciation. She uses MACRS depreciation. Calculate the first year depreciation on the building, and also on the machinery:

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:4. Dana forms a small manufacturing company. Her company places the following ng properties into service during the year, on the dates indicated: Type

of property Date placed in service Cost Business building April 6 $275,000 Furniture June 5 $57,000 Machinery September 2 $65,000 Computer

December 27 $25,000 She chooses not to

o any Section 179 expense, and also elects not to take bonus depreciation. She uses MACRS depreciation.

Calculate the first year depreciation on the building, and also on the machinery:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT