Pacific was a nich included a and registered ed in trade or b

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 13DQ

Related questions

Question

Typewritten only and i'll upvote.

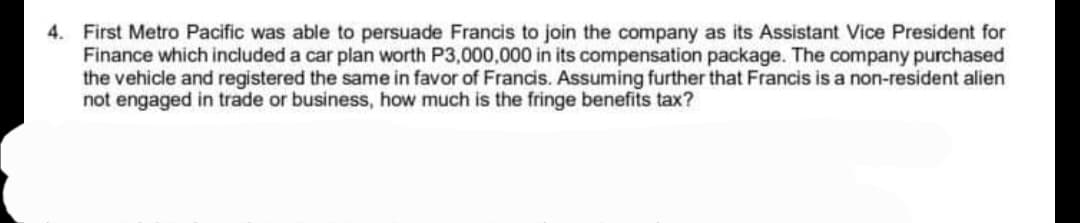

Transcribed Image Text:4. First Metro Pacific was able to persuade Francis to join the company as its Assistant Vice President for

Finance which included a car plan worth P3,000,000 in its compensation package. The company purchased

the vehicle and registered the same in favor of Francis. Assuming further that Francis is a non-resident alien

not engaged in trade or business, how much is the fringe benefits tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you