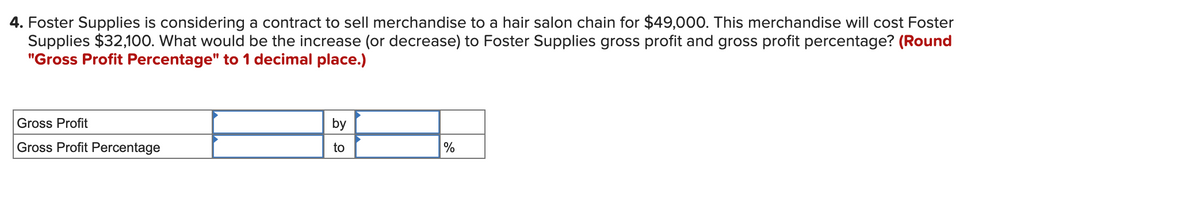

4. Foster Supplies is considering a contract to sell merchandise to a hair salon chain for $49,000. This merchandise will cost Foster Supplies $32,100. What would be the increase (or decrease) to Foster Supplies gross profit and gross profit percentage? (Round "Gross Profit Percentage" to 1 decimal place.) Gross Profit by Gross Profit Percentage to %

4. Foster Supplies is considering a contract to sell merchandise to a hair salon chain for $49,000. This merchandise will cost Foster Supplies $32,100. What would be the increase (or decrease) to Foster Supplies gross profit and gross profit percentage? (Round "Gross Profit Percentage" to 1 decimal place.) Gross Profit by Gross Profit Percentage to %

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 7E: Record the following transactions for a perpetual inventory system in general journal form. a. Sold...

Related questions

Question

![Required information

[The following information applies to the questions displayed below.]

Foster Supplies is a wholesaler of hair supplies. Foster Supplies uses a perpetual inventory system. The following

transactions (summarized) have been selected for analysis:

a. Sold merchandise for cash (cost of merchandise $34,917).

b. Received merchandise returned by customers as unsatisfactory (but in perfect condition)

for cash refund (original cost of merchandise $390).

c. Sold merchandise (costing $9,595) to a customer on account with terms n/60.

d. Collected half of the balance owed by the customer in (c).

e. Granted a partial allowance relating to credit sales the customer in (c) had not yet

paid.

f. Anticipate further returns of merchandise (costing $310) after year-end from sales made

during the year.

$ 62,080

420

20,200

10,100

194

430](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F1130bb74-d759-4a7d-be09-076557ecc6db%2Fc60e48d5-5faa-4ebd-a887-bfdc8a60e93b%2F3339q4f_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Foster Supplies is a wholesaler of hair supplies. Foster Supplies uses a perpetual inventory system. The following

transactions (summarized) have been selected for analysis:

a. Sold merchandise for cash (cost of merchandise $34,917).

b. Received merchandise returned by customers as unsatisfactory (but in perfect condition)

for cash refund (original cost of merchandise $390).

c. Sold merchandise (costing $9,595) to a customer on account with terms n/60.

d. Collected half of the balance owed by the customer in (c).

e. Granted a partial allowance relating to credit sales the customer in (c) had not yet

paid.

f. Anticipate further returns of merchandise (costing $310) after year-end from sales made

during the year.

$ 62,080

420

20,200

10,100

194

430

Transcribed Image Text:4. Foster Supplies is considering a contract to sell merchandise to a hair salon chain for $49,000. This merchandise will cost Foster

Supplies $32,100. What would be the increase (or decrease) to Foster Supplies gross profit and gross profit percentage? (Round

"Gross Profit Percentage" to 1 decimal place.)

Gross Profit

by

Gross Profit Percentage

to

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning