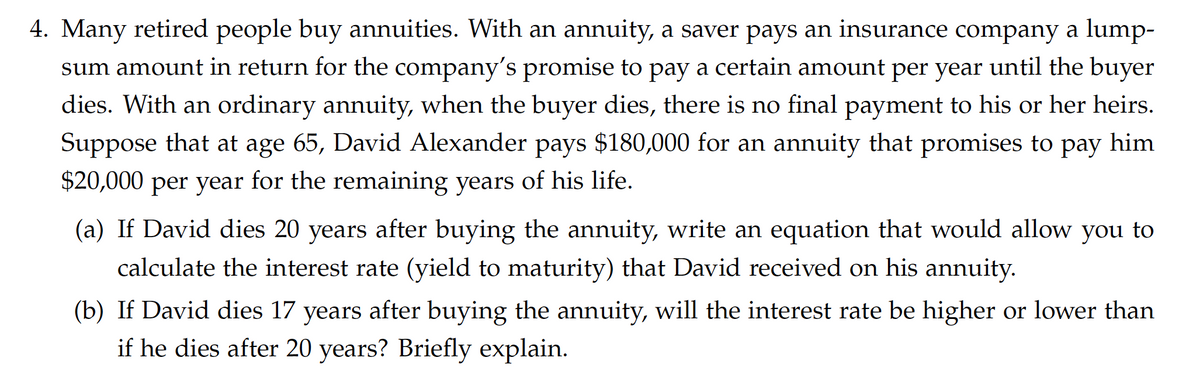

4. Many retired people buy annuities. With an annuity, a saver pays an insurance company a lump- sum amount in return for the company's promise to pay a certain amount per year until the buyer dies. With an ordinary annuity, when the buyer dies, there is no final payment to his or her heirs. Suppose that at age 65, David Alexander pays $180,000 for an annuity that promises to pay him $20,000 per year for the remaining years of his life. (a) If David dies 20 years after buying the annuity, write an equation that would allow you to calculate the interest rate (yield to maturity) that David received on his annuity. (b) If David dies 17 years after buying the annuity, will the interest rate be higher or lower than if he dies after 20 years? Briefly explain.

4. Many retired people buy annuities. With an annuity, a saver pays an insurance company a lump- sum amount in return for the company's promise to pay a certain amount per year until the buyer dies. With an ordinary annuity, when the buyer dies, there is no final payment to his or her heirs. Suppose that at age 65, David Alexander pays $180,000 for an annuity that promises to pay him $20,000 per year for the remaining years of his life. (a) If David dies 20 years after buying the annuity, write an equation that would allow you to calculate the interest rate (yield to maturity) that David received on his annuity. (b) If David dies 17 years after buying the annuity, will the interest rate be higher or lower than if he dies after 20 years? Briefly explain.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 39P

Related questions

Question

100%

Transcribed Image Text:4. Many retired people buy annuities. With an annuity, a saver pays an insurance company a lump-

sum amount in return for the company's promise to pay a certain amount per year until the buyer

dies. With an ordinary annuity, when the buyer dies, there is no final payment to his or her heirs.

Suppose that at age 65, David Alexander pays $180,000 for an annuity that promises to pay him

$20,000 per year for the remaining years of his life.

(a) If David dies 20 years after buying the annuity, write an equation that would allow you to

calculate the interest rate (yield to maturity) that David received on his annuity

(b) If David dies 17 years after buying the annuity, will the interest rate be higher or lower than

if he dies after 20 years? Briefly explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT