4. Non annual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of 11.00%; however, interest will be compounded quarterly. Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. Value Interest Rates Nominal rate Periodic rate Effective annual rate Clancy needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes his local bank because he is being offered a nominal rate of 10.00%. However, since the bank is compounding its interest semiannually, the loan will impose an effective interest rate of on his loan. Another bank is also offering favorable terms, so Clancy decides to take a loan of $15,000 from this bank. He signs the loan contract at 13.00% compounded daily for three months. Based on a 365-day year, what is the total amount that Clancy owes the bank at the end of the loan's term? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $15,495.19 $16,037.52 $16,115.00 $16,424.90

4. Non annual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of 11.00%; however, interest will be compounded quarterly. Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. Value Interest Rates Nominal rate Periodic rate Effective annual rate Clancy needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes his local bank because he is being offered a nominal rate of 10.00%. However, since the bank is compounding its interest semiannually, the loan will impose an effective interest rate of on his loan. Another bank is also offering favorable terms, so Clancy decides to take a loan of $15,000 from this bank. He signs the loan contract at 13.00% compounded daily for three months. Based on a 365-day year, what is the total amount that Clancy owes the bank at the end of the loan's term? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $15,495.19 $16,037.52 $16,115.00 $16,424.90

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.21MCE

Related questions

Question

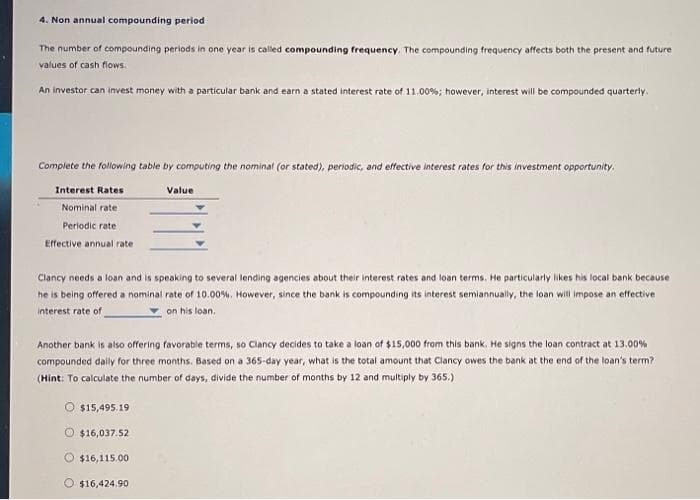

Transcribed Image Text:4. Non annual compounding period

The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future

values of cash flows.

An investor can invest money with a particular bank and earn a stated interest rate of 11.00%; however, interest will be compounded quarterly.

Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity.

Interest Rates

Nominal rate :

Periodic rate

Effective annual rate

Clancy needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes his local bank because

he is being offered a nominal rate of 10.00%. However, since the bank is compounding its interest semiannually, the loan will impose an effective

interest rate of

on his loan.

Another bank is also offering favorable terms, so Clancy decides to take a loan of $15,000 from this bank. He signs the loan contract at 13.00%

compounded daily for three months. Based on a 365-day year, what is the total amount that Clancy owes the bank at the end of the loan's term?

(Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.)

O $15,495.19

Ⓒ$16,037.52

Value

$16,115.00

O $16,424.90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT