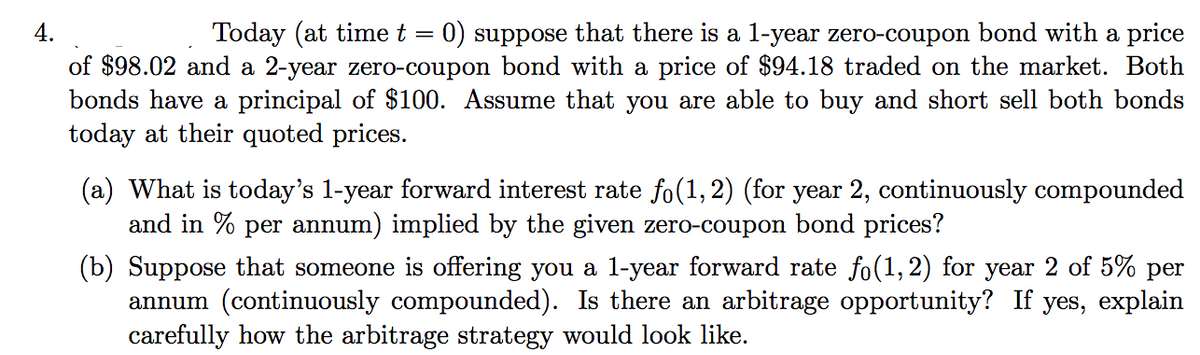

4. Today (at time t = 0) suppose that there is a 1-year zero-coupon bond with a price of $98.02 and a 2-year zero-coupon bond with a price of $94.18 traded on the market. Both bonds have a principal of $100. Assume that you are able to buy and short sell both bonds today at their quoted prices. (a) What is today's 1-year forward interest rate fo(1, 2) (for year 2, continuously compounded and in % per annum) implied by the given zero-coupon bond prices?

4. Today (at time t = 0) suppose that there is a 1-year zero-coupon bond with a price of $98.02 and a 2-year zero-coupon bond with a price of $94.18 traded on the market. Both bonds have a principal of $100. Assume that you are able to buy and short sell both bonds today at their quoted prices. (a) What is today's 1-year forward interest rate fo(1, 2) (for year 2, continuously compounded and in % per annum) implied by the given zero-coupon bond prices?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter16: Capital Structure Decisions

Section: Chapter Questions

Problem 10MC: Suppose there is a large probability that L will default on its debt. For the purpose of this...

Related questions

Question

Only Part A

Transcribed Image Text:4.

Today (at time t = 0) suppose that there is a l-year zero-coupon bond with a price

of $98.02 and a 2-year zero-coupon bond with a price of $94.18 traded on the market. Both

bonds have a principal of $100. Assume that you are able to buy and short sell both bonds

today at their quoted prices.

(a) What is today's 1-year forward interest rate fo(1, 2) (for year 2, continuously compounded

and in % per annum) implied by the given zero-coupon bond prices?

(b) Suppose that someone is offering you a l-year forward rate fo(1, 2) for year 2 of 5% per

annum (continuously compounded). Is there an arbitrage opportunity? If yes, explain

carefully how the arbitrage strategy would look like.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT