4. Wazhing Co. has the following information on December 31, 20d before any year-end adjustments. Accounts receivable. Jan 1 Net aredit sales 30,000 270,000 140,000 Collections from customes (burbuding zecoveries) Allowance for doubthal accounts. Jan. 1 Write-ofts 10,000 5,000 Recoveries 1.000 Percentage of receivalbles 5% How mach is the bad debt expense? a4250 b4300 C4550 d. 10.300

4. Wazhing Co. has the following information on December 31, 20d before any year-end adjustments. Accounts receivable. Jan 1 Net aredit sales 30,000 270,000 140,000 Collections from customes (burbuding zecoveries) Allowance for doubthal accounts. Jan. 1 Write-ofts 10,000 5,000 Recoveries 1.000 Percentage of receivalbles 5% How mach is the bad debt expense? a4250 b4300 C4550 d. 10.300

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Topic Video

Question

Cam you please answer these problems with solutions so I can understand it. Thank you so much! this is intermediate accounting problems

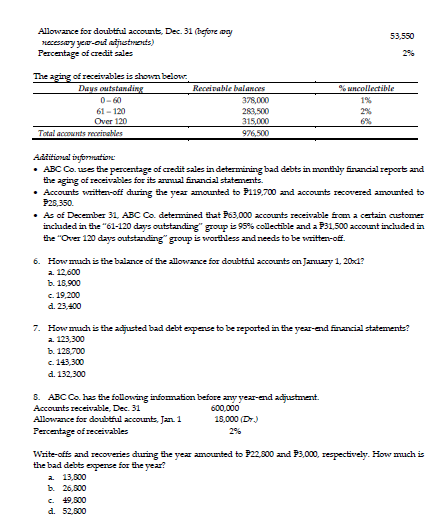

Transcribed Image Text:Allowance for doubtful account, Dec. 31 (before wy

nacessary yer-oul atjatments)

Percentage of credit sales

53,550

2%

The aging of receivables is shown below.

Days outstanding

Receivable balances

% uncollectible

0-60

378,000

1%

61 - 120

283,500

2%

Over 120

315,000

976,500

6%

Total accounts receinables

Additional information

• ABC Co. uwes the percentage of credit sales in determining bad debts in monthly financial report and

the aging of receivables for its armal financial statements.

• Accounts written-off during the vear amounted to Pl19,700 and accounts recovered amounted to

P26,350.

• As of December 31, ABC Co. determined that P63,000 accounts receivable from a cetain customer

inchuded in the "61-120 days outstanding" group is 95% collectible and a P31,500 account included in

the "Over 120 days outstanding" group is worthless and needs to be written-of.

6. How much is the balance of the allowance for doubtful accounts on January 1, 201?

a. 12,600

b. 18,900

c. 19,200

d. 23,400

7. How much is the adjusted bad debt expence to be reported in the year-ed financial statements?

a. 123,300

ь. 128,700

c. 143,300

d. 132,300

S. ABC Co. has the following information before any yer-end adjustment.

Accounts receivable, Dec. 31

600,000

Allowance for dorubtful accounts, Jan. 1

18,000 (Dr.)

Percentage of receivables

2%

Write-offs and recoveries during the year amounted to P22,300 and P3,000, respectively. How much is

the bad debts experce for the year?

a 13,500

b. 26,500

c. 19,500

d. 52,000

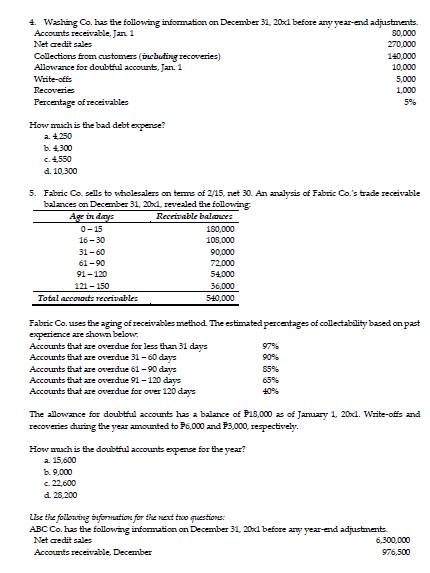

Transcribed Image Text:4. Wzching Co. has the following information on December 31, 20xd before any year-end adjustnents.

Ассоnts reсeivable, Jan 1

80,000

Net credit sales

270,000

Collections fromcustomers (buchuding recoveries)

Allowance for doubtful account, Jan 1

140,000

10.000

Write-offs

5,000

Recoveries

1,000

Percentage of receivables

5%

How mmach is the bad debt expemse?

a 4.250

b. 4.300

C4550

d. 10,300

5. Fabric Co. sells to wholesalers on terms of 2/15, net 30. An analysis of Fabric Co.'s trade receivable

balances on December 31, 20xd, revealed the followring

Ag in days

Receivable balawes

0-15

180,000

16-30

108,000

31-60

90,000

61-90

72,000

91-120

54.000

121- 150

36,000

540.000

Total acconauts receivables

Fabric Co. uses the aging of receivables method. The estimated percentages of collectability based on past

experience are shown below.

Accounts that are overdue for less than 31 days

97%

Accounts that are overdue 31 -60 days

90%

Accounts that are overdue 61-90 days

S5%

Accounts that are overdue 91-120 days

Accounts that are overdue for over 120 days

65%

40%

The allowance for doubtiul accounts has a balance of P18,000 as of Jamuary 1, 20x1. Write-ofis and

recoveries during the year amounted to P6,000 and P3,000, respectively.

How mach is the doubtful accounts expense for the year?

a. 15,600

ь. 9,000

c. 22,600

d. 28,200

LBe the follouing syformation for the next two questions:

ABC Co. has the following information on December 31, 20xd before any year-end adjustments.

Net credit sales

6,300,000

Accounts receivable, December

976,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College