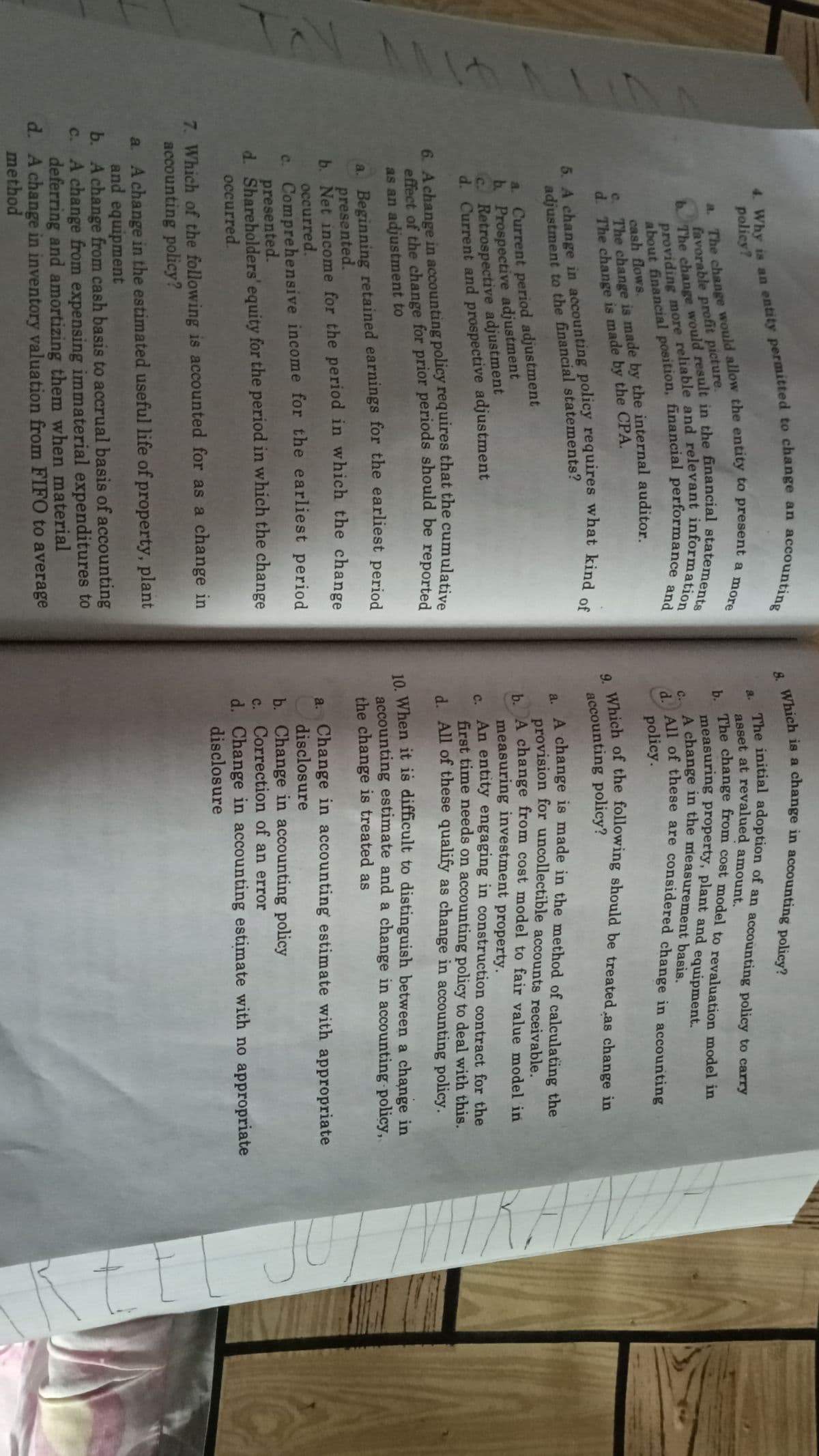

4. Why is an entity permitted to change an account policy? a. The change would allow the entity to present a more favorable profit picture. bThe change would result in the financial statements providing more reliable and relevant information about financial position, financial performance and cash flows. e. The change is made by the internal auditor d. The change is made by the CPA.

4. Why is an entity permitted to change an account policy? a. The change would allow the entity to present a more favorable profit picture. bThe change would result in the financial statements providing more reliable and relevant information about financial position, financial performance and cash flows. e. The change is made by the internal auditor d. The change is made by the CPA.

Chapter1: Accounting As A Tool For Managers

Section: Chapter Questions

Problem 10MC: Which of the following statements is incorrect? The practice of management accounting is fairly...

Related questions

Question

Transcribed Image Text:4. Why is an entity permitted to change an account:

policy?

The initial adoption of an accoùnting policy to carry

a.

The change from cost model to revaluation model in

measuring property, plant and equipment.

A change in the measurement basis.

C All of these are considered change in accounting

favorable profit picture.

с.

cash flows.

The change is made by the internal auditor

policy.

accounting policy?

. A change is made in the method of calculating the

provision for uncollectible accounts receivable.

A change from cost model to fair value model in

measuring investment property.

s An entity engaging in construction contract for the

first time needs on accounting policy to deal with this.

d. All of these qualify as change in accounting policy.

adjustment to the financial statements?

a. Current period adjustment

b. Prospective adjustment

C. Retrospective adjustment

d. Current and prospective adjustment

6. Achange in accounting policy requires that the cumulative

effect of the change for prior periods should be reported

as an adjustment to

10. When it is difficult to distinguish between a change in

accounting estimate and a change in accounting policy,

the change is treated as

a. Beginning retained earnings for the earliest period

presented.

b. Net income for the period in which the change

occurred.

c. Comprehensive income for the earliest period

presented.

d. Shareholders' equity for the period in which the change

occurred.

a. Change in accounting estimate with appropriate

disclosure

b. Change in accounting policy

c. Correction of an error

d. Change in accounting estimate with no appropriate

disclosure

7. Which of the following is accounted for as a change in

accounting policy?

a. A change in the estimated useful life of property, plant

and equipment

b. A change from cash basis to accrual basis of accounting

c. A change from expensing immaterial expenditures to

deferring and amortizing them when material

d. A change in inventory valuation from FIFO to average

method

a. The change allow the entity to a more

about and

5. A in policy what kind of

b The would in the statements

providing more and information

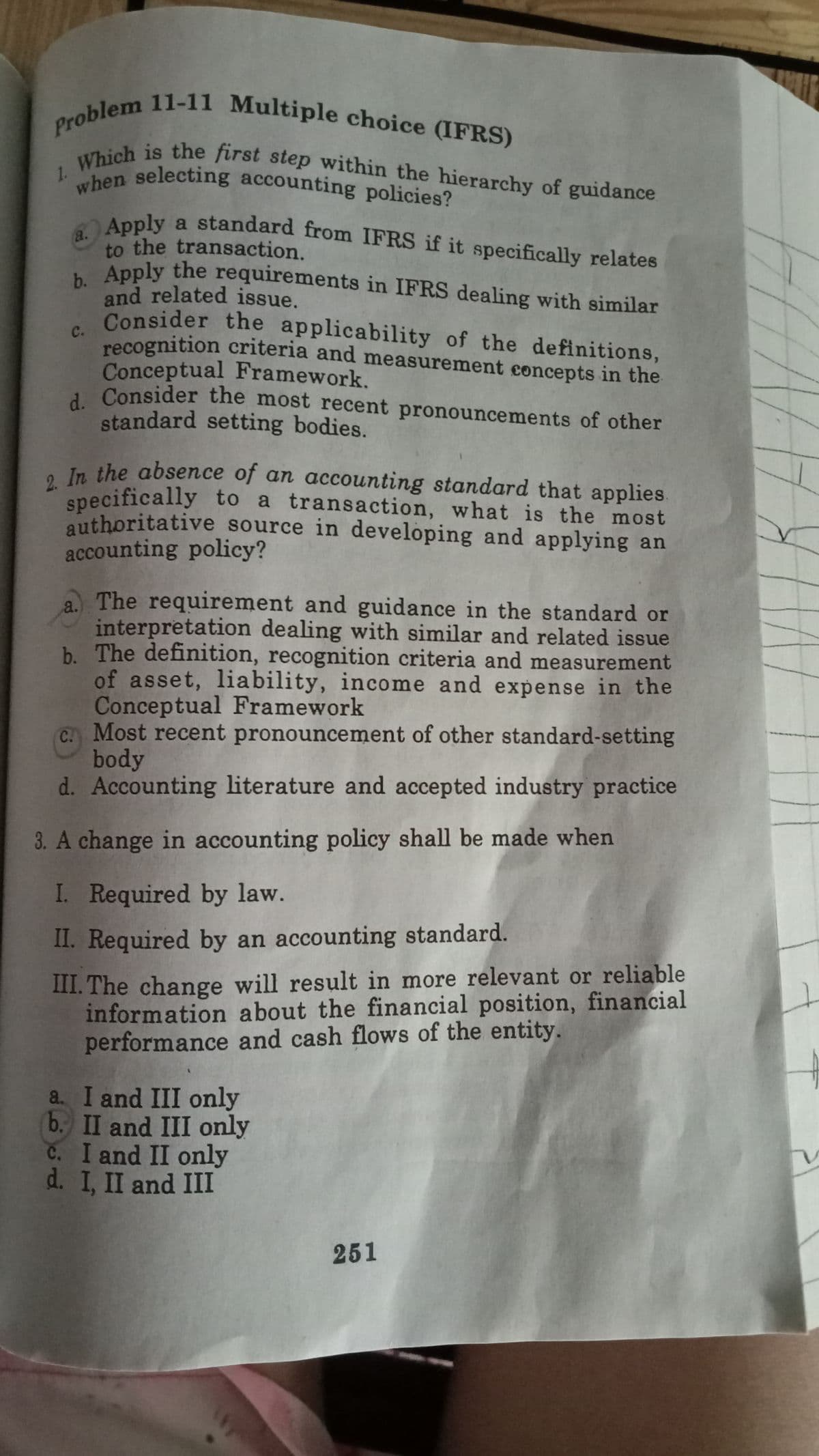

Transcribed Image Text:2. In the absence of an accounting standard that applies.

Which is the first step within the hierarchy of guidance

Problem 11-11 Multiple choice (IFRS)

when selecting accounting policies?

b. Apply the requirements in IFRS dealing with similar

Apply a standard from IFRS if it specifically relates

1.

"hen selecting accounting policies?

a.

Apply a standard from IFRS if it specifically relates

to the transaction.

Apply the requirements in IFRS dealing with similar

and related issue.

Consider the applicability of the definitions,

c.

recognition criteria and measurement concepts in the

Conceptual Framework.

1 Consider the most recent pronouncements of other

standard setting bodies.

e In the absence of an accounting standard that applies.

specifically to a transaction, what is the most

authoritative source in developing and applying an

accounting policy?

a The requirement and guidance in the standard or

interpretation dealing with similar and related issue

b. The definition, recognition criteria and measurement

of asset, liability, income and expense in the

Conceptual Framework

C. Most recent pronouncement of other standard-setting

body

d. Accounting literature and accepted industry practice

3. A change in accounting policy shall be made when

I. Required by law.

II. Required by an accounting standard.

III. The change will result in more relevant or reliable

information about the financial position, financial

performance and cash flows of the entity.

a I and III only

b. II and III only

C. I and II only

d. I, II and III

251

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning