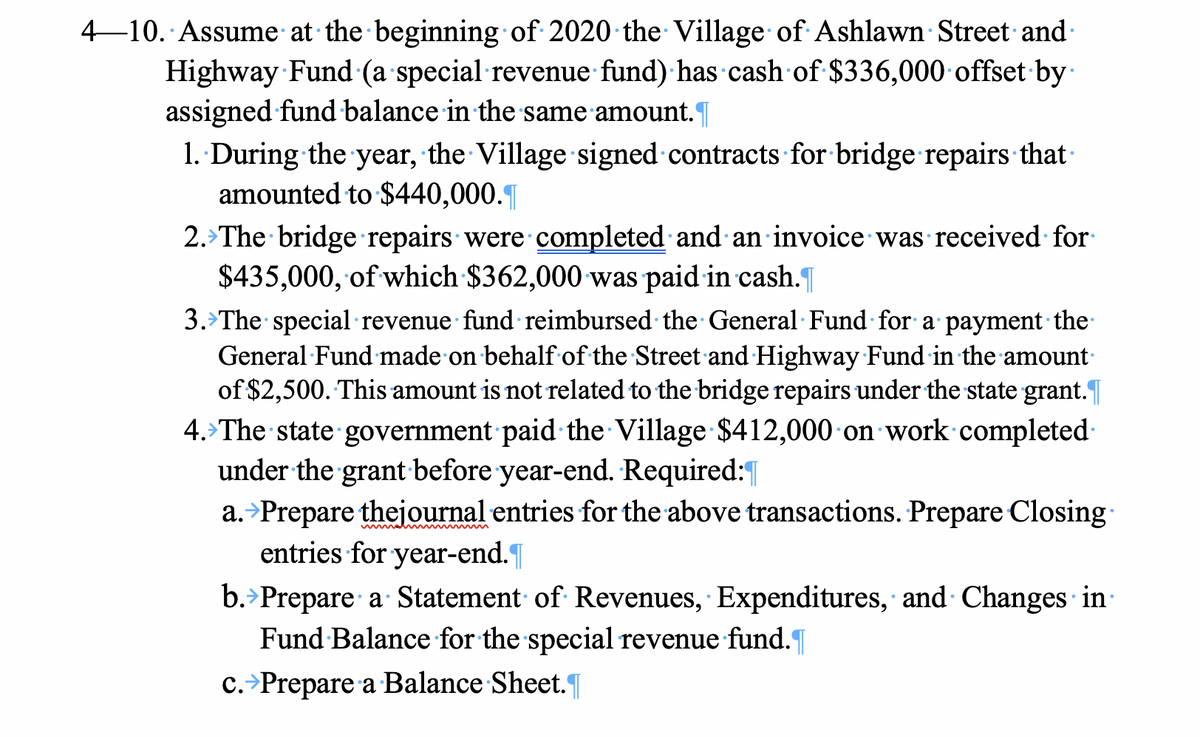

4–10. Assume at the beginning of 2020 the Village of Ashlawn Street and Highway Fund (a special revenue fund) has cash of $336,000·offset by assigned fund balance in the same amount. 1.. During the year, the Village signed contracts for bridge repairs that- amounted to $440,000.¶| 2. The bridge repairs were completed and an invoice was received for $435,000, of which $362,000 was paid in cash.| 3.>The special revenue fund reimbursed the General Fund for a payment the General Fund made on behalf of the Street and Highway Fund in the amount of $2,500. This amount is not related to the bridge repairs under the state grant. 4. The state government paid the Village $412,000 on work completed- under the grant before year-end. Required: a.>Prepare thejournal entries for the above transactions. Prepare Closing entries for year-end.| b.>Prepare a Statement of Revenues, Expenditures, and Changes in- Fund Balance for the special revenue fund.| c.>Prepare a Balance Sheet.

4–10. Assume at the beginning of 2020 the Village of Ashlawn Street and Highway Fund (a special revenue fund) has cash of $336,000·offset by assigned fund balance in the same amount. 1.. During the year, the Village signed contracts for bridge repairs that- amounted to $440,000.¶| 2. The bridge repairs were completed and an invoice was received for $435,000, of which $362,000 was paid in cash.| 3.>The special revenue fund reimbursed the General Fund for a payment the General Fund made on behalf of the Street and Highway Fund in the amount of $2,500. This amount is not related to the bridge repairs under the state grant. 4. The state government paid the Village $412,000 on work completed- under the grant before year-end. Required: a.>Prepare thejournal entries for the above transactions. Prepare Closing entries for year-end.| b.>Prepare a Statement of Revenues, Expenditures, and Changes in- Fund Balance for the special revenue fund.| c.>Prepare a Balance Sheet.

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 12DQ

Related questions

Question

100%

Transcribed Image Text:4–10. Assume at the beginning of 2020 the Village of Ashlawn Street and

Highway Fund (a special revenue fund) has cash of $336,000 offset by

assigned fund balance in the same amount.

1.. During the year, the Village signed contracts for bridge repairs that

amounted to $440,000.|

2.>The bridge repairs were completed and an invoice was received for

$435,000, of which $362,000 was paid in cash.

3.>The special revenue fund reimbursed the General Fund for a payment the

General Fund made on behalf of the Street and Highway Fund in the amount

of $2,500. This amount is not related to the bridge repairs under the state grant.

4. The state government paid the Village $412,000 on work completed

under the grant before year-end. Required:|

a.>Prepare thejournal entries for the above transactions. Prepare Closing

entries for year-end.|

b.>Prepare a Statement of Revenues, Expenditures, and Changes in·

Fund Balance for the special revenue fund.

c.>Prepare a Balance Sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you