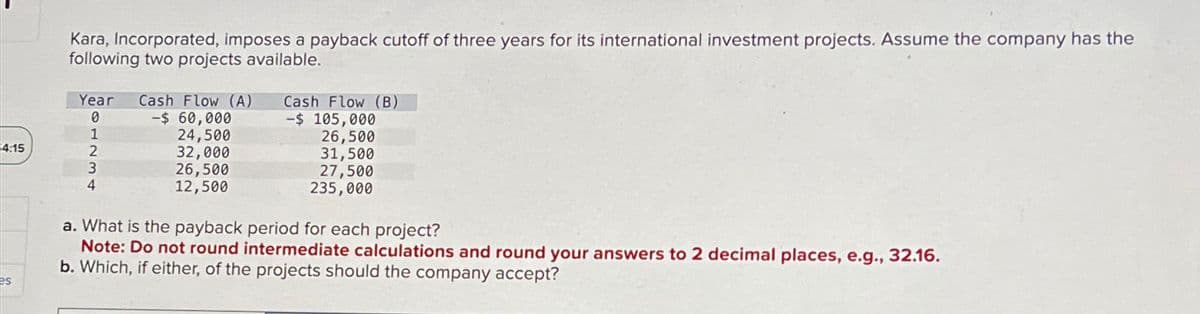

4:15 Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) 0 1231 -$ 60,000 24,500 32,000 26,500 12,500 Cash Flow (B) -$ 105,000 26,500 31,500 27,500 235,000 4 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? es

4:15 Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) 0 1231 -$ 60,000 24,500 32,000 26,500 12,500 Cash Flow (B) -$ 105,000 26,500 31,500 27,500 235,000 4 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? es

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 14PROB

Related questions

Question

pr.0

Transcribed Image Text:4:15

Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the

following two projects available.

Year Cash Flow (A)

0

1231

-$ 60,000

24,500

32,000

26,500

12,500

Cash Flow (B)

-$ 105,000

26,500

31,500

27,500

235,000

4

a. What is the payback period for each project?

Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.

b. Which, if either, of the projects should the company accept?

es

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning