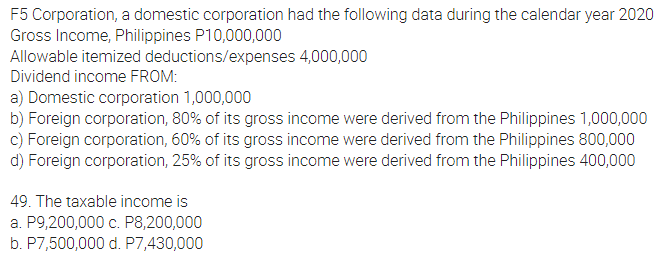

49. The taxable income is a. P9,200,000 c. P8,200,000 b. P7,500,000 d. P7,430,000

Q: (Guarantee by old partners in specific ratio). Antonio and Chekov were partners sharing profits in…

A:

Q: Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $20,800 $19,900 Inventory 72,000 72,700 Accounts…

A: The cash flow from operating activity represents the amount of cash inflows and outflows in the…

Q: Edwards City has the following information for its general fund for the upcoming fiscal year. Which…

A: Budgetary fund balance can be calculated after deducting Appropriations from estimated revenue. If…

Q: Prepare journal entries Oct 7 Sold merchandise on credit to Lacson Retailers terms n/30, FOB…

A: The term n/30 means the payment on sale or purchase made on credit is due within 30 days from the…

Q: Harwood Company uses a job-order costing system that applies overhead cost to jobs on the basis of…

A: Manufacturing overheads are the costs incurred on the production of the goods. It includes indirect…

Q: Riffa Company is a merchandiser that provided a balance sheet as of September 30 as shown below:…

A: Note: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Consider a 00 par valu vertible semiannually, which will convertible semiannually. Consti

A: Bond refers to the fixed income financial documents which reflect the loan taken by a borrower from…

Q: Which of the following funds is used to account for government sponsored investment pools that…

A: An Investment Trust Fund is a fund that develops when the government sponsors a multi-government…

Q: How much is the unrealized gain at Dec 31, 20X1? 1,000 15,000 50,000 65,000

A: The securities held for trading means those securities that are purchased by the company for a short…

Q: Joshua Scott invests $40,000 into his new business. How would this transaction be entered in the…

A: Journal entries are the basic method for recognizing the financial transaction and these journal…

Q: Company provided the following information for the current year: Current service cost 500,000…

A: The benefit-cost ratio (BCR) is a profitability indicator used in cost-benefit analysis to determine…

Q: • The GROSS INCOME is: 1. . . • The TAXABLE INCOME (LOSS) is: 2. • The INCOME TAX DUE AND PAYABLE…

A: The gross receipts mean those receipts that are received by the company for the services rendered by…

Q: The following information is available for ABC Co. Budgeted sales Gross profit as a percentage of…

A: With the given details, we need to calculate the amount paid to trade payable in the Month of June.…

Q: Cambridge Corp. has a single class of shares. As its year ended December 31, 2015, the company had…

A: The journal entry can be defined as the process of recording business transactions in the accounting…

Q: Smart Ltd negotiated a lease for equipment on the following terms: the lease had a 3 year term; the…

A: Lease can be defined as a financial arrangement in which one party uses the asset provided by other…

Q: On Oct 1, 20X1 ABC Co. discounted a one year 12% P600,000 note received from a customer on January…

A: Note discounting: Note discounting means selling or pledging the notes to the bank prior to the…

Q: ABC Corp acquired 30,000 shares of XYZ Co. The shares were actively traded in the three markets. The…

A: Shares which are actively traded in market is to be recognised as investment at fair value. Fair…

Q: An entity issued ten-year P1,000,000 debenture bonds at the beginning of the current year. The bonds…

A: The annual stated interest rate refers to the rate applied to the par value for the periodic…

Q: After-tax Income (Tax Deduction) After-tax Income (Tax Credit)

A: A single taxpayer is a person who is unmarried and filling his income tax. the pre-tax income means…

Q: In accounting for lease contracts, companies reporting under U.S. GAAP O are required to treat the…

A: ASC 842 is an accounting standard that deals with accounting of leases. Leases are two types.…

Q: 16. ABC Corp holds 1,000 shares of XYZ Corp.'s shares since 2019. The following are data available…

A: If investment in equity stock are treated as held for trading then such investments are designated…

Q: Joe operates a business that locates and purchases specialized assets for clients, among other…

A: Business income refers to the income that is earned by doing regular business activities such as the…

Q: describe the structure of a bank bill. In your explanation, clearly distinguish the roles of the…

A: Introduction: A bill of exchange is a written document that obligates one party to pay another a…

Q: An entity shall present all items of income and expenses recognized in a period: I-in a single…

A: Profit and loss is a financial statement that helps in depicting the position of profitability of an…

Q: Smart Ltd negotiated a lease on the following terms: the lease had a 3 year term; the purchase price…

A: The answer for the multiple choice question and relevant working are presented hereunder : Purchase…

Q: January 1, 2013 2-year-old Cattle 12,000 New Born Cattle 4,000 December 31, 2013 2-year old cattle…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: QUESTION 3 Johan Graphic Enterprise was established by Mr. Johan on 1 January 2021. At the end of…

A: 1. Income Statement - It is the statement that shows the income earned and expenses incurred in the…

Q: Illustration. The balance sheet of Mateo Roa on Oct. 1, 2021, before accepting Martin Penaco as his…

A: The conversion of sole proprietorship business into partnership business is done by transferring all…

Q: 8. When specified receivables are used to secure for a loan on a notification basis, which…

A: The account receivables are the current assets of the company, they represent the sale made by the…

Q: en the information below for HooYah! Corporation, compute the expected share price at the end of…

A: For determining the P/E ratio, the Price of the share is divided by the EPS value related to that…

Q: Beginning finished goods inventory Beginning work in process inventory Beginning raw materials…

A: Cost of goods manufactured = Beginning WIP + Direct materials + direct labor + manufacturing…

Q: client who is in his 70's. in 2020, he incurred significant capital losses in the amount of $65,000…

A: The capital losses are very common methods of making loss but only $3000 can be adjusted against…

Q: What is the composition (weights) of the portfolio? (Round answer to 4 decimal places, e.g.…

A: In the question, Portfolio return is given and asked to calculate weights. In this case, we will…

Q: 12. What amount in profit or loss should be recognized in 2021 as a result of the reclassification?

A: Gain or loss due to the changes in the accounting method of recording the investment depends upon…

Q: Little Shark Gaming Company, a publicly listed company, has just started operating as a digital…

A: On the issue of a share, any amount received more than the par value of the shares issued should be…

Q: Classify each item by type of business activity- operating, investing, or financing. Also indicate…

A: Statement of cash flow (CFS) refers to a financial statement of the company which shows the flows of…

Q: Problem 5-17 Applying Overhead; Journal Entries; Disposition of Underapplied or Overapplied Overhead…

A: The overapplied overhead cost is calculated as excess of applied overhead cost more than the actual…

Q: In a factory, a team of six maintenance staff are paid a guaranteed weekly wage. Which of the…

A: LABOUR COST IS THE PAYMENT MADE TOWARDS LABOUR INVOLVED IN PRODUCTION OF PRODUCT OR SERVICE .

Q: Vertical Analysis Prepabe Chipotle Mexican Grill, Inc. Income Statements For the Years Ended…

A: Vertical analysis of the income statement represents the percentage of a line item with respect to…

Q: Salman, capital Advertising expense Accounts payable Sales commission revenue Land Supplies expense…

A: Introduction: Trial balance: All the final ledger accounts balances are posted in Trial balance to…

Q: PT ABC has two production departments, namely departments A and B to produce its products. The…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: On 31 October 2012 the carrying amount of an entity’s delivery truck was R200 000 when its…

A: Introduction: In accounting, impairment is a continuous decrease in the value of the a company's…

Q: Revenue... Expenses: Vera Bradley, Inc. Income Statements For the Years Ended January 31 (in…

A: An income statement showing the income and expenses of a company. It also displays if a corporation…

Q: 1. Enumerate 10 reason why do you need to study Information System in the field of accounting. 2.…

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Evaluate the two alternatives A and B and decide the economic justified alternative using: Present…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Prepare journal entries to record the following production activities. 1. Incurred $45,000 of direct…

A: Direct cost transfer to work in progress account and indirect cost such as indirect material,…

Q: Craven City borrows $1,000,000 in bonds payable on January 1, 2022, and the bonds are scheduled to…

A: Debt service fund is used to repay debt.Repayment of debt include both principal plus interest.Bond…

Q: 0.The following data were available for Product Z at Mar 31, 20X1: Beg inventory 50 units @ 12…

A: Solution: There are various method of inventory valuation as under: 1. First in First Out (FIFO) 2.…

Q: The following information is available for B Co. Budgeted annual sales Opening inventory Closing…

A: Formula: Number of units produced during the year = Budgeted Annual Sales + Closing Inventory –…

Q: Transaction costs are capitalized when acquiring investment in equity or debt securities, except…

A: Transaction costs are incurred while investment is done in equity or debt security.Whether it should…

Step by step

Solved in 2 steps

- Phils. Corporation reported the following gross income and expenses Philippines Overseas Gross income 38,000,000 14,000,000 52,000,000 deductions 15,000,000 3,000,000 18,000,000 taxable income 23,000,000 11,000,000 34,000,000 Compute the income tax due for 2019 if Phils is a domestic corporation: P10,200,000 P6,900,000 P8,500,000 P6,800,0004. XYZcorporation reported the following gross income and expenses: Gross income in the Philippines is 38,000,000 while deductions is 15,000,000 for a total taxable income of 23,000,000. Abroad, the gross income is 14,000,000 while the deduction is 3,000,000 for a total taxable income of 11,000,000. Compute the income tax due for 2021 if XYZ is a domestic corporation. P10,200,000 P6,900,000 P8,500,000 P6,800,000A resident foreign corporation has the following income and expenses for the year: Philippines Abroad Gross sales P100,000,000 P40,000,000 Cost of sales 40,000,000 20,000,000 Operating expenses 30,000,000 12,000,000 1. How much is the income tax due assuming the taxable year is 2021?2. Assuming the corporation is a nonresident foreign corporation and the taxable year is 2021, how much is the income tax due?

- 4. Compute the income tax due for 2021 if XYZ is a domestic corporation. XYZ reported the following gross income and expenses: Philippines Abroad Gross income 38, 000, 000 14, 000, 000 52, 000, 000 Deductions 15, 000, 000 3, 000, 000 18, 000, 000 Taxable Income 23, 000, 000 11, 000, 000 34, 000, 000 P10,200,000 P6,900,000 P8,500,000 P6,800,000Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an International Carrier.A Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an non-resident owner or lessor of aircraft, machineries & other equipment A Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P500,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a business partnership organized in the Philippines Qalvin Corporation, a MSME, reported the following in 2023: in 2022:…

- Based on the below data, answer as required: WITHIN OUTSIDE Gross Income P8,000,000 P4,000,000 Business Expenses 5,000,000 3,000,000 Sale of land and warehouse (cost P2M) 3,000,000 A. If X is a domestic corporation, how much is the taxable income and income tax due in the Philippines per annual ITR? B. If X is a resident foreign corporation, how much is the taxable income and income tax due in the Philippines per annual ITR?BTS Corporation provided the following data for calendar year ending December 31, 2016: (1$ = P50) Philippines Abroad Gross income 4,000,000 $ 40,000 deductions 2,500,000 $15,000 Income tax paid $ 3,000If the corporation is a domestic corporation, its income tax payable is a. 450,000 b. 1,280,000 c. 825,000 d. 675,000Qalvin Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P700,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a Joint Venture formed for the undertaking of construction projects or exploration under service contracts with the government

- Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Government-owned and Controlled Corporation.Qalvin Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P500,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a Joint Venture formed for the undertaking of construction projects or exploration under service contracts with the government Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is a Non-resident Foreign Corporation.Qalvin Corporation, a large corporation, reported the following in 2023: in 2022: Related Unrelated Total Gross income P300,000 P200,000 P500,000 Deductions 100,000 100,000 200,000 Taxable income P200,000 P100,000 P300,000 Compute the income tax due if Qalvin is exempt non-profit corporation Qalvin Corporation, a MSME, reported the following in 2023: in 2022: Philippines Abroad Total Gross income P500,000 P200,000 P700,000 Direct Deductions 200,000 300,000 500,000 Common Expenses 150,000 Compute the income tax due if Qalvin is a resident foreign corporation